UK Prime Minister Johnson received support for a December 12th 2019 election as the main opposition party, the Labour Party, dropped its opposition to the snap election. Polls suggest that Johnson’s Tories are set to sweep into Parliament with a majority which would make passage of the Withdrawal Bill more likely and Brexit a reality. The British Pond surged as the EU and UK renegotiated the Brexit deal, but stalled as MP’s in the UK agreed on the bill while they disagreed on the timetable. A fresh election is expected to break the deadlock and the GBP/AUD has already stabilized and shows signs of a recovery following a profit-taking sell-off which took it down to the top range of its short-term support zone.

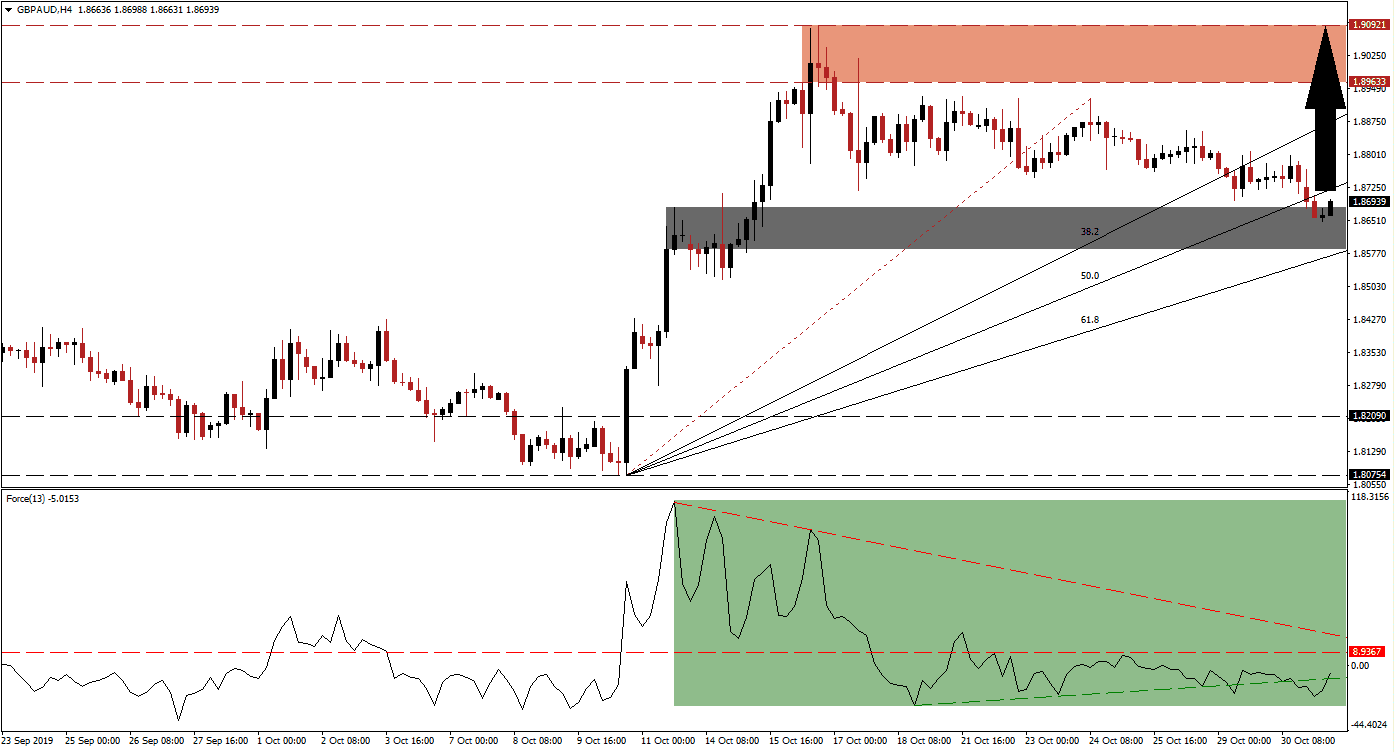

The Force Index, a next generation technical indicator, initially descended after price action pushed above its short-term support zone and into its resistance zone; this led to the formation of a negative divergence. The GBP/AUD then broke down below its resistance zone and was never able to recover, a sideways trend with a bearish bias emerged and the Fibonacci Retracement Fan sequence was redrawn. The Force Index completed a breakdown below its horizontal support level, turning it into resistance, and moved below its ascending support level; this is now being reversed as marked by the green rectangle. A push to the upside is expected to take this technical indicator back above its horizontal resistance level and price action into its resistance zone. You can learn more about the Force Index here.

As the short-term support zone, located between 1.85857 and 1.86807 as marked by the grey rectangle, has stabilized price action and allowed bullish momentum to build, a short-covering rally may follow. The ascending 61.8 Fibonacci Retracement Fan Support Level is about to enter this zone while the 50.0 Fibonacci Retracement Fan Resistance Level has eclipsed it; this resulted in an increase in upside pressure and the GBP/AUD has already ascended above its short-term support zone. A breakout above its 50.0 Fibonacci Retracement Fan Resistance Level is now pending which will turn it back into support.

Forex traders are now advised to monitor the Force Index for a potential double breakout, together with the intra-day high of 1.88075; this level marks the last time price action pierced its 38.2 Fibonacci Retracement Fan Resistance Level to the upside which was reversed into its short-term support zone. A confirmed advance above this level is expected to take the GBP/AUD back into its resistance zone which is located between 1.89633 and 1.90921 as marked by the red rectangle. Volatility over the next few weeks during the election campaign is likely to be elevated. You can learn more about a breakout here.

GBP/AUD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.86900

Take Profit @ 1.90500

Stop Loss @ 1.85700

Upside Potential: 360 pips

Downside Risk: 120 pips

Risk/Reward Ratio: 3.00

In case the Force Index fails to advance and reverses back below its ascending support level, the GBP/AUD may attempt a breakdown below its short-term support zone. Events out of the UK election campaign as well developments from the apparently stalled US-China trade negotiations are expected to provide fundamental catalysts into each direction. The next long-term support zone is located between 1.80754 and 1.8209.

GBP/AUD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.85100

Take Profit @ 1.82100

Stop Loss @ 1.86250

Downside Potential: 300 pips

Upside Risk: 115 pips

Risk/Reward Ratio: 2.61