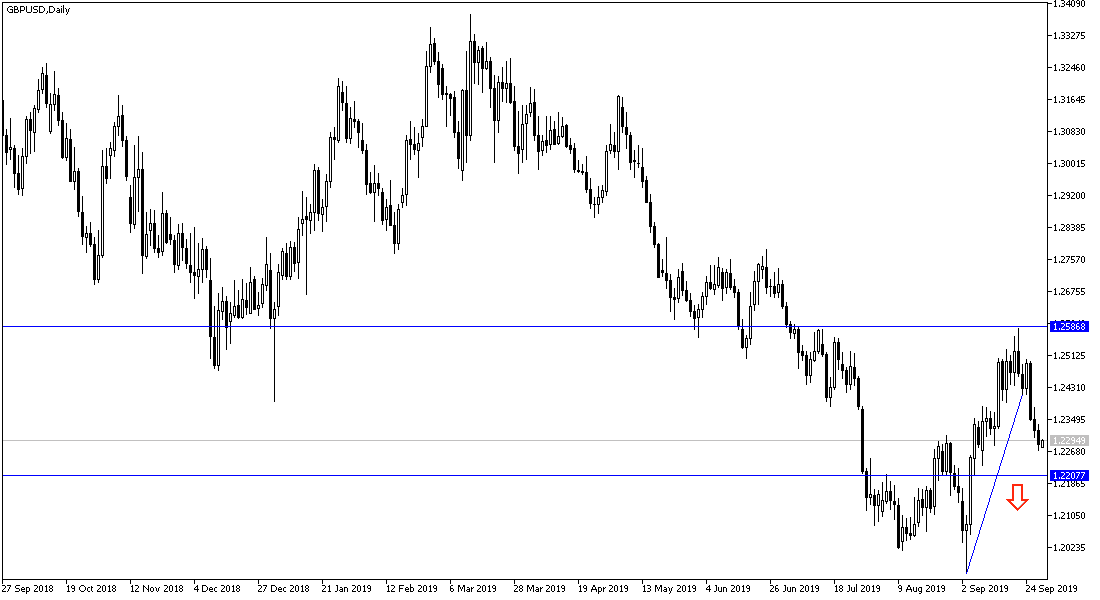

Earlier this week, the GBP/USD pair attempted to reverse the five-day losing streak which pushed it towards the 1.2270 three-week low. Monday's gains reached 1.2345 resistance, but quickly eased as the US dollar strengthened to 1.2275 support before settling around 1.2295 early Tuesday. Renewed fears of a no-deal Brexit have been a major driver of the GBP's losses again. Boris Johnson, who took over as Conservative leader instead of Prime Minister Theresa May two months ago, has pledged that Britain will leave the European Union as scheduled on October 31 with or without a deal governing future relations with the bloc.

His enemies in parliament - including members of his own party - are determined to avoid getting out without a deal, as economists say it will disrupt trade with the European Union and plunge Britain into recession. Lawmakers have already passed a law requiring the government to seek to postpone Brexit if it cannot conclude a deal with the EU by October 19. Johnson is also under scrutiny for allegations that an American businesswoman, Jennifer Arcory, received money and privileges from London coffers while Johnson was mayor between 2008 and 2016.

Yesterday's data showed that the UK economy grew slightly faster than previously estimated in the second quarter. Data from the Office for National Statistics showed that GDP was revised to 1.3 percent year-on-year in the second quarter, from the previous estimate of 1.2 percent. This followed a 2.1 percent growth in the first quarter.

Data from the Bank of England showed that British household borrowing fell in August as uncertainty surrounding Brexit weighed on consumer confidence. Consequently, the number of mortgage approvals for home purchases fell to 65,500 in August from an 18-month high of 67,000 recorded in July. This was well below expectations of 66,500 approval.

According to the technical analysis of the pair: As we expected in the previous analysis, the bearish momentum for the GBP/USD performance will remain valid as long as it is stable below the 1.2300 support. As shown on the daily chart below, there is a break of the general trend, and the support levels 1.2250 and 1.2180 and psychological support 1.2000 may be the next targets for the pair, especially if pessimism about Brexit future continues. As for the upward correction, the chance of a rebound will be stronger if the pair returns to move around and above the 1.2500 psychological resistance again.

As for the economic data, the GBP will react to the release of the UK Manufacturing PMI. During the US session, the ISM Manufacturing PMI and Construction Spending Index will be released.