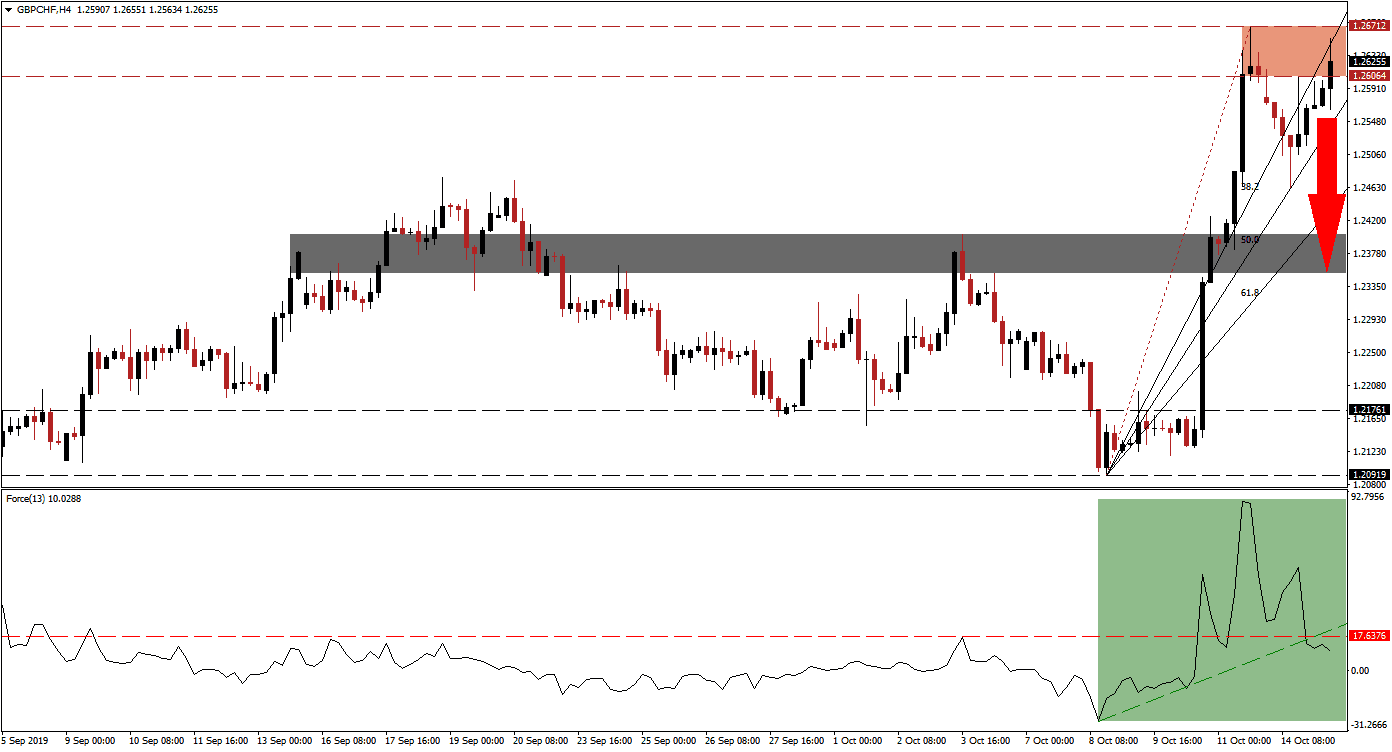

Cautious optimism in regards to Brexit starts to establish, but with the EU summit only two days away it remains an unlikely breakthrough to accomplish as divisions remain. The overall tone is more optimistic as both sides are inching closer to a potential deal, but caution is advised. Following announcements that the UK and Ireland have had successful discussions in regards to the border issue, the British Pound accelerated to the upside. The GBP/CHF surged over 575 pips in a short period of time which resulted in a steep Fibonacci Retracement Fan sequence and price action is currently testing the strength of its resistance zone.

The Force Index, a next generation technical indicator, suggests that the uptrend is exhausted and points towards a price action reversal. The sharp advance in the GBP/CHF was confirmed as the Force Index accelerated to the upside as bullish momentum expanded. After price action completed a breakdown below its resistance zone and into its 50.0 Fibonacci Retracement Fan Support Level, from where it reversed back into its resistance zone, bullish momentum started to collapse. This technical indicator quickly completed a breakdown below its horizontal support level, turning it into resistance which led to a push below its ascending support level while the Force Index remains in positive territory; this is marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Forex traders should now monitor the Force Index as the GBP/CHF is attempting another surge and breakout above its resistance zone which is located between 1.26064 and 1.26712 as marked by the red rectangle. A major wildcard in Brexit discussions for British PM Johnson are his allies from the DUP in Northern Ireland who prop up his government. Any Brexit deal needs to be acceptable to them and the EU has asked for more concessions which has complicated a potential deal. The risk remains to the downside and a move by the Force Index is expected to spark the next move to the downside.

A sustained move in the GBP/CHF below its intra-day low of 1.25634, the low of the most recent price action move which covered the distance between its narrow 50.0 Fibonacci Retracement Fan Support Level and 38.2 Fibonacci Retracement Fan Resistance Level, is also expected to pressure this currency pair further to the downside. The next short-term support zone is located between 1.23524 and 1.24023 as marked by the grey rectangle; this would keep the longer-term uptrend intact. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

GBP/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.26250

Take Profit @ 1.23750

Stop Loss @ 1.26700

Downside Potential: 250 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 5.56

Any positive news surrounding a Brexit deal is expected to result in a breakout by the GBP/CHF above its resistance zone. Volatility is expected to remain elevated and today’s UK economic data could provide a short-term fundamental catalyst. The next resistance zone is located between 1.27954 and 1.28636 which represents a pause from a preceding sharp sell-off. The Force Index would need to move back above its ascending resistance level, together with a positive fundamental catalyst, in order to validate more upside.

GBP/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.26950

Take Profit @ 1.28500

Stop Loss @ 1.26300

Upside Potential: 155 pips

Downside Risk: 65 pips

Risk/Reward Ratio: 2.39