House prices in the UK posted an unexpected monthly contraction in September, but the data was not sufficient to pressure the British Pound to the downside. This kept the GBP/CHF well supported at its ascending 61.8 Fibonacci Retracement Fan Support Level from where more upside is expected. Disappointing retail sales data out of Switzerland added to downside pressure in the Swiss Franc, further supporting price action. Today’s UK Manufacturing PMI is likely to provide the next short-term fundamental catalysts with Brexit set to dominate; the UK is scheduled to leave on October 31st 2019.10.1

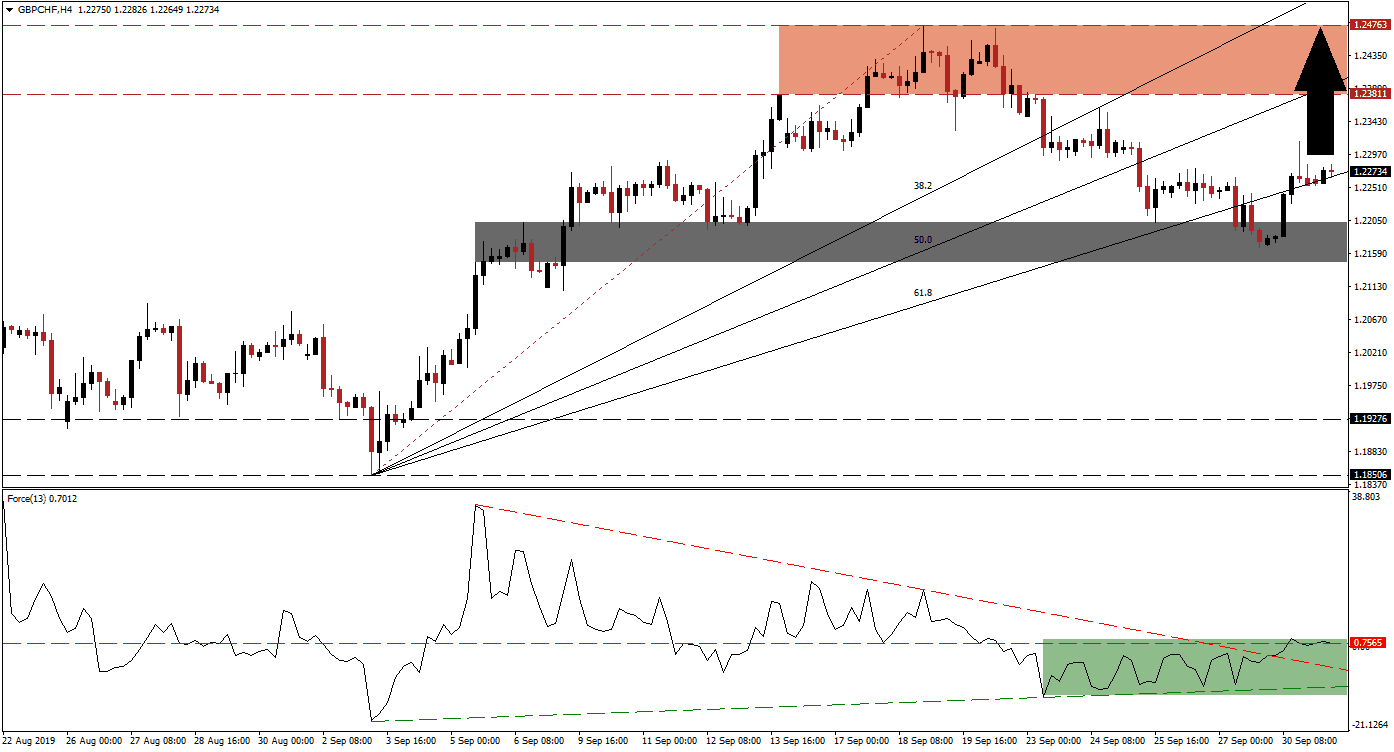

The Force Index, a next generation technical indicator, entered a sideways trend with a bullish bias after the GBPCHF pushed below its 38.2 Fibonacci Retracement Fan Support Level, turning it into resistance. A shallow ascending support level has lifted this technical indicator above its descending resistance level which now acts as a support level while the Force Index is trading above-and below its horizontal resistance level. This is marked by the green rectangle. A sustained move above this level will turn it into support and is expected to lead price action back into its resistance zone. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Following the rejection by its resistance zone, the GBP/CHF entered a sell-off which resulted in a breakdown below the entire Fibonacci Retracement Fan sequence, turning it from support to resistance. Price action descended further until it reached its short-term support zone which is located between 1.21473 and 1.22025 as marked by the grey rectangle. This sufficed to force a price spike which took this currency pair back above its 61.8 Fibonacci Retracement Fan Resistance Level, turning it into support. A minor sideways trend emerged following the breakout and forex traders should monitor the intra-day low of 1.22544 which has previously keep the uptrend alive.

As long as price action can maintain its position above its 61.8 Fibonacci Retracement Fan Support Level with the Force Index advancing, more upside in the GBP/CHF is expected. The next resistance zone is located between 1.23811 and 1.24763 which is marked by the red rectangle. A move above the intra-day high of 1.23155, the high of the most recent breakout, is expected to attract fresh buy orders in this currency pair and drive price action to a breakout above its 50.0 Fibonacci Retracement Fan Resistance Level which is passing through the resistance zone. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

GBP/CHF Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 1.22700

- Take Profit @ 1.24700

- Stop Loss @ 1.22250

- Upside Potential: 200 pips

- Downside Risk: 45 pips

- Risk/Reward Ratio: 4.44

Should the Force Index reverse and push below its descending support level, the GBP/CHF cold follow with a breakdown below its 61.8 Fibonacci Retracement Fan Support Level, turning it back into resistance. This should take price action back into its short-term support zone from where a breakdown is unlikely without a fundamental catalyst. The current fundamental picture favors short-term upside in this currency pair.

GBP/CHF Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 1.22150

- Take Profit @ 1.21500

- Stop Loss @ 1.22450

- Downside Potential: 65 pips

- Upside Risk: 30 pips

- Risk/Reward Ratio: 2.17