Pressure on the US dollar against other major currencies increased after the Federal Reserve announced yesterday a cut in US interest rates for the third time in 2019. The EUR/USD has been moving towards the 1.1170 resistance and sticking to its gains ahead of the release of Eurozone inflation figures.

The Fed cut interest rates for the third time this year in a bid to maintain economic growth in the face of global threats. But they said it would not have another cut again in the coming months unless the economic outlook worsened. The rate was cut to a range between 1.50% and 1.75% and this cut will affect many consumer and business loans. A statement by the Federal Reserve after the bank's last policy meeting, removed a key phrase it has used since June to signal a possible rate cut in the future. At a press conference, Chairman Jerome Powell suggested that the Fed will now stop cutting rates unless the economic picture darkens.

"If there are developments that will cause a material re-adjustment of our outlook, we will respond appropriately," Powell said.

The phrase the Fed removed yesterday from its policy statement was that it would "act as necessary to maintain economic growth." This was a sign that they were expected to continue to facilitate credit to help the US economy. In its new statement, the Fed said instead that it would review the latest economic data until it “assesses the appropriate course” of interest rates.

Two Fed policymakers objected to yesterday's decision. Boston Fed President Eric Rosengren and Kansas City Fed President Esther George said they would prefer to leave interest rates unchanged. Both have abstained from three interest rate cuts this year.

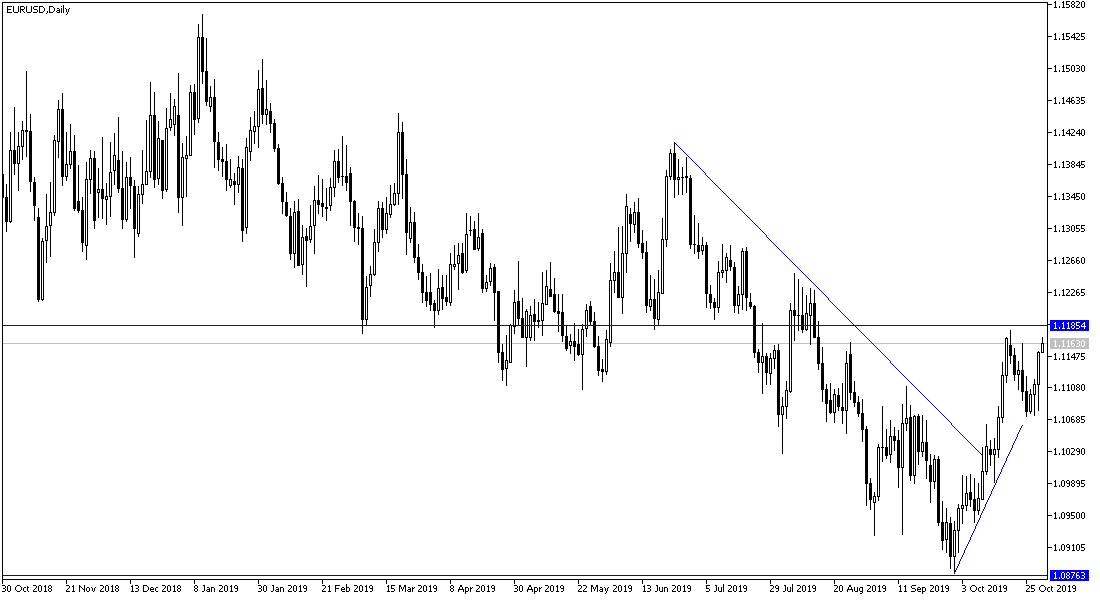

According to the technical analysis of the pair: As we pointed out in recent technical analysis, the stability of the EUR/USD pair above the 1.1120 resistance will support the upward correction. The pair now needs stronger catalysts to complete the bounce, and resistance levels at 1.1200 and 1.1285 might be the nearest targets for the bulls. On the downside, the pair’s current support levels are 1.1090 and 1.1000 and stability below the last level threatens the current bullish outlook. I still prefer to sell the pair on every bullish rebound.

As for the economic calendar data: From the Eurozone, there will be inflation rate, economic growth and unemployment rate data announcement. From the United States, the Federal Reserve's preferred inflation gauge, the personal consumption expenditure, along with the average spending and income of the US citizen, jobless claims and the cost of employment index data will be announced.