Over the course of last week's trading, the EUR/USD fell to the 1.0880 support, its lowest level in 28 months, as pessimism about the outlook for the Eurozone economy continues, despite the ECB's stimulus plans, including interest rate cuts and asset purchase plans. The German economy is leading the slowing economy in the region, and at the same time, Merkel government opposes the bank's plans. Recent voices have been raised calling for countries to launch their own stimulus plans along with the bank's plans to speed up the recovery process. Eurozone economy faces threats of increased US tariffs on European imports.

Weak US economic indicators contributed to a halt in the dollar's gains and allowed the pair to bounce back to 1.1000 resistance for a short time before closing the week around 1.0977.

For the US economy. The ISM manufacturing PMI for September reported a contraction for the second consecutive month. In contrast, the Services PMI pointed to a growth despite falling to a reading of 52.6, the lowest reading since August 2016. By the end of the week, employment data showed disappointing results. The US economy succeeded in creating a total of only 136,000 jobs in the non-agricultural sector, below expectations of 145,000. Meanwhile, wage growth was reported to have fallen to 0.0%, down from 0.4% the previous month. A positive US unemployment rate fell to 3.5% is the lowest level in 50 years.

Learn about the data and events that will affect the performance of the Euro this week:

The German economy is still struggling with a future of recession and there will be several important data releases this week that could intensify or ease concerns about the welfare of Europe's largest economy. Factory orders in August are expected to decline by -0.4% from -2.7% the previous month, and this release will be on Monday at 9.30 GMT. German industrial production is expected to show a -0.3% decline in August and data will be released at 7.00 GMT on Tuesday. In the previous month, production fell by - 0.6%. Other key data is the German Inflation in September, which is expected to show a 0.2% decline when released at 7.00 on Friday.

A lower than expected result would likely weigh on the EUR.

A meeting of Eurozone finance ministers will begin on Thursday. It will weigh heavily on the euro because the most important issue for the summit is the prospect of more fiscal stimulus in Europe to boost growth.

Learn about the most important data and events that will affect the USD this week:

At the beginning of the week, the US dollar will be on a date with the first remarks by Federal Reserve Governor Jerome Powell. Powell is expected to confirm his statement on recent occasions that the bank will monitor economic developments and external risks to determine appropriate monetary policy. Emphasizing the independence of the Bank's decisions away from the political management of the country.

On Tuesday, the US producer price index (PPI) will be released, which is a measure of inflation, and expectations are for a drop in prices, confirming that US inflation will continue to fall despite tow US rate cut decisions this year. Later, there will be new remarks by Federal Reserve Governor Jerome Powell.

Wednesday. It will be the most important and most influential on the US dollar with comments by US central bank governor Powell, and the release of the last Fed meeting minutes, in which, as expected, it cut US interest rates for the second time in 2019. Any pessimistic signals on the minutes of the split will increase expectations of a third rate cut before the end of the year.

Thursday. The release of US consumer price figures, which if dropped as expected, will increase downward pressure on the US dollar, as it reinforces expectations that US interest rates could be cut soon.

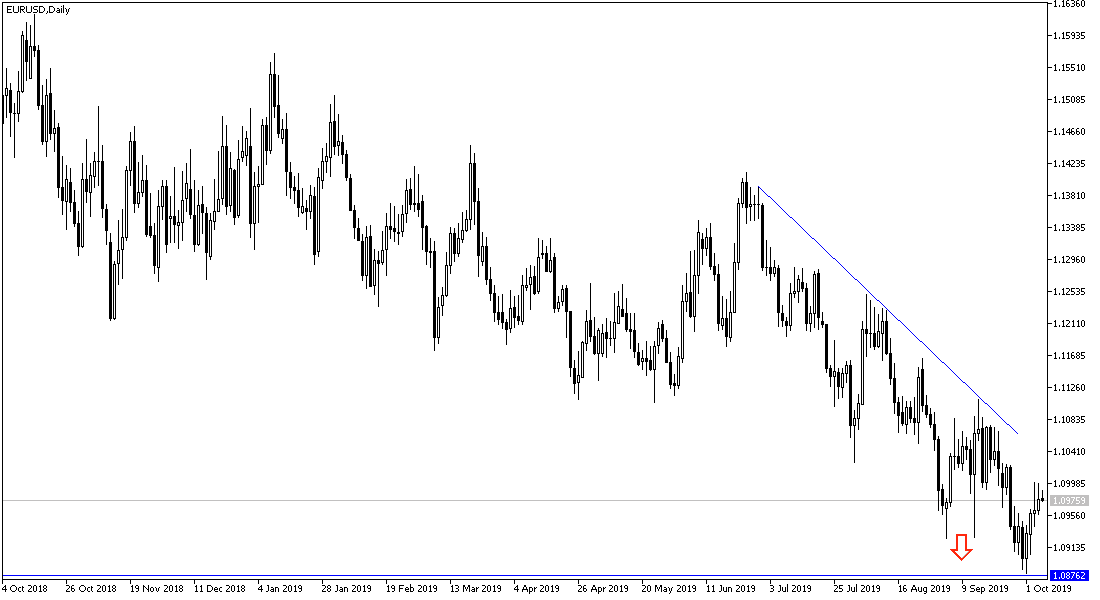

EUR/USD technical outlook for this week:

The general trend of the EUR/USD is still bearish and will remain so for a long time until the positive results of the stimulus plans presented by the European Central Bank and its member states. Despite expectations of a US rate cut, the US dollar remains strong.

The most important support levels for the EUR/USD for this week are: 1.0945, 1.0835 and 1.0700 respectively.

The most important resistance levels for the EUR/USD for this week are: 1.1030, 1.1120 and 1.1260 respectively.