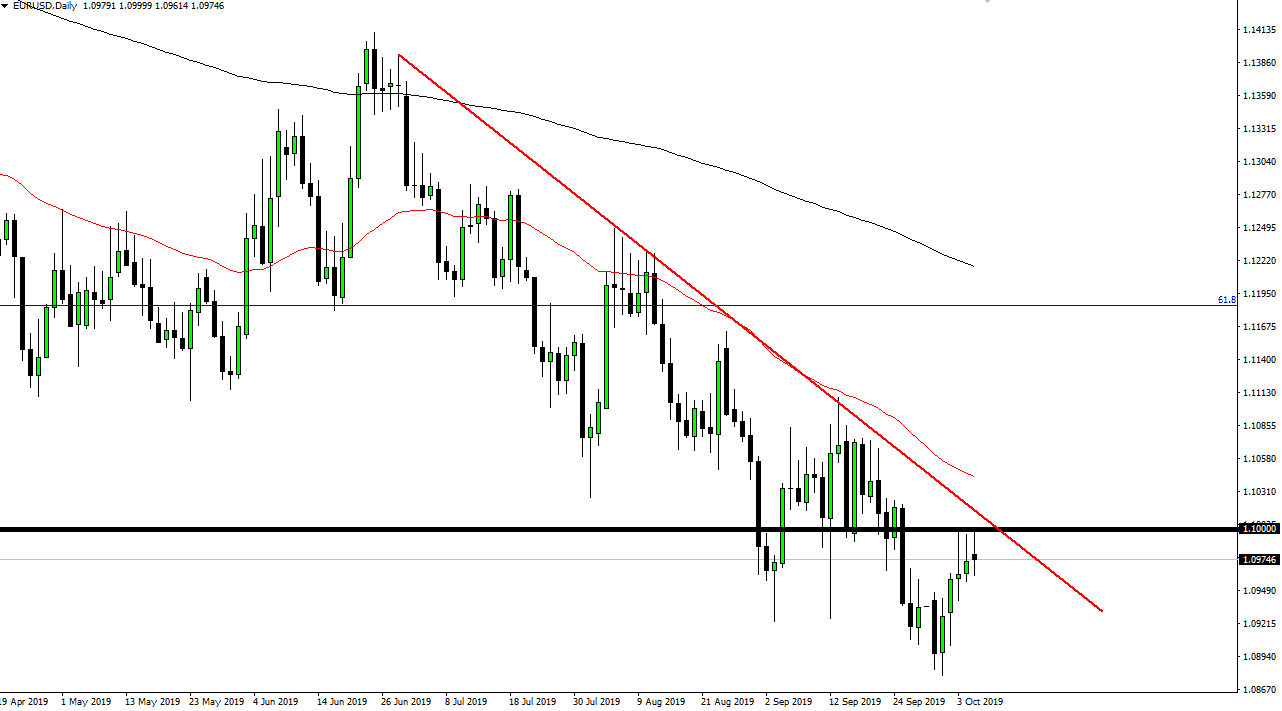

The Euro initially was all over the place during the trading session on Monday but was essentially chopping around and floundering more than anything else. The 1.10 level offers significant psychological resistance, and as a result we have pulled back from that level again. It looks as if the Euro is going to continue to struggle and it should be pointed out that we are in the longer-term downtrend anyways.

The downtrend is not only signified by “lower highs and lower lows”, but the downtrend line and 50 day EMA as well. A break down below the last couple of days should bring in more selling pressure, and I think Brexit will continue to weigh upon the Euro in general. Beyond that, the US dollar should be strengthened by stock market traders, and of course bond markets as well. Looking at this chart, it’s obvious that the trend should continue to go lower, as we are not only below those levels, but also below the 61.8% Fibonacci retracement level. Because of this, it’s likely that the market could go down to the 100% Fibonacci retracement level, but it should also be pointed out that the area around the 1.0750 level is a gap on the daily charts.

All things being equal, it’s very likely that the choppy trading should continue, and therefore I think it’s only a matter time before we get lower, but we will get the occasional bounce that you should be aware of. This bounce is offer short-term selling opportunities, and ultimately this is a market that is more short-term scared than anything else. It’s going to be difficult to hang onto a longer-term trade, so therefore I suspect you are better off fading short-term shooting stars and the like. I think the volatility is going to make it very difficult hang on to this situation. All things being equal, it’s likely that the market will have the occasional headline here and there that comes into the market and make things difficult. At this point, buying is something that I’m not interested in, but I would reconsider all that if we broke above the 50 day EMA on a daily close. That could show a significant momentum in the opposite direction, perhaps reaching towards the 1.12 level. All things being equal though, I don’t think that happens anytime soon. I remain bearish.