The GBP/USD pair gained 2.5% over the course of last week's trading, supported by growing expectations for a possible Brexit deal. The pound was the best-performing major currency last month, signaling that traders quickly cut expectations of a “no-deal” Brexit on October 31. The pair's gains reached the 1.2707 resistance, its highest level in three and a half months before settling around 1.2605 at the time of writing, awaiting any developments.

The Brexit Marathon is not over yet, even if there is an agreement between the two parties, there is an important parliamentary tour to approve what will be agreed upon. The EU summit, which begins on Thursday, 17 October, will discuss developments with the UK. However, there is still a critical week for the GBP, as if a deal is concluded with the EU, it must go through the deeply divided UK Parliament. We expect the pound to continue rising if the parliament approves the Brexit deal next Saturday.

Prime Minister Boris Johnson will ask parliament to support any Brexit deal he gets from the European Union within 24 hours of this week's European summit, The Times newspaper reported on Saturday. Johnson will present a vote proposal that asks lawmakers to support any agreement he receives from the EU at the October 17-18 summit.

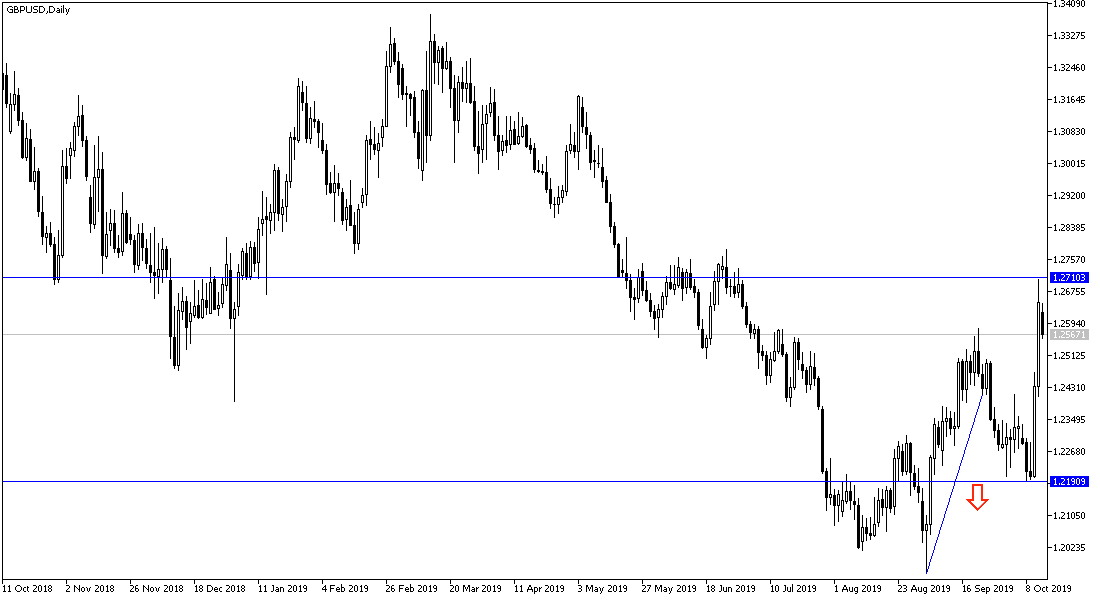

According to the technical analysis of the pair: As we continuously expected in technical analysis that the path of Brexit determines the fate of the GBP/USD direction, which triggered a strong break of the downward trend that dominated the performance for a longer time. Stability above 1.2700 resistance will remain the key for further gains that will support the pair's move towards the 1.3000 consecutive high, all of which will depend on continued optimism for the Brexit agreement. Conversely, if the negotiations fail or the agreement is not passed and the exit date is postponed, the pound could lose all its recent gains. Currently the closest support levels are 1.2590, 1.2500 and 1.2420 respectively.

As for the economic calendar data today: Today is a public holiday in the US markets, and there are no significant economic data from the UK.