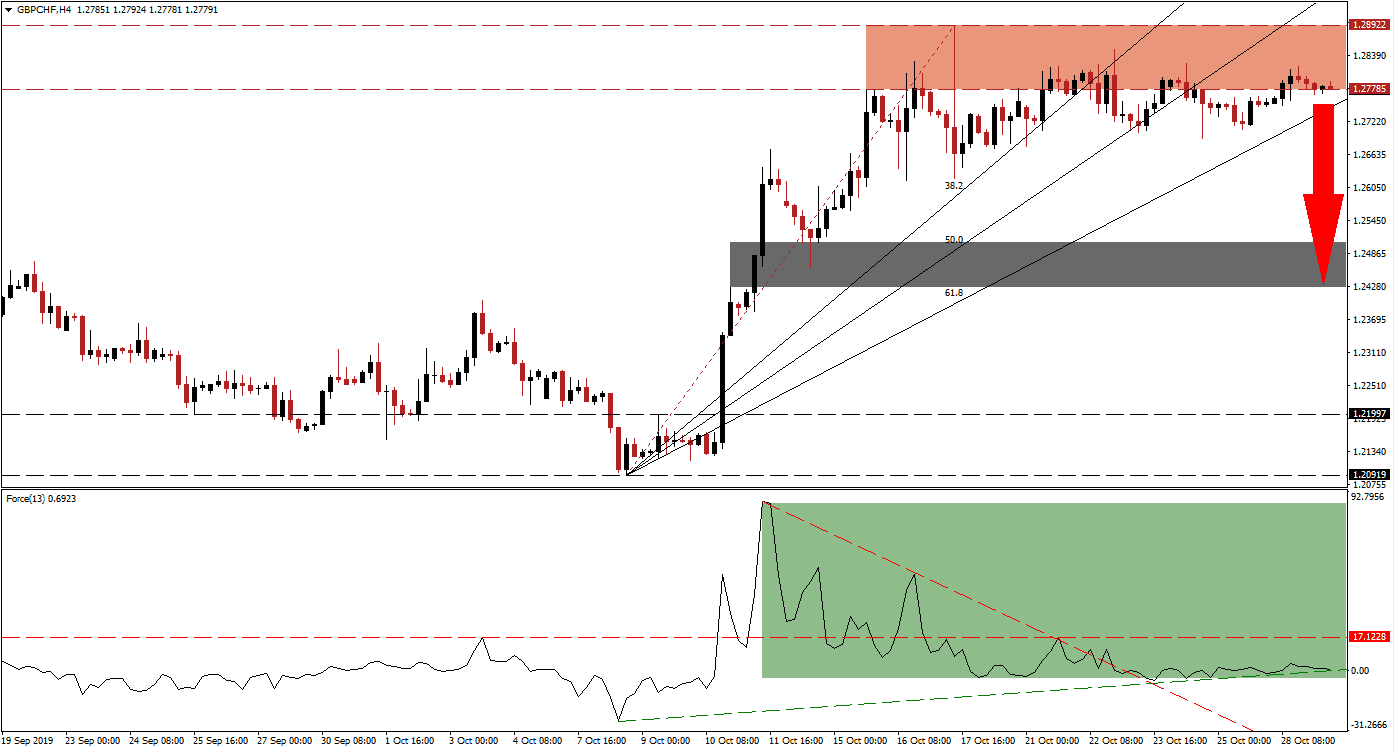

UK Prime Minister Boris Johnson lost yesterday’s Parliament vote for a snap election on December 12th 2019, but he will try again today. The EU granted what many now refer to a “flextension”, an extension of Brexit until January 31st 2020 or until Parliament will have the votes to pass the renegotiated Brexit bill. Johnson has the votes for the bill, but the timetable was voted down. The British Pound surged to five-month highs before uncertainty derailed the rally. The GBP/CHF surged into its resistance zone, but the choppy sideways trade which followed has now resulted in the Fibonacci Retracement Fan crossing this zone; this has increased pressures on price action. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next generation technical indicator, points towards the collapse in bullish momentum and suggests that a corrective phase may be next for the GBP/CHF. The first push into its resistance zone resulted in the emergence of a negative divergence, a bearish trading signal which s created when an asset advances and its technical indicator contracts. A breakdown in price action below its resistance zone was confirmed as the Force Index completed a breakdown below its horizontal support level, turning it into resistance. A sideways trend followed and this technical indicator crossed below its descending resistance level; the Force Index is now on the verge of a breakdown below its ascending support level, as marked by the green rectangle, which is likely to trigger a sell-off in this currency pair.

Bearish pressures are on the rise after the 38.2 and the 50.0 Fibonacci Retracement Fan Support Levels crossed above the resistance zone with the 61.8 Fibonacci Retracement Fan Support Level closing in on the bottom range of it. The resistance zone is located between 1.27785 and 1.28922 as marked by the red rectangle. After the initial spike to the top range of this zone, the GBP/CHF has remained close to the bottom range in another sign that bullish momentum is weak. Give the close proximity of the 61.8 Fibonacci Retracement Fan Support to the resistance zone, a double breakdown should initiate a sell-off. You can learn more about a breakdown here.

Forex traders should monitor the intra-day high of 1.26712 following a breakdown in price action, this level represents the peak of the breakout above its short-term resistance zone which turned it into support and where any corrective phase may reach its end point. This short-term support zone is located between 1.24263 and 1.25059 as marked by the grey rectangle. A sell-off into this zone, which is expected to be partially driven by profit-taking, will keep the long-term uptrend in the GBP/CHF intact.

GBP/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.27800

Take Profit @ 1.24650

Stop Loss @ 1.28550

Downside Potential: 315 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 4.20

Volatility is expected to remain elevated and news flow surrounding Brexit and the upcoming election will have a material impact on price action. Despite PM Johnson’s defeat yesterday, two minority opposition parties are in support of elections in order to break the Brexit deadlock. A reversal in the Force Index could further increase breakout pressures in the GBP/CHF. The next resistance zone is located between 1.30084 and 1.30653.

GBP/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.29150

Take Profit @ 1.30600

Stop Loss @ 1.28650

Upside Potential: 145 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.90