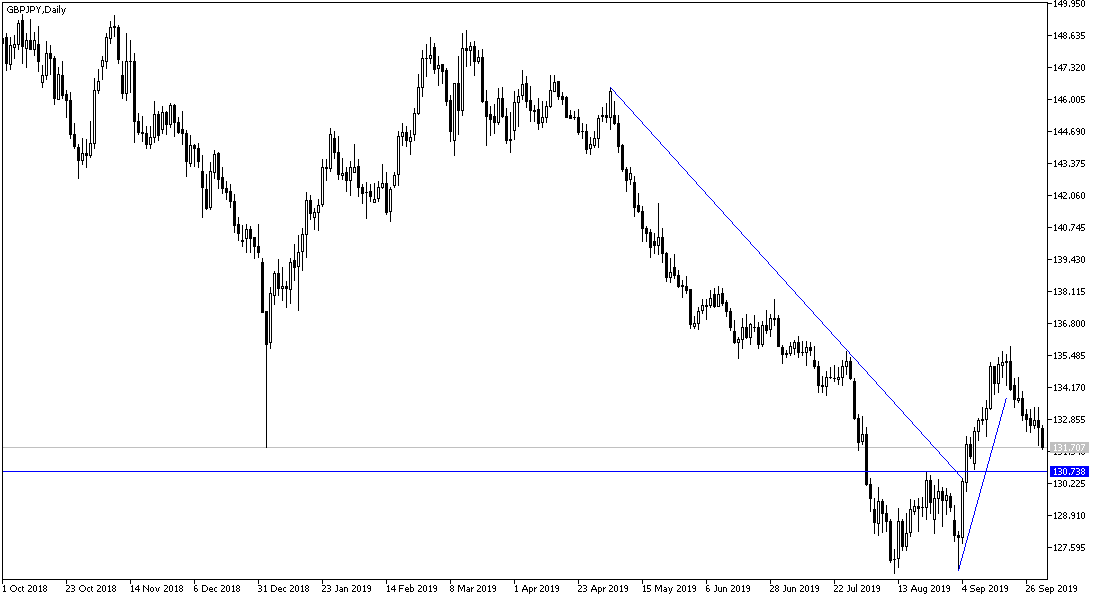

Completing the downward correction, GBP/JPY fell to the 131.77 support before, settling around 132.31 at the time of writing. Completing the pace of decline to the 130.00 psychological support will consolidate the downside force and support further selling on the pair, which is facing intense pressure due to the absence of a clear vision for the future of Brexit, which is the closest to be without a deal. The pair has seen a 1.07% drop in the past week. Indicators on the charts suggest that the pair may fall to the 50% retracement level of the previous rally before resuming its new bullish trend. There is a strong possibility that the pair will continue to drop to the 131.25 support level as support begins at the 50% retracement level of the previous rally. At the same time, a break below 131.00 support would confirm the trend line move to 127.50 support.

Since the Japanese yen is a safe haven currency, it means that it rises when sentiment is negative and falls when it is positive. Continued global trade concerns stemming from the strained relationship between the US and China will support a stronger yen. Brexit and the economic slowdown in the Eurozone are joining the list of concerns that support investors' appetite for the Yen.

On the economic front, the Tankan Manufacturing Survey revealed that growth in the sector is at its lowest level in six years despite the high expectations made by the manufacturing sector in the third quarter, however, the data did not affect the Yen at the time of its release. Economists believe that sentiment among Japan's big manufacturers is falling to its lowest level in more than six years. Japan is affected by the slowdown in global economic growth and the negative effects of the US-China trade war that hit supply chains in Asia.

In contrast, the UK manufacturing PMI rose to 48.3 from 47.4. This was better than expected but does not change anything physically. The manufacturing sector remains in deflation as long as it is below the 50 level. Uncertainty about Brexit remains.

The Brexit path will remain the strongest influencer on the GBP/USD trend. And as shown on the daily chart, the price dropping to the 130.00 support will increase the bearish momentum and begin the trend change. On the other hand, 135.00 resistance is still an upside momentum. The Pound may be affected on Wednesday by the release of the British Construction PMI.