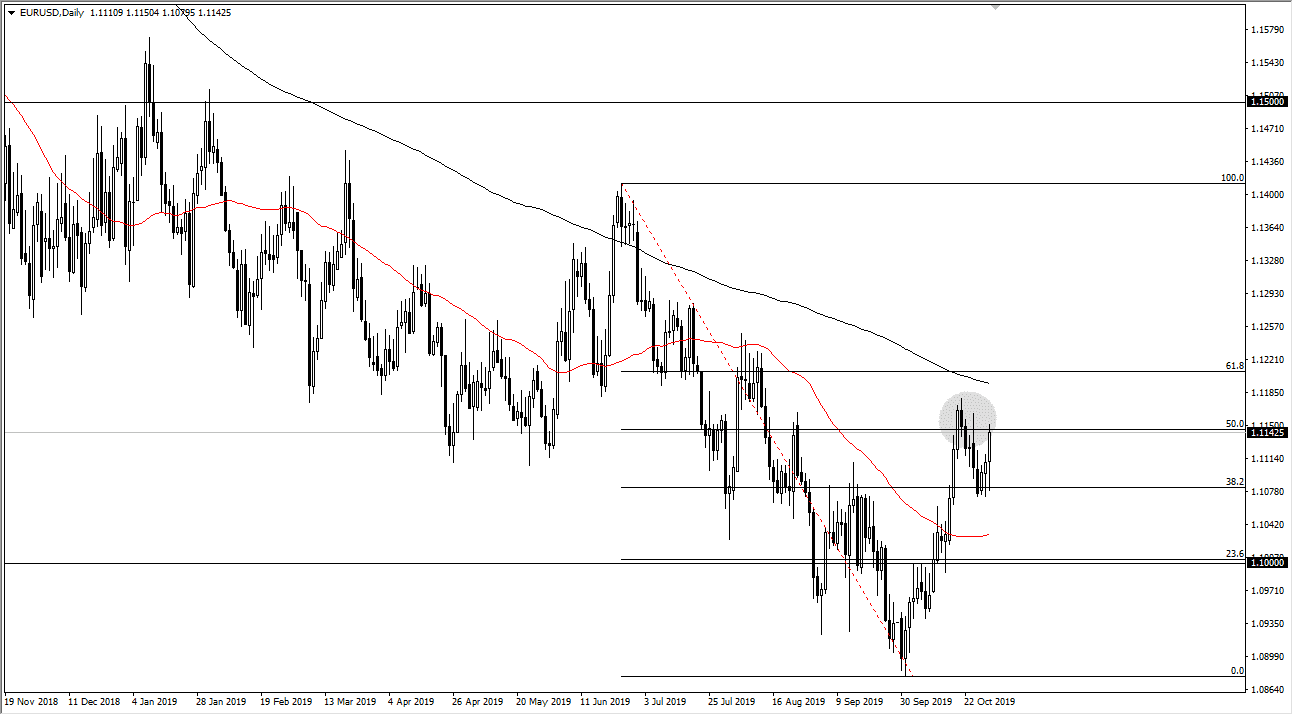

The Euro initially fell during the trading session on Wednesday, but found support of the 1.1075 level again, rallying quite significantly to reach the 1.1150 level. At this point, the market looks likely to try to reach towards the significant 200 day EMA above, pictured in black on the chart. At this point, the market is very likely to see a lot of resistance in that area, so keep in mind that it’s going to take a significant amount of momentum to breakout to the upside.

That being said, signs of exhaustion could be a nice selling opportunity, as this is an area that has caused some selling pressure recently. It is also the 50% Fibonacci retracement level and it should be noted that the market has seen progressively “lower highs” on the chart over the last couple of trading sessions. If we do break down from here, the market could go looking towards the 1.1075 underneath, as we have seen it offer abounds previously. Every down below there opens up the door to the 50 day EMA underneath, and then perhaps the 1.10 level after that. After that, the market then goes looking towards the lows closer to the 1.09 level.

While the US dollar got hit somewhat hard on Wednesday, the reality is that we have been in a downtrend for almost 3 years now, and it’s very likely that we will continue to see more selling pressure eventually. After all, the European Union is on the verge of a larger recession, while the United States is still growing at the very least. While that growth hasn’t been extraordinary, it’s much stronger than anything we see in any of the other major economies, so it still helps the US dollar in general. Ultimately, the interest rate cut during the day on Wednesday does work against the strength of the US dollar, but the interest rates still suggest that we should be going lower given enough time. After all, the Federal Reserve has cut rates by 25 basis points, but it has also suggested that it was going to be pausing its quantitative easing cycle, and that of course should eventually benefit the greenback. Quite often, the initial reaction is reversed, and that could be what we are getting ready to see, and I will be more than willing to short signs of exhaustion. However, if we do clear the 200 day EMA to the outside and sliced through the 61.8% Fibonacci retracement level, then it could be the beginning of a trend change for a longer-term move.