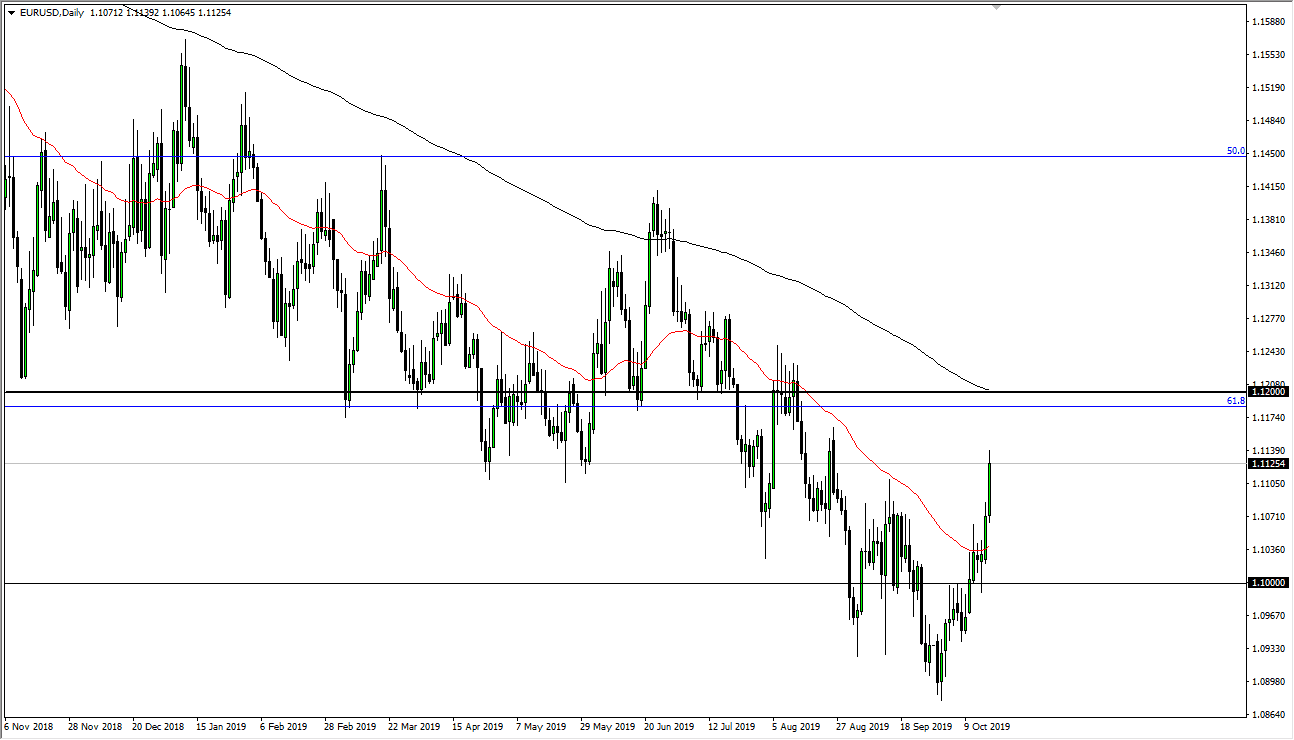

The Euro rallied a bit during the trading session on Thursday to reach towards the 1.1130 level, before running into a little bit of resistance. However, there’s even more resistance at the 1.12 level, as it is a large come around, psychologically significant figure and of course an area that has attracted a lot of attention in the past. While the Euro has been very bullish as of late, the reality is that it is still very much in a downtrend. When you zoom out, the last 18 months has seen the market break above the 50 day EMA several times, but not above the 200 day EMA for more than a brief few sessions. Looking at this chart, that’s exactly where we are right now and it’s likely that the market will remember that.

Looking at this chart, the 200 day EMA is also at the 1.12 level, which is reason why that should come into play. The recent move has been rather parabolic so it’s difficult to imagine a scenario where we simply shoot straight up in the air. Ultimately, I believe that the market will pull back from that area and I am more than willing to start selling in that general vicinity. After all, the European Union is heading into a recession and although the Federal Reserve is likely to cut interest rates, the reality is that there is a global dollars shortage when it comes to funding debt, which will creep into this pair as well.

If the market does break above the 1.12 level on a weekly close, then I would be bullish and start to be a buyer longer term. On the daily chart by itself I’m not going to start trading against what has been a very crucial downtrend. Overall, this is a market that has been very reliable to the downside so until it shows me something different I will look at this as yet another rally that will probably be sold into. I think at this point it’s a matter of waiting for a nice selling opportunity before you can get involved. Simply jumping in right here would be reckless though, because we do not know whether or not the trend can change. If the market were to break out significantly above the 1.12 level we could be looking at a move to the 1.15 handle.