Earlier this week, the GBP / JPY pair showed consolidation despite expectations of a bearish price gap for all GBP pairs after British Prime Minister Boris Johnson failed to pass his latest agreement with the EU to avoid a chaotic exit from the block at the end of this month. The pair traded around the 140.43 level at the beginning of the trading, and gains last week reached the 141.48 resistance, the highest in five months, before closing last week around the 140.61 resistance. The opportunity for the pound to plunge was halted by press reports that the EU would give Britain a flexible postponement until February 2020. During this period, if the European Parliament approves the final agreement at any time, the exit will be adopted. After a month or two, or less or more, until the new date.

However, the pound could be under pressure if the House of Commons insists on its position towards Johnson's agreement with the EU. In this situation, Johnson wrote to the President of the European Council, Donald Tusk: “My opinion and the position of the government (is) that an additional extension would harm the interests of the UK and our EU partners, and the relationship between us.” Johnson has long announced that he intends to take his country out of the EU on October 31 with or without a BREXIT deal, and his minister in charge of Brexit confirmed this position again.

"We will leave by October 31," Michael Goff told Sky News on Sunday. “We have the means and the ability to do it.” It is worth mentioning that, Johnson’s conservative conservative party has only 288 seats in the 650-seat House of Commons, so it needs the support of some opposition lawmakers.

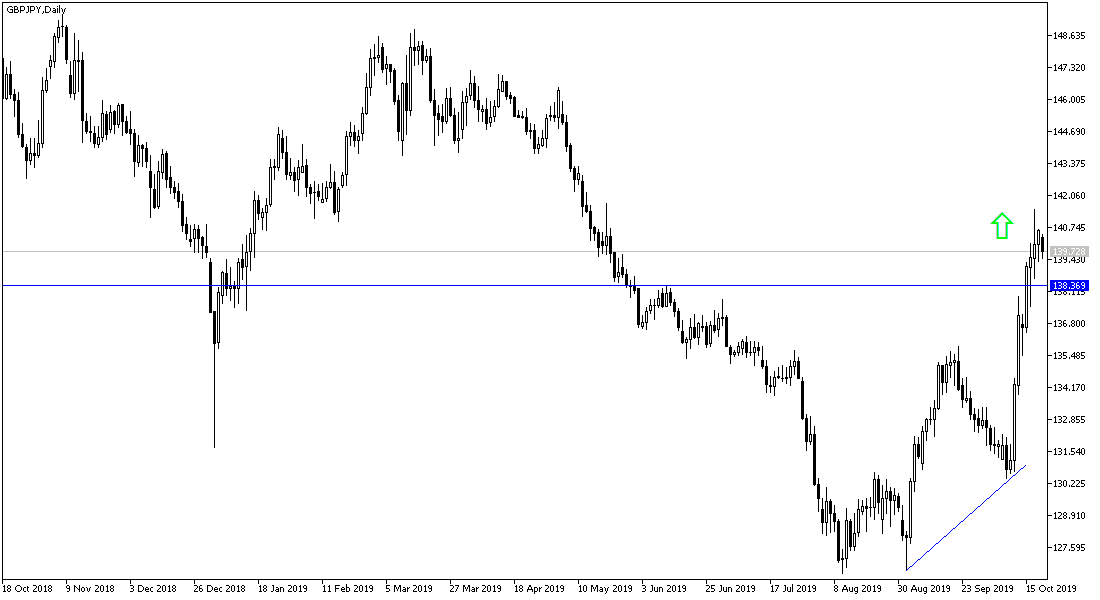

According to the technical analysis of the pair: As the Japanese yen is one of the most important safe havens for investors in times of uncertainty, the growing fears of a vague Brexit future may lose GBP / JPY a lot of gains, and the first targets of the bears then might be at 139.30, 138.40 and 136.70 on قespectively. However, optimism that the Brexit deal is nearing will increase the bullish momentum of the pair, which is still supported by stability above the psychological resistance of 140.00, which paves the way for the pair to test new record highs.

As for today's economic data: [rom Japan the Trade Balance and all Industries Index data will be announced. From the UK, House Price Index will be released.