The British pound has gone back and forth during the trading session on Monday after initially gapping lower, as the market simply doesn’t know what to do right now. It’s obvious that the Brexit situation continues to cause issues, and therefore it’s most likely going to be a scenario where the market doesn’t do much until we get the next headline coming out of either London or the EU to move the markets. Currently, it seems as if a lot of traders are exhausted by the entire scenario, so it’s likely that the pair goes sideways in the short term. However, it’s only a matter time before Boris Johnson or somebody else says something to send this market in one direction or the other.

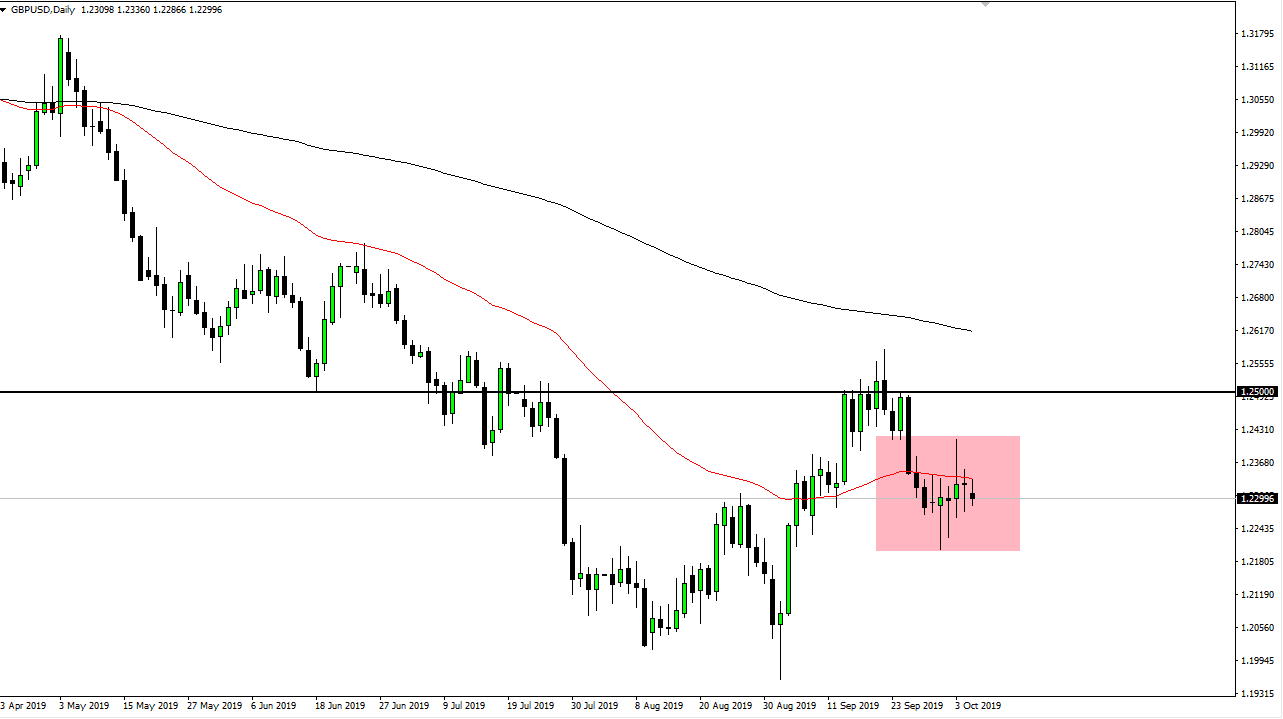

The downside is protected by the 1.22 level, and if we can break down below there, it’s very likely that the pair goes down to the 1.20 level after that. That being said, if we can break above the 1.24 handle, then we could be going to the 1.25 level after that. The 1.25 level is also backed up by the 200 day EMA, so I do think that it’s easier to fall from here then it is to rise. At this point, we need to see some type of conclusion to where the market and more importantly the politicians are going.

The 50 day EMA is just above and could offer a bit of technical resistance as well. The most important thing to think about is that we have been in a downtrend for quite some time and it’s likely that the markets will continue to find plenty of reasons to break down, at least until we get some type of certainty out of Brexit. It doesn’t even need to be good news, it just needs to be confirmed news. Ultimately, this is a market that should have at least one more major “flush lower” after the UK leaves, and then we will begin the rebuilding process for the British pound going forward. Ultimately, this should be a longer-term “buy-and-hold” situation, but we aren’t there yet, and probably have a couple of rough weeks ahead of us in the meantime. I still believe it’s easier to sell so if we can break down below the 1.22 level, I will be much more aggressive and I would be on a break to the upside.