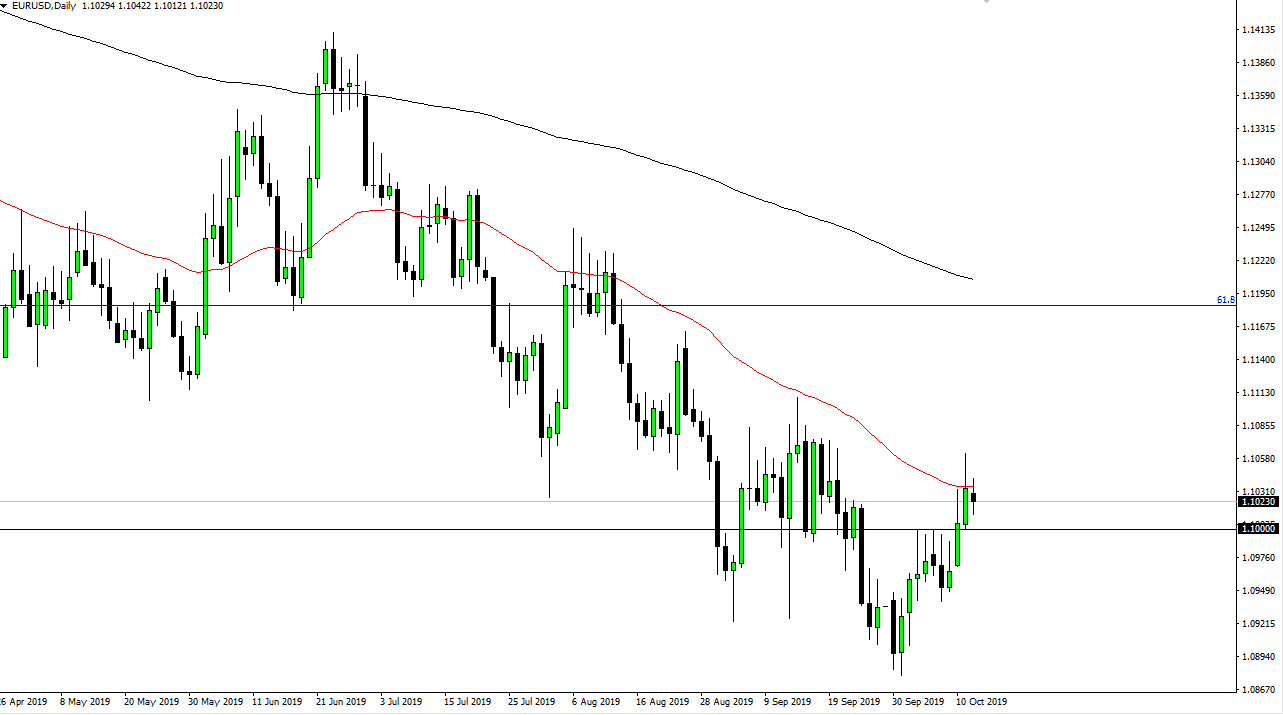

The Euro went back and forth during the trading session on Monday, showing signs of confusion and exhaustion. After all, the market has been very bullish as of late, but is now starting to approach the 50 day EMA. The 50 day EMA is flattening out and has offered quite a bit of resistance, more than once. With that in mind I would suspect that it should continue, all things being equal.

The candlesticks lately have given us quite a bit of bullish pressure, but at this point we have formed several long wicks to the upside which shows just how much we are running into as far as selling pressure. We are in a downtrend, so you shouldn't be looking for any type of buying opportunity anyway. The 50 day EMA is of course a major technical indicator, just as the 1.11 level above is significant structural resistance. I’m looking for an opportunity to start selling, and a break down below the candle stick from the Monday session might be that reason. If we were to break down below the 1.10 level, then it’s likely that we will pick up quite a bit of downward momentum at this point.

On the other hand, if we were to break above the 1.12 level, then it’s likely that the market could go much higher, as we would probably take off and break above the 200 day EMA. That of course would represent a longer-term trend change possibly, and have the markets rushing to the upside as they have been so oversold. That being said, the fundamental situation does not make sense for this market to have a major trend change as bonds in the European Union for the most part are offering negative yield, while the US bond markets have been offering positive. Beyond that, the United States does tend to be a place where people put money when people are a bit concerned, as treasury markets are considered to be the safe haven.

We are still very much in a downtrend, and that should continue to be the most important thing you pay attention to on the chart. Beyond all of the things mentioned previously we also have to worry about Brexit which is still a complete mess. There is a gap down at the 1.0750 level that has yet to be filled, and that might be where we are going over the longer-term.