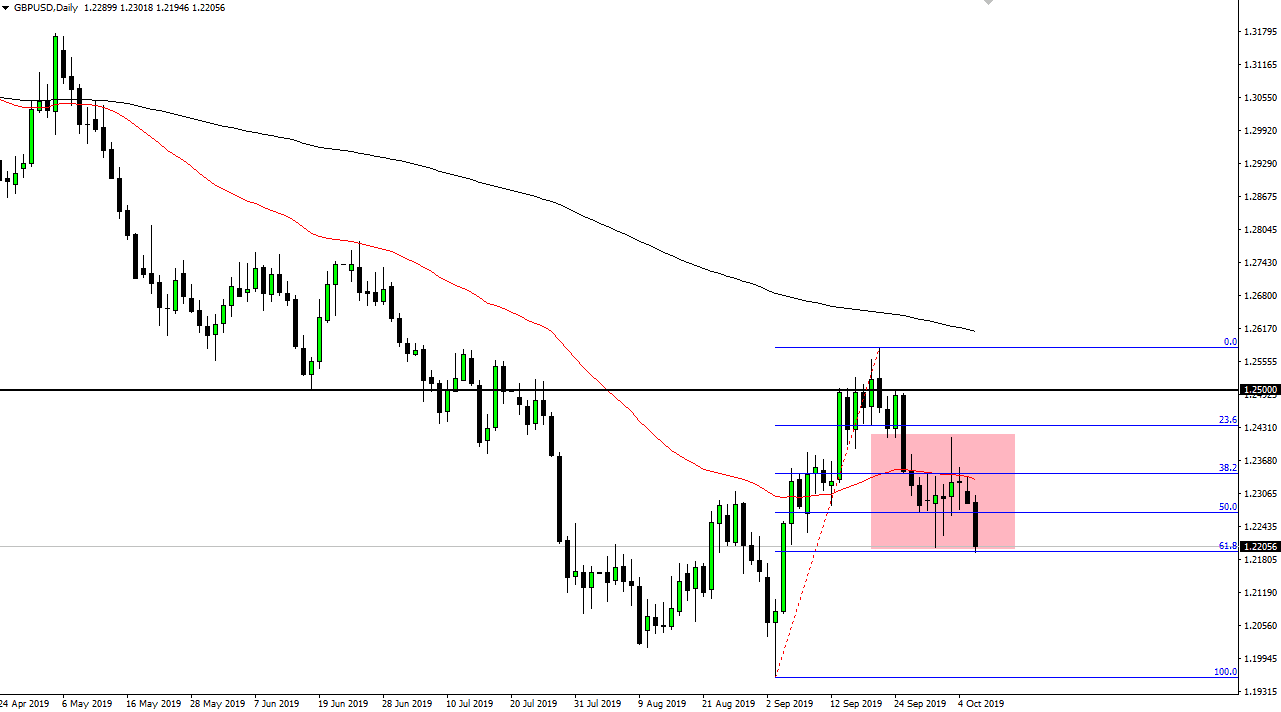

The British pound has fallen rather hard during the trading session on Tuesday after reports surfaced that Angela Merkel told Boris Johnson that the Brexit deal will be signed without Northern Ireland staying in the customs union. Ultimately, this is a market that has plenty of reasons to be skittish, and at this point it’s likely that we will continue to see a lot of choppiness, and recently you have seen several erratic candlesticks that shape a consolidation range.

Looking at the candle stick for the trading session on Tuesday though, it’s obvious that we are pressing the 1.22 handle, and at that level gives Way we could go lower, perhaps reaching down towards the 1.20 level. It would jive well with the longer-term downtrend but quite frankly it’s not until we get at least an hourly close underneath there that I would be willing to short this market. Otherwise, the market probably goes looking to the 1.23 level as a bit of “fair value”, and then the 1.24 level after that. Ultimately, this is a marketplace that is going to be very risk sensitive, especially when it comes to all nonsense Brexit.

In fact, a huge portion of the movement during the day was after that comment about Northern Ireland, which at the time of writing has not been confirmed one way or the other. However, in the last several months we have seen the British pound get thrown around by algorithms every time something comes out on Twitter. All things been equal though, it certainly looks as if closing towards the bottom of the range for the day suggests that we could go much lower. With that in mind, again I would be a seller on an hourly close below the 1.22 handle.

The 50 day EMA above is going to offer resistance, just as the 1.24 level will be. After the action on Tuesday though, I certainly think that there is much more likelihood of a break down than a move higher. The 61.8% Fibonacci retracement level lines up quite nicely at the 1.22 level, so if we break down below there the market goes down to the 1.20 level by most accounts. With this, the market continues to look like it’s in a longer-term trend to the downside. In fact, I would consider this still in a downtrend until we break above the 200 day EMA which is currently trading near the 1.27 level.