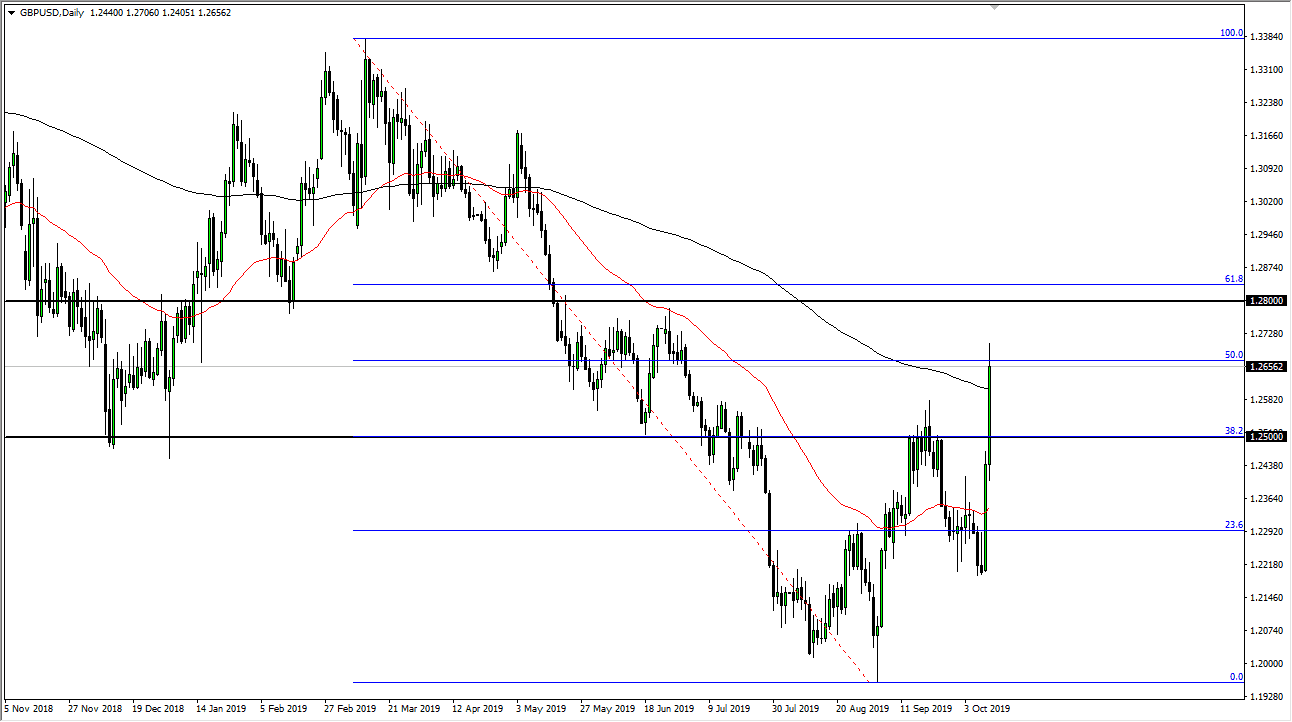

The British pound has formed another extraordinarily bullish candle stick during the trading session on Friday, as headlines and the rumors continue to come out on Twitter to move the market into believing that Brexit is close to becoming a reality. That deal of course would be good for the British economy and the British pound overall as it would bring some sort of certainty to the market that hasn’t had it for three years now. That being said though, the British pound has rallied about 450 pips over the last two days. This can’t go on.

Another thing that you need to keep in mind is that we have broken through the 200 day EMA which of course is a very bullish sign, but there have been headlines over the last few hours of the Friday session that suggests that perhaps the over exuberant reaction was a bit overdone. With that in mind, we could very well see this market open up with a major gap lower on Monday. If you are not long of this market right now, you should probably wait for some type of pullback in order to take advantage of value. This is especially true near the 1.25 handle which was significant resistance previously. If we were to break down below that level though, then the market is probably going to completely reverse the move.

Obviously, that reversal would be due to some type of breakdown in talks, which is a very real possibility. Beyond all of that, the volume in the British pound based upon the spreads that I was watching today was a bit lacking. There is a lot of talk of basic algo trading to say the least, as the headlines continue to throw things back and forth based upon robots reading Twitter feeds. That being said, with all of the potential noise out there, it’s going to be a very difficult market to trade until we get some type of confirmation of something happening. So far, we’ve only had a lot of “feel-good tweets” and the like as people are saying things are going better, but keep in mind that this was mainly between Boris Johnson and the Irish prime minister. Unfortunately, those guys are the only players in the room so we could very well see a quick reversal. I believe that the 1.25 level holding at support is crucial for the buyers.