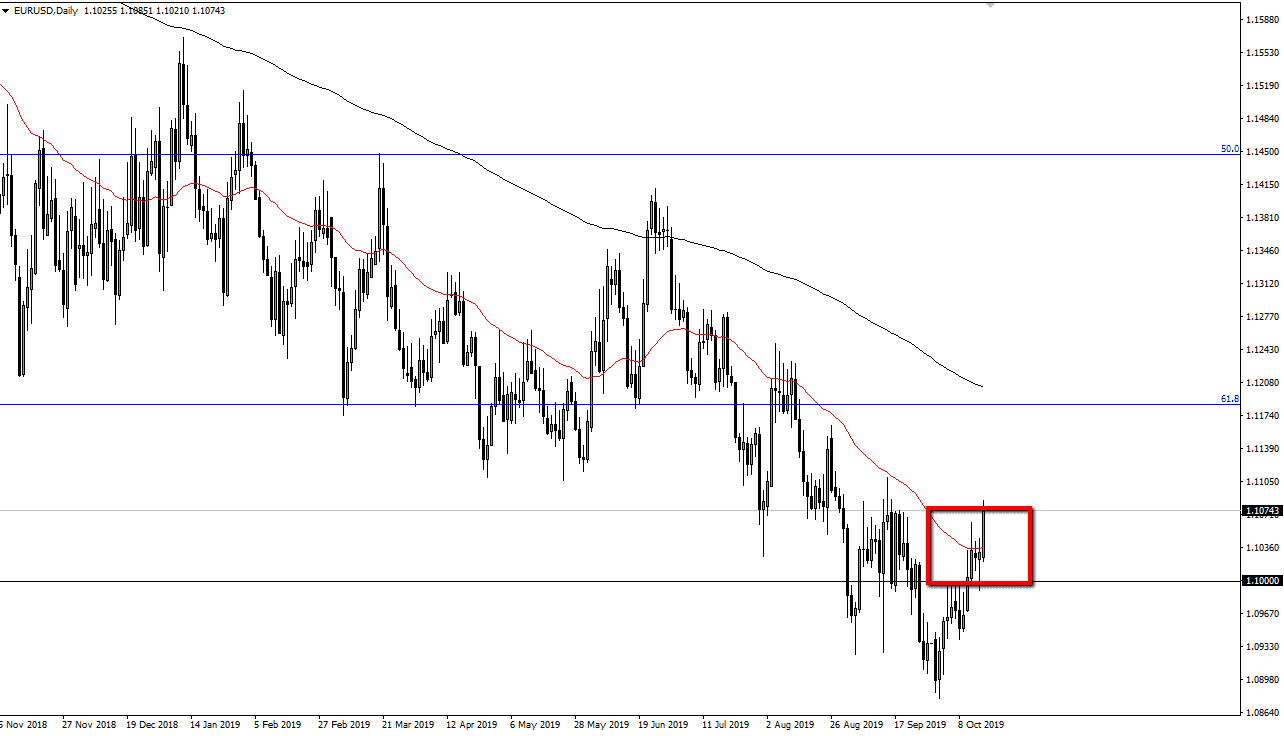

The Euro has rallied significantly during the trading session on Wednesday, breaking above the 50 day EMA late in trading. The fact that we are hanging onto gains is of course a bullish sign but when you look at the longer-term charts, we have broken above the 50 day EMA several times, as the 200 day EMA continues to be the more important of the moving averages to pay attention to. Because of this, although things certainly look a bit bullish from short-term perspective, I don’t necessarily believe that we are ready to go higher for anything significant.

Ultimately, the 1.12 level is significant resistance and near the 61.8% Fibonacci retracement level as well as the 200 day EMA. I’m looking for some type of exhaustion to take advantage of, as this market is still very much in a downtrend although this has been a nice turnaround. Again though, all you have to do is look at longer-term charts to see that these nice turnarounds have happened more than once. With that being the case, you should look at these rallies as an opportunity to pick up the US dollar “on the cheap” as it has been for the last 18 months or so.

It’s not until we break above the 200 day EMA that I think that the market can be bought up with any type of confidence. Remember, even though the Brexit situation seems to be getting a bit better, there are still a lot of variables out there that could continue to work against the value of the Euro. The Germans looked to be heading towards a recession, and of course the US economy continues to grow. However, retail sales were weekend in America during the session on Wednesday, and that will of course have a lot of people concerned about the US economy in general. This was a one-time miss, so retail sales will be paid attention to going forward. All things being equal I would anticipate quite a bit of choppiness but we are still very much in a downtrend, so I’m looking for signs of exhaustion to fade. We don’t have that at the moment, but it certainly could show itself rather quickly. While the candle stick does look somewhat impressive, when you look at it, the market really only had about a 60 PIP range for the day, not necessarily anything of impressive momentum.