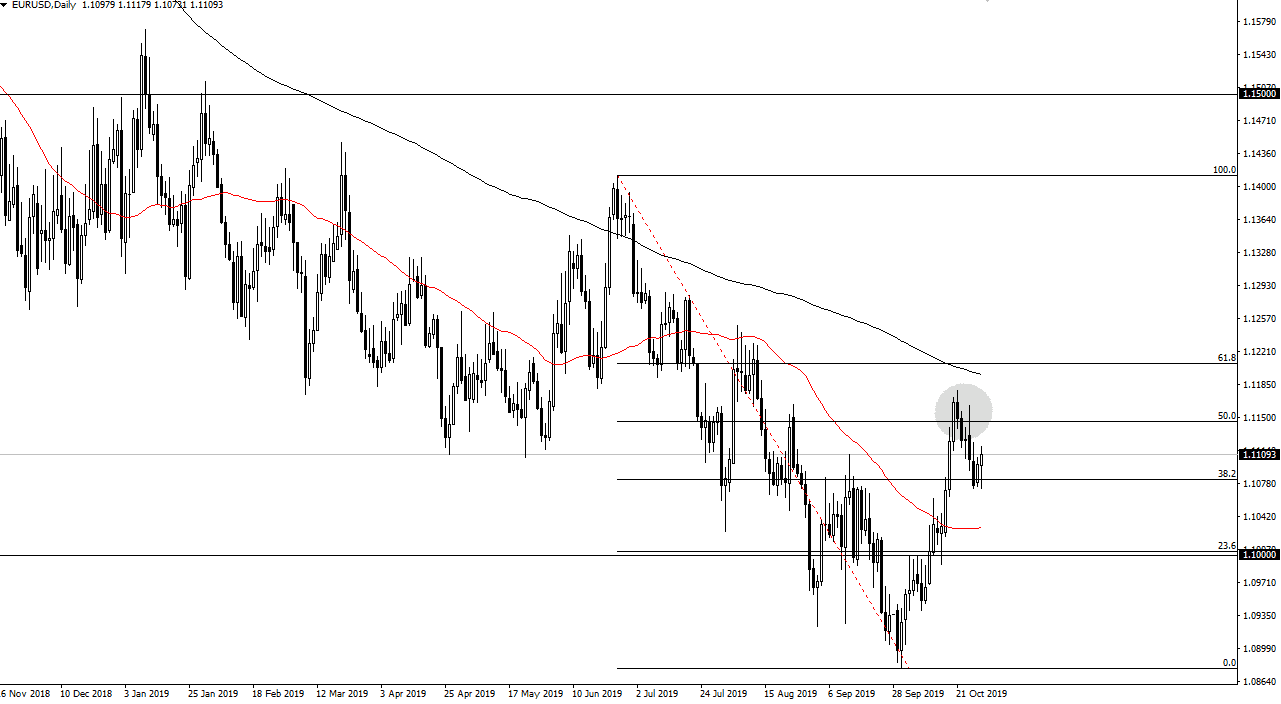

The Euro initially fell during the trading session on Tuesday, reaching down towards the 1.1075 level underneath. The market has turned around to show signs of strength, forming a bit of a hammer like candle. However, there is significant resistance above at the 50% Fibonacci retracement level, which is based at the 1.1150 level. The market has pulled back from that level a couple of times, and it also looks as if the 200 day EMA is going to race towards that area. It’s very likely that we will continue to see a lot of sellers jumping into this market and pushing the Euro lower.

However, it should be noted that the FOMC statement can cause quite a bit of volatility in the US dollar, and of course the US dollar should have quite a reaction against the Euro as this is essentially the biggest measure of the US dollar and the most heavily traded Forex pair.

At this point, if we were to break down below the 1.1075 handle, the market could go much lower, reaching towards the 50 day EMA and then the 1.10 level underneath which is a major round figure that will cause quite a bit of reaction. The market is still very much in a downtrend, but it’s obvious that the market is trying to build up enough momentum to at least make a run at the 200 day EMA and it’s likely that the FOMC statement will be the catalyst for the market to move in one direction or the other. Between now and then it’s very unlikely that market moves drastically, as it will simply grind back and forth on short-term charts. However, you can expect the business to pick up as that announcement comes out at 2 PM Eastern Standard Time, and as market participants parse the words of the accompanying statement. Ultimately, this is a market that seems to be trying to figure out its overall directionality, but it should be noted that the market has rallied like this previously, only to roll right back over. With that being the case, a breakdown would not be a huge surprise due to the overall downward pressure. However, if we can get a significant move above the 200 day EMA, it could be the beginning of something quite a bit more impressive.