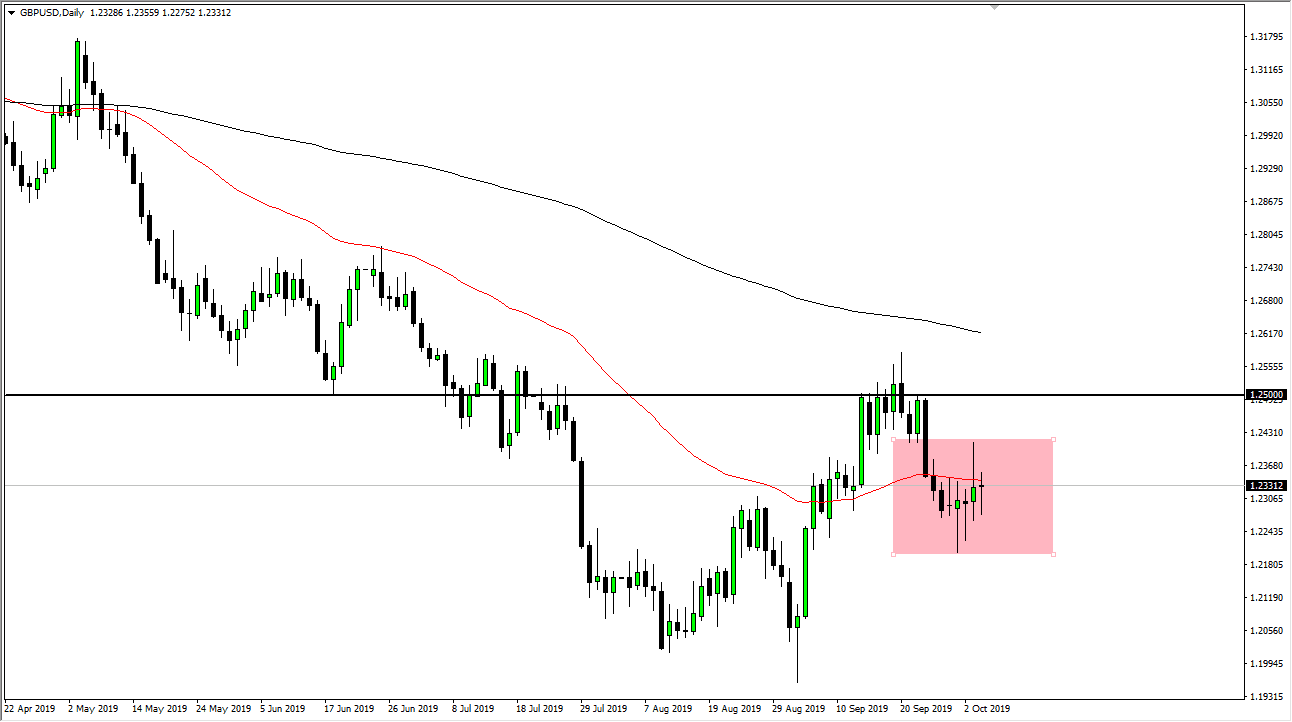

The British pound initially fell during the Friday session but then turned around of form a bit of a hammer as the market continues to dance around the 1.23 region. This is an area that has formed several hammers and a couple of shooting stars, which tells me that there is a lot of inertia being built up for a potential move. This makes quite a bit of sense, because Brexit negotiations continue, and we are getting relatively close to some type of resolution, be it good or bad.

Looking at the candle stick from the Thursday session, it is in fact a very negative, but the way we have turned around on Friday shows that there are plenty of traders out there willing to step in and pick up the British pound when they think it’s cheaper. If we can break above the top of the Thursday candle stick, then the market is likely to go to the 1.25 level which is the next parish barrier. A break above that level does open the door to much higher trading, and very well could be accompanied by some type of good news involving the Brexit.

Alternately, if we break down below the Tuesday session, we could drop significantly and reach towards the 1.20 level underneath, which was where we had originally bounced from. That would continue the overall downtrend, but in the short term I think what we are going to see is a lot of choppiness in this little box that I have drawn on the chart. I don’t think that it’s going to be easy to trade this market, and it will of course be susceptible to headlines that can suddenly change everything. With that being the case it’s likely best to be traded with a small position sizing at best.

However, we will eventually get some type of resolution to Brexit, and when we do we can start to trade with more conviction. I do believe that we are much closer to the bottom of the British pound and we are the top, so I suspect that a lot of “smart money” is starting to buy the pound in this general vicinity. That doesn’t mean that there will be a bigger dip lower, but after that big flush, I would anticipate that a lot of career building trades will be made to the upside.