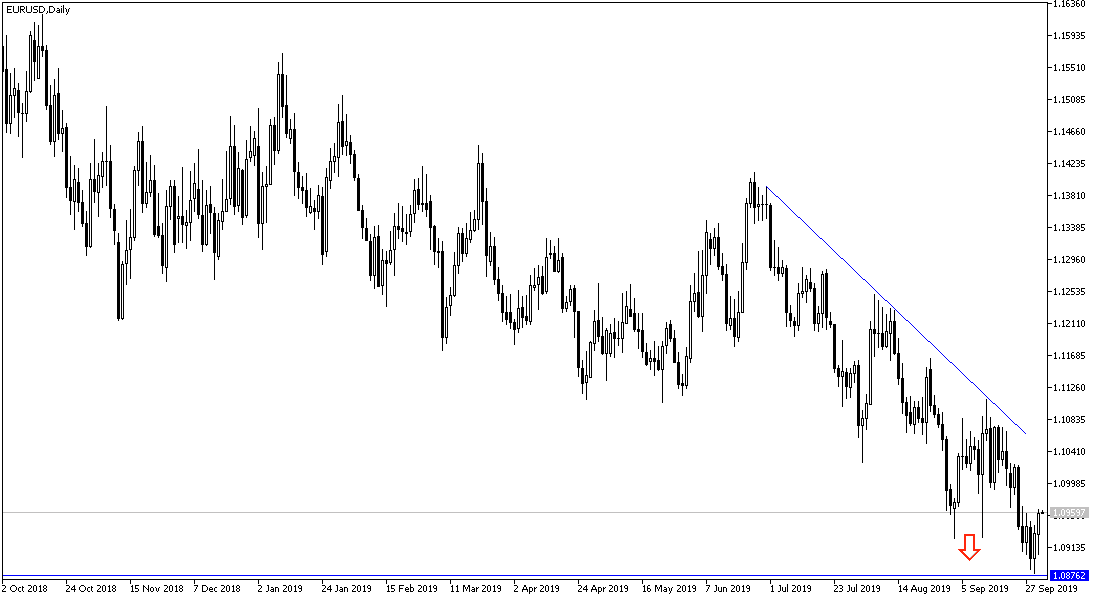

Continuous bearish momentum pushed EUR / USD to test the 1.0880 support, its lowest level in 28 months, and the pair attempted to rebound higher during Wednesday's trading session to 1.0963, and until now the stronger trend is still bearish. The bearish sentiment is expected to continue, especially with the continues pessimism due to economic crisis of the Eurozone, led by Germany, which is going through its worst performance, even worse than the economic situation during the global financial crisis 2008-2009 - prompting a group of leading research institutions along with the German government to reduce their economic forecasts for the country, where its output growth is expected to increase by 0.5% this year and 1.1% in 2020. That growth will rise to 1.4% in 2021. Their expectations were lower than the spring forecasts that the economy, the largest in Europe, will grow 0.8% this year and 1.8% in 2020. Last year, GDP increased by 1.5%.

The slowdown in the region's economy had to be intervened by the European Central Bank (ECB) with emergency stimulus plans to counter the slowdown, including interest rate cuts and bond buying plans. The economic indicators of the bloc's member states continue to support further stimulus plans by the ECB at upcoming meetings.

German Chancellor Merkel pointed to a formal shift in her country's fiscal position by saying that monetary policy should not be overburdened. The head of the German central bank, Weidman, who often opposes all of Draghi's actions, including testifying before the European Court of Justice against the ECB itself, criticized Draghi's leadership style. Weidmann wanted more and longer discussions about asset purchases. Merkel seems to be moving in the other direction. As the German economy grows for the second consecutive quarter, the government is working on a number of financial initiatives, including the recently announced € 54 billion climate change initiative. Other measures being considered include increased support for the purchase of electric vehicles and other stimulus plans.

Despite technical pressures on different time frames, the EUR is still struggling to maintain modest bullish momentum. The Euro has not risen in two consecutive sessions for nearly three weeks. On the daily chart, the EUR / USD continues to trade within a bearish channel, with strong support at 1.0800. Therefore, bears may target long-term gains at the 1.0883 support level or below at the 1.0800 psychological level. On the other hand, bulls are hoping for a significant change in direction by targeting profits around 1.1027 or higher at 1.1096.

The price of the pair will react with the release of the services PMI for Germany, France and the region as a whole, followed by the release of the producer price index and retail sales for the Eurozone. From the US, there are jobless claims, ISM services and US factory orders.