Ahead of the release of important inflation figures from the Eurozone, the price of the EUR/USD has been moving in a limited range since the beginning of this week between 1.0991 tested yesterday and 1.1046, as the euro lacks the momentum and incentives to achieve further gains as expectations continue that the Eurozone economy will continue to suffer as global trade wars continue. Yesterday, survey data from the ZEW-Leibniz Center for European Economic Research in Mannheim, showed that German investor confidence fell less-than-expected in October, while their assessment of the current economic situation deteriorated to its lowest level since 2010. The ZEW economic sentiment index for Germany fell slightly to - 22.8 from -22.5 in September. Economists had expected a reading of -27. However, the reading remained below its long-term average of 21.4.

Meanwhile, the survey's current assessment index fell 5.4 points to -25.3, the lowest level since April 2010. Economists had expected a reading of -26. Commenting on the results, ZEW Chairman Achim Wambach said that the slight decline in the ZEW economic sentiment index and the status index indicates that financial market experts are still expecting further deterioration in the German economy. "The recent settlement of the US-China trade dispute does not seem to reduce economic uncertainty at this stage."

Partial agreement between the United States and China has weakened the US dollar, which has been a safe haven for investors throughout their 15-month trade dispute, weakening expectations for global economic growth.

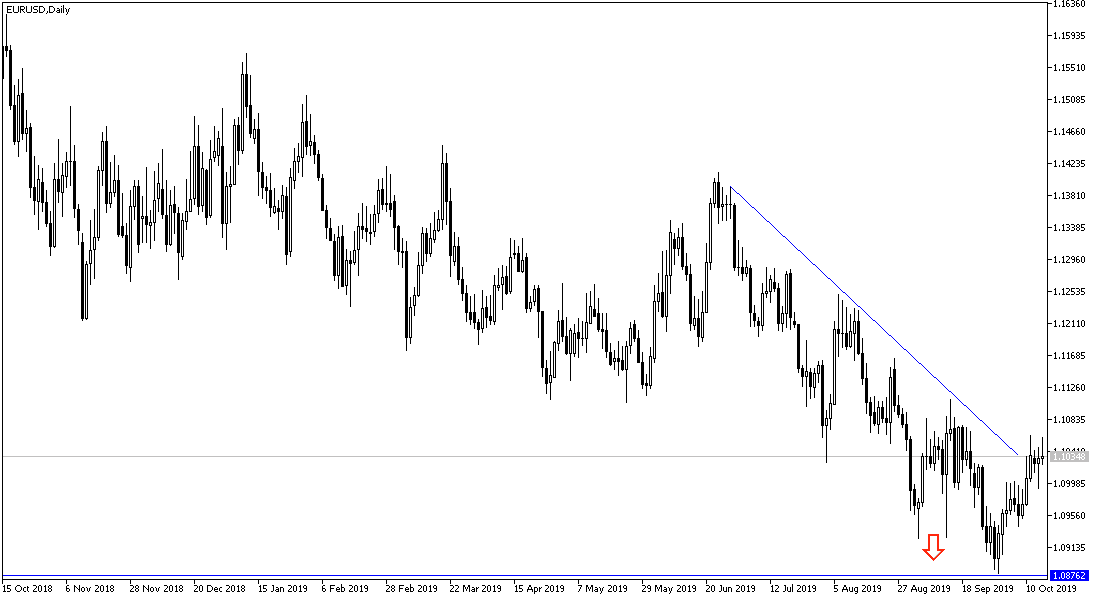

According to the technical analysis of the pair: No change in my technical outlook. At the long term, the EUR / USD pair still retains its bearish momentum and recent correction moves need stronger catalysts. This will depend on a return to confidence in the performance of the German economy, which is leading the Eurozone economy. We want to see resistance levels 1.1085, 1.1145 and 1.1200 to confirm the strength of the upwards correction. On the downside, if the pair returns to stabilize below the 1.10 support, it will irritate the bears to take the pair to stronger bearish levels again.

As for the economic calendar data today: First from the Eurozone, there will be the release of the consumer price index along with the trade balance. From the US, retail sales and the NAHB housing index will be released.