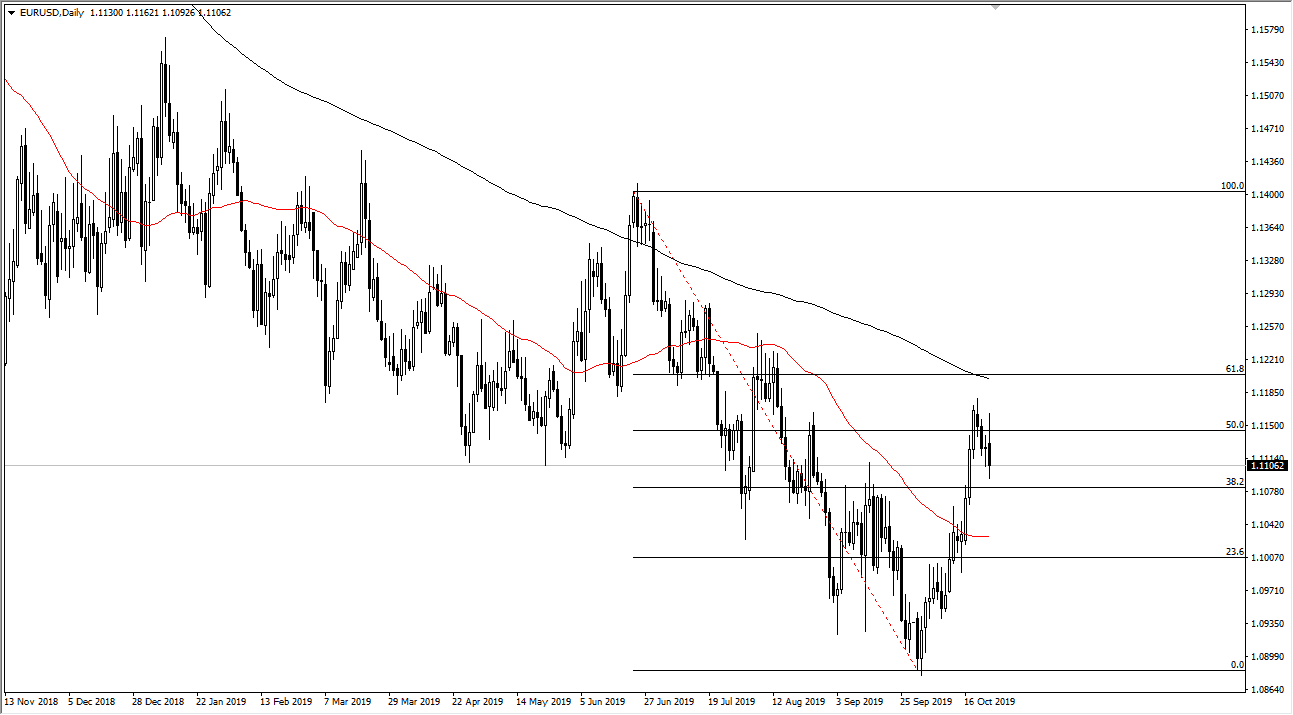

During the trading session on Thursday, the Euro went back and forward and all over the place as one would expect, but when you look at the technical analysis standpoint, the market has tried to rally and make a fresh, new high, but then turned around to drift much lower. At this point, the market is likely to continue to go to the downside, as the 50% Fibonacci retracement level has in fact held. Beyond that, the 200 AMA above offers resistance and it’s likely that we will continue to see sellers jump back into this market.

Even though the market has shot straight up in the air recently, we have done this before. All you have to do is look back at the last couple of years and see that every time we have broken above the 50-day EMA, we have seen a lot of selling pressure near the 200 AMA. The latest move has simply been what we have seen more than once, so I do like the idea of selling this market in this area, because it's simply history repeating itself. The European Union is heading into recession, and the central bank of course is very loose with its monetary policy.

The market is very likely to continue to go lower based upon the three-year trend, and of course the demand for US dollars out there picking up. The bond markets have been strong until recently, so that of course drives up the value of the greenback as well. Alternately, if we break above the 61.8% Fibonacci retracement level/200 AMA, then the market could go looking towards the 1.14 level which is a 100% Fibonacci retracement level. All things being equal I do think that selling the rallies continues to work and that may be what we have just seen yet again.

If we do break out to the upside though, it could be the beginning of a trend change but we still have a lot of work to do as there has been so much structural damage done to the Euro. As Germany looks ready to head into recession, that of course works against this currency as well so ultimately it looks as if the market is facing in the right direction and should continue to go lower based upon what we have seen. Feeding short-term rallies continues to be my strategy.