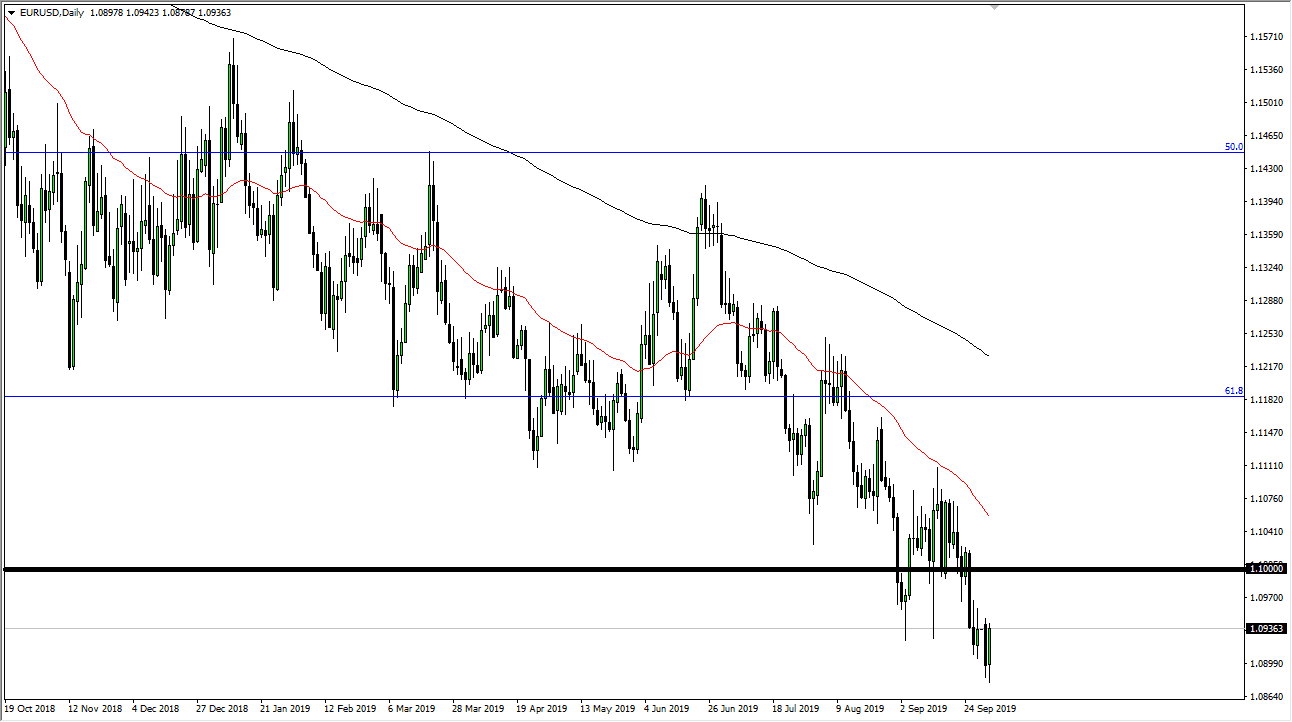

The Euro initially fell during the trading session, breaking down below the 1.09 level on Tuesday again. However, we did bounce after the less than stellar ISM numbers coming out of the United States during the day hit the headlines. That being said, it doesn’t really matter because the downtrend has been ensconced in this pair for 18 months or more. Every time we rally like this, it’s only a matter time before the sellers return and nothing has changed in the European Union over the last 24 hours that would make the Euro suddenly attractive. This is simply a reaction to the Federal Reserve having to cut interest rates in the future, but that’s not necessarily something that wasn’t already known.

At this point I believe that the 1.10 level above is significant resistance and clearly any type of exhaustive candle in that area will attract a lot of attention. That would be a nice selling opportunity from what I see and I do not have any interest in trying to buy this market because I do believe that it happens given enough time. In fact, we are well below the 61.8% Fibonacci retracement level from the longer-term move, which has me looking for a move lower. The gap below at the 1.0750 level is my target at the moment, but I also recognize based upon historical action over the last 18 months that he will continue to be very choppy on the way down. It’s a zigzag pattern that will continue to extend to the downside.

I simply wait for rallies that show signs of exhaustion in the form of a shooting star or other such candle stick that I can take advantage of. The world is short of US dollars right now anyway, so there is a lot of demand out there for liquidity. That will continue to elevate the US dollar, and it should also be noted that the US Dollar Index hit a high during the intraday session, so a little bit of profit taking may have occurred as well. With that, I believe that this market sees plenty of resistance between here and the 1.10 level, and I am more than willing to short the first signs of exhaustion that appears. Short-term charts will probably continue to be the way to play this market though, as it does tend to chop around so much.