Despite the optimism of all global financial markets for what has been achieved on the course of negotiations for the future of Brexit between Britain and the European Union in the past two weeks, we had expected that any negative developments in the Brexit deal would cost the Pound most of its gains, and bring it back into the quagmire of weakness. On Saturday, the British House of Commons opposed Boris Johnson's deal with the European Union and demanded a postponement until next January, which could force Johnson to apply to the EU for a delay. Johnson's response was violent, saying what happened was not binding on him and he would not ask for a delay. In the country on October 31 with or without a deal. Optimism has pushed the GBP / USD pair to make stronger gains, pushing it towards the 1.2988 resistance, the closest to the 1.3000 psychological resistance, and the highest in five months. It closed the week around the 1.2970 resistance level. We expect a violent bearish gap for the pair in early trading in response to what happened in the House of Commons.

Johnson's deal would lead to Britain getting out of the EU in a tougher position, an agreement that could cut off Northern Ireland. There will be new trade barriers and additional border inspections. The deal also excludes a new customs union and appears to prevent a close relationship with the single European market. Without a strong and active government in the UK, a Brexit would require widespread deregulation (for example, environmental protection and the protection of workers and consumers).

The strong gains of the pair were supported by a weaker US dollar after the release of a series of important US economic indicators that reinforced expectations that the US Federal Reserve, at this month's meeting, will cut US interest rates for the third time this year to protect the longest period of economic growth in the country's history. The most notable weakness was in inflation, retail sales and US industrial production.

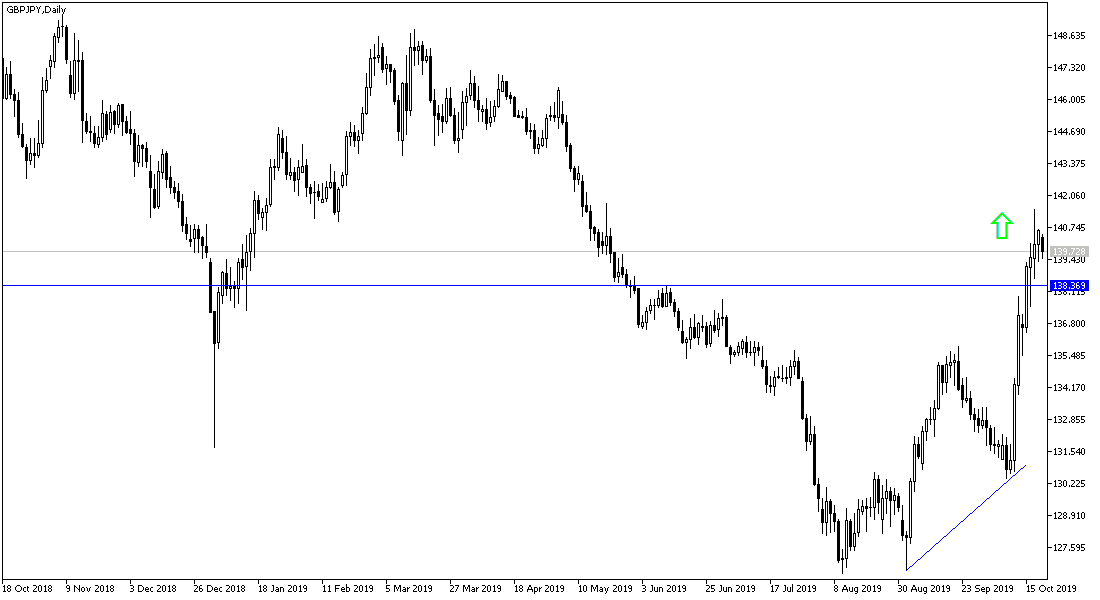

According to the technical analysis of the pair: After two consecutive weeks of stronger gains for the GBP/USD, which turned the general trend upward near the 1.3000 psychological resistance. Disappointed by the British parliament vote on the latest Brexit deal and technical indicators reaching overbought areas, we now expect a quick sell-off that could take the pair to the support levels of 1.2880, 1.2790 and 1.2650 in the first trading sessions this week. We have always recommended selling the pair from each bullish level (all recent technical analysis can be reviewed).

On the economic data front today: The trading session has no important economic releases, whether from Britain or the United States of America. Only the influence of Brexit developments.