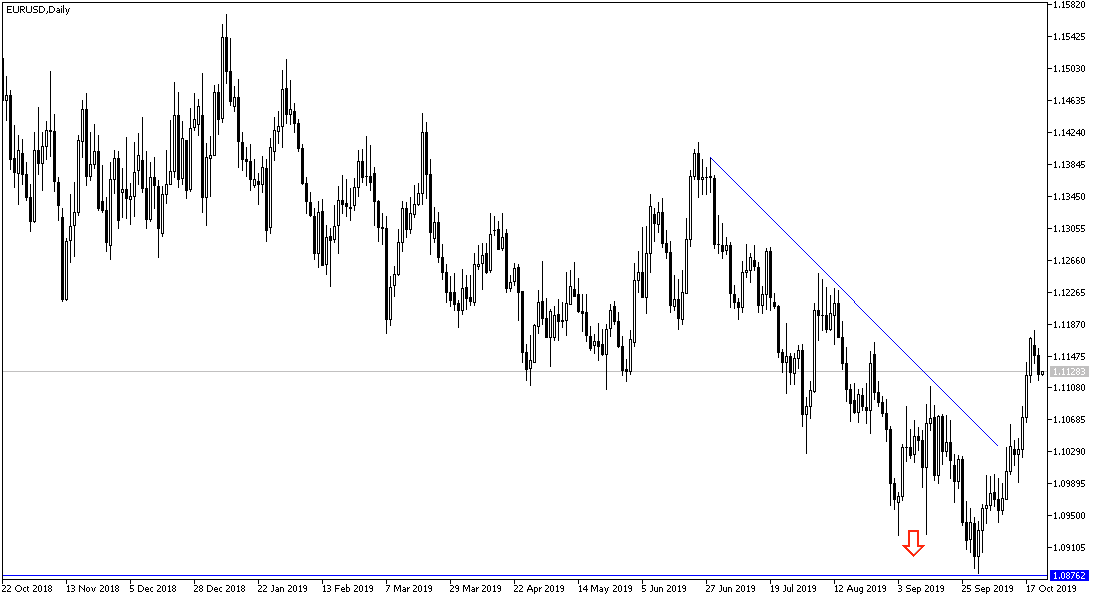

EUR/USD has not gained more momentum to complete the bullish correction since the beginning of this week, as it moved towards the 1.1179 resistance during Monday's session, its highest level in more than two months, and returned to the 1.1117 support with the lack of important economic data. Tomorrow, the pair will receive a package of influencing data and events, especially the purchasing managers' index of the manufacturing and services sectors of the Eurozone economies and then the announcement of the monetary policy of the European Central Bank at the last meeting of the bank under the leadership of Mario Draghi.

On the US side. Existing US home sales fell more-than-expected in September. After announcing an unexpected jump in existing home sales last month, the National Association of Realtors released a report on Tuesday showing current home sales fell more-than-expected in September. Existing home sales fell 2.2 percent to an annual rate of 5.38 million in September after jumping 1.5 percent to 5.50 million in August, NAR said.

Economists had expected current home sales to fall 0.7 percent to 5.45 million from 5.49 million the previous month. Despite the monthly decline, the report said existing home sales in September rose 3.9 percent from the same month last year.

On Thursday, the Commerce Department is due to release a separate report on new home sales in September. New home sales are expected to fall 1.7% to 701,000 homes year on year in September after rising 7.1% to 713,000 homes in August.

Divergent economic performance and monetary policy between the United States and the Eurozone remain in favor of the US dollar.

According to the technical analysis of the pair: on the daily chart, the 1.1120 resistance still supports the strength of the EURUSD upward correction and at the same time, any drop towards the support areas 1.1055 and 1.0980 is a strong threat to the latest performance of the pair. Investors are eyeing the Federal Reserve's monetary policy decisions next week amid growing expectations for a third US interest rate cut in 2019 to maintain the country's economic growth.

As for the economic calendar data: the Euro is on a date with the announcement of consumer confidence for the Eurozone. From the US, only US oil inventories are expected.