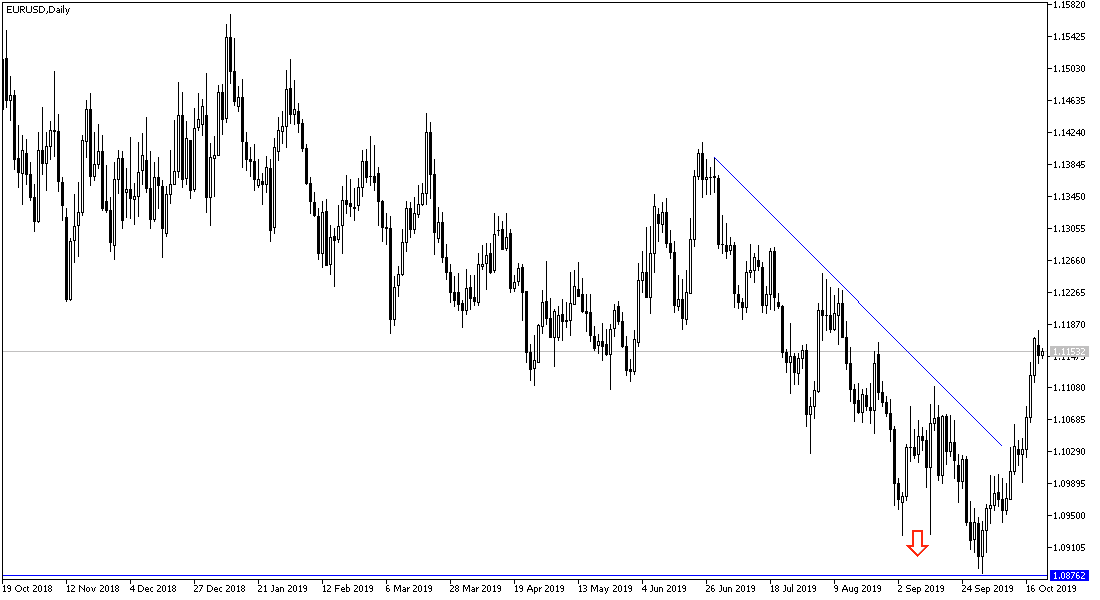

At the beginning of this week, the price of the EUR/USD has been holding its gains between the 1.1138 support and the 1.1180 resistance, waiting any developments. With the economic calendar lacking any important economic data, the pair remained in a narrow range and settled around 1.1153 at the time of writing. Announcement of Existing Home Sales Figures, and awaiting the development of the Brexit course, the single European currency will be due this week with details of the last ECB monetary policy meeting under the leadership of Mario Draghi. Financial markets are awaiting new stimulus plans by the bank, which may be carried out by the new leader, Christine Laggard, but in a different form from Draghi through a stimulus by the bank and urging European governments to provide domestic support to their economies to accelerate the pace of economic recovery in the block, in the face of continued trade wars led by the Trump administration against the rest of the world economies.

Japan's September trade figures showed that the pace of exports and imports fell moderately to produce an unexpected large trade deficit of 123 billion yen (about $ 1.1 billion). The median forecast in the Bloomberg survey was a surplus of 54 billion yen. Many observers do not seem to appreciate that Japan's current account surplus is driven not by the trade account but by the capital account. Profits from abroad, for example profits and returns on portfolio investments, are the engines of Switzerland for example. Exports fell 5.2% year on year after a 8.2% decline in August. The average Bloomberg survey was to fall by 3.7%. Imports were down 1.5% after August's decline of 11.9% and expectations of a 2.8% decline.

According to the technical analysis, the EUR / USD still has a chance to complete the bullish correction as long as it holds above 1.1120 resistance, but at the same time, we still expect a bearish bounce if there are disappointing results of the economic indicators from the Eurozone, especially from Germany. Completing the bullish correction might hit resistance levels at 1.1220 and 1.1330 respectively. Should the pair collapse to the support areas of 1.1090 and 1.0980, confidence in the completion of the current bullish correction will be shaken.

As for today's economic data, there are no significant economic data coming out of the Eurozone. From the US, existing home sales figures will be released.