The bearish momentum of EUR/USD is expected to remain valid for the longest period as the Eurozone economy is still far from benefiting from the ECB's stimulus plans at its last meeting. The biggest economy in the Eurozone is driving the slowdown, and the continuing trade wars led by the Trump administration are expected to hit the EU, and the beginning will be with auto sector, Europe's most important industry, especially Germany.

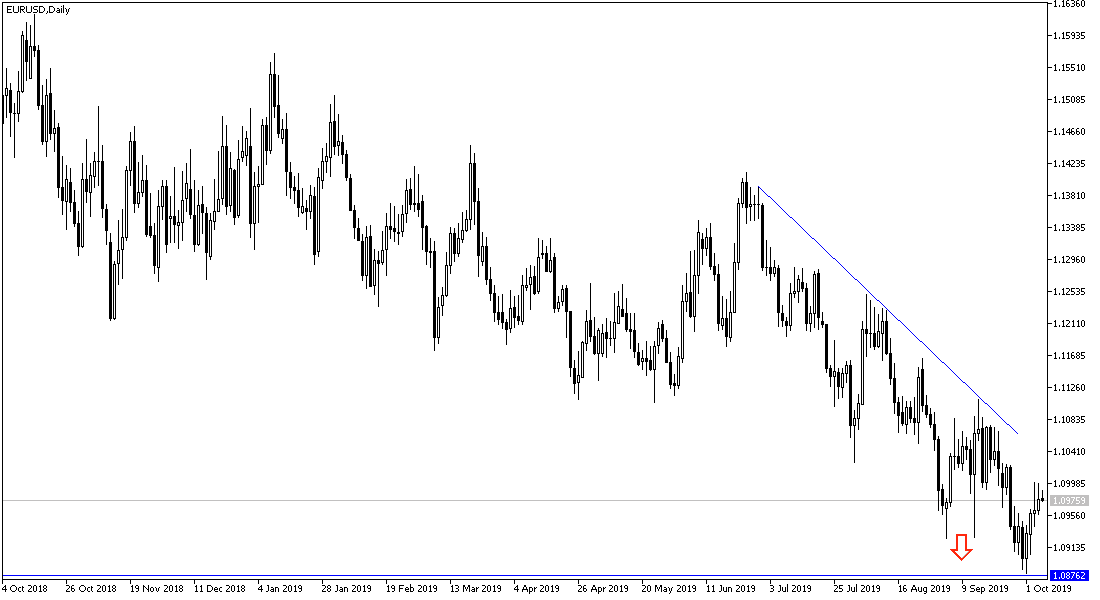

The EUR / USD saw a temporary recovery towards 1.1000 resistance during last week's trading. Forex traders are monitoring any gains for the pair to return to selling.

Germany, the world's fourth largest economy, is shrinking and facing inflationary pressures even though the entire yield curve is below zero. Negative interest rates did not stimulate inflation. It did not support investment. Lower interest rates did not increase demand, and throughout Europe, negative rates does not prevent recession. In contrast, inflation in the US and UK is higher than inflation in the Eurozone and Japan, although their recent interest rates are negative.

It is the United States. Weaknesses in the PMI and ISM reports and a drop in US equities have led to speculation that there will be no Fed rate cuts this year, and possibly two Fed cuts. One at the end of this month and one at the last meeting in mid-December. The two-year bond yield fell more than 20 basis points last week. The yield on federal funds futures in January 2020 fell 12 basis points last week to 1.455%. The current average effective rate is about 1.83% -1.85%. However, US employment data does not show that the economy is falling significantly.

Job growth has slowed, but the unemployment rate continues to fall, reaching 3.5%, the lowest level since the end of 1969, with a steady participation rate (63.2%). The underemployment rate also fell to a new cyclical level (6.9% vs. 7.2%). Some economists interpret last month's revisions as an indication of the fundamental trend, and the 45,000 upward revisions help offset a slightly higher non-farm payrolls than expected in September.

According to the technical analysis of the pair: The general trend of the EUR / USD is still bearish, and what will support the strength of this trend, is a break below the 1.0900 support, which is currently closest to it. As we expected before, we now confirm that an attempt for an upward correction higher will not be strengthened without a break above the 1.1100 resistance.

As for the economic data: The euro will face the release of German factory orders and the Sentix index of investor confidence for the Eurozone. The US dollar will face remarks from Federal Reserve Governor Jerome Powell later in the day.