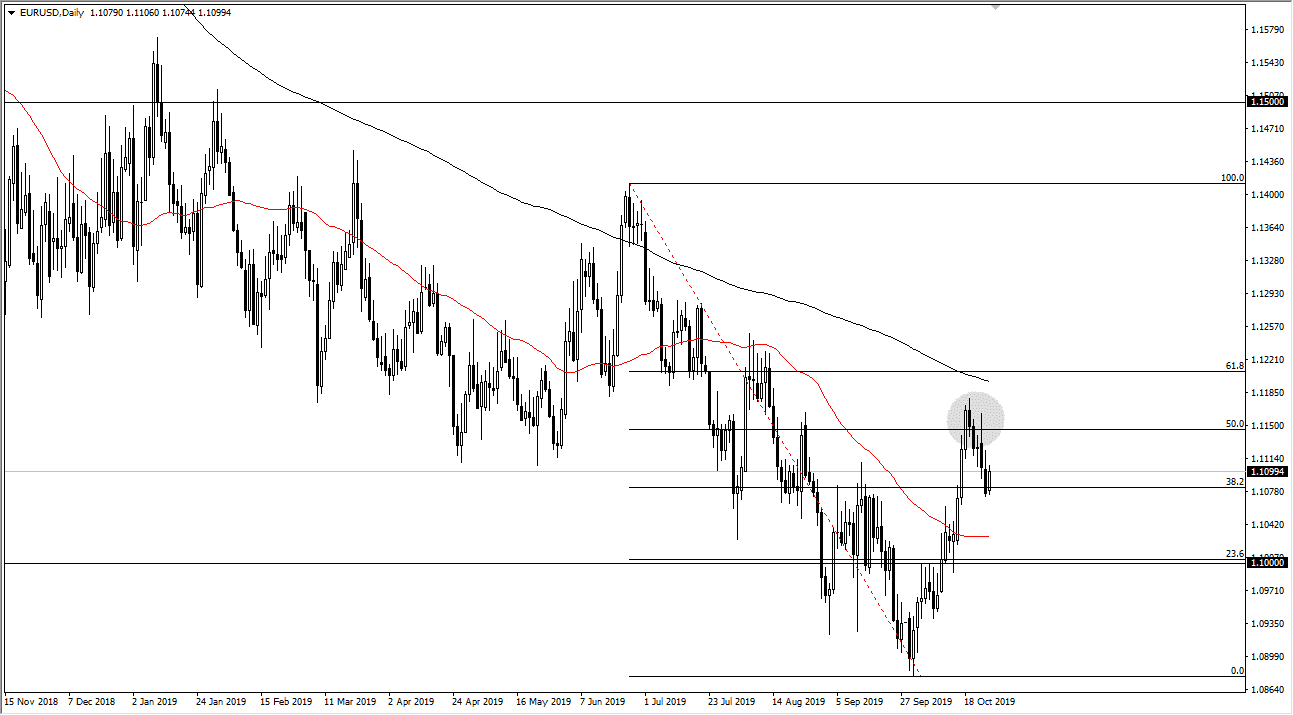

The euro bounced a little bit during the trading session on Monday from the lows of Friday trading. That being said though, the market looks very likely to continue to drift a bit lower, because although the Monday session was bullish, the question now is going to come down to whether or not we will continue to reach towards the 50 day EMA.

The overall longer-term trend has decidedly been negative, and it would continue to cause a lot of issues. The market has bounced all the way to the 200 day EMA more than one time, and it’s likely that we continue to see sellers every time the market rallies. Quite frankly, the market has been relentlessly negative, but occasionally we will get these large parts to the upside. That looks to be what we have just gone through, and this in the past has offered a lot of opportunities. The 50% Fibonacci retracement level has offered resistance previously, so it will be interesting to see whether or not the market recognizes that level as resistance yet again.

To the downside, if we were to break down below the 50 day EMA, the market will then try to break down below the 1.10 level. Hello there, the market is likely to go looking towards a 1.09 level. Quite frankly, I don’t have the interest in buying the Euro at this point but would have to take serious stock of a major move above the 61.8% Fibonacci retracement level which is currently sitting at the 1.12 level. If we do break above there, then it’s likely that the market goes looking towards the 100% Fibonacci retracement level, which is closer to the 1.14 handle.

Overall, I believe that the US dollar should continue to strengthen in times of uncertainty, but we also have the FOMC Meeting Statement coming out on Wednesday and then of course could cause a lot of volatility in the greenback. That of course will have a major influence on this market, so Tuesday might be a bit quiet in general as we await word out of the Federal Reserve. Ultimately, market participants will continue to weigh the different geopolitical and economic issues out there that could cause volatility in this currency pair. Overall, we are still in a downtrend regardless of how much we have rallied recently, and therefore looking for signs of exhaustion would be the way to go.