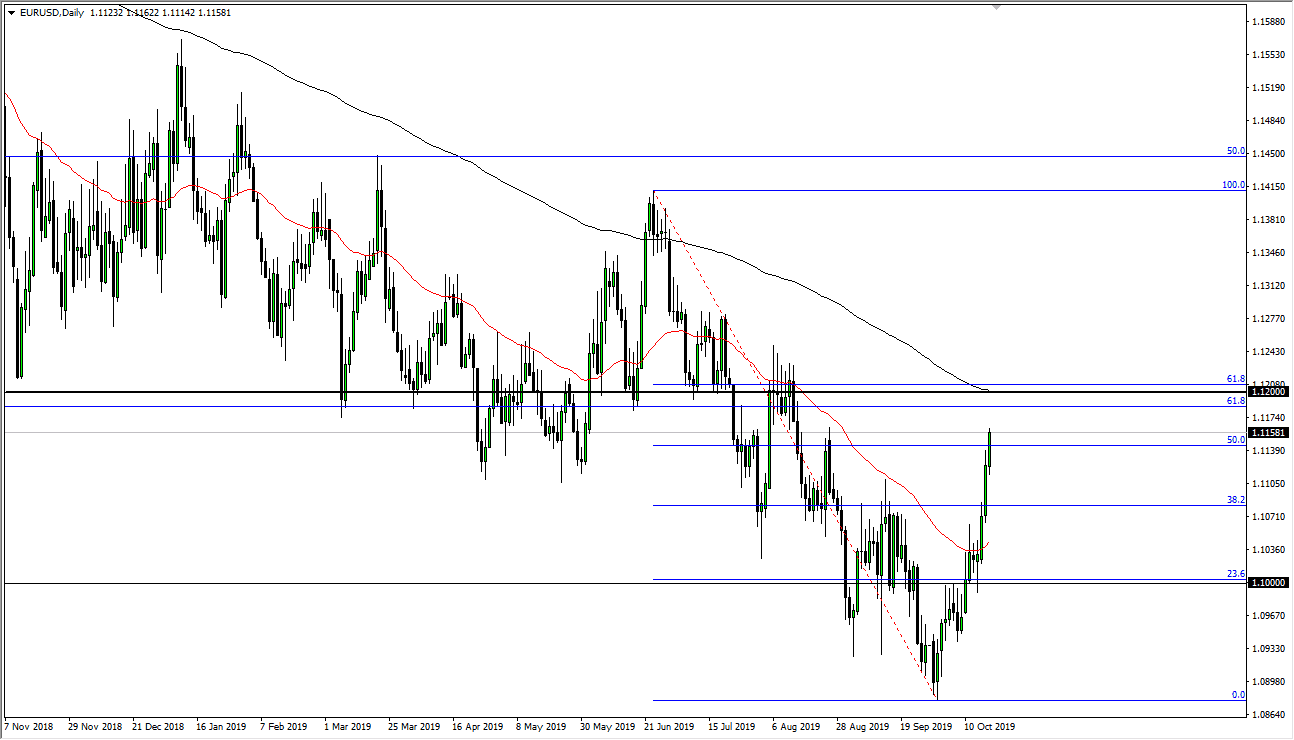

The Euro has rallied again during the trading session on Friday as we continue to see a bit of a reaction to the repo operations in the United States. That being said, it’s very likely that the 1.12 level will be tested, but this is an area that should be relatively resistive as it was relatively supportive in the past. When you zoom out over the last 18 months, you can see that it’s been more than once that we have broken between the 50 day EMA and the 200 day EMA, so although things have been rather strong over the last several days, the reality is that we still haven’t broken the trend.

Over the weekend, we will get a Brexit boat out of the UK parliament, and that will certainly have an effect on not only the British pound but also the Euro. If that’s going to be the case, then it’s likely that we could see a massive turnaround if the UK parliament decides to vote against it. On the other hand, if they vote for it, then you would have to think that a lot of this has already been priced into the currency. This could end up being a “sell the news” situation. However, we always have to look at both sides of the potential trade.

A daily close above the 200 day EMA with any type of resiliency and an impulsive candle, I’d be more than willing to switch the trend on my chart and served looking for buying opportunities. However, this is a pair that tends to be very slow and changing its mind, so don’t be surprised at all to see this market role right back over. I am going to take my time getting involved, because I recognize that a breakout to the upside could lead to a buy-and-hold situation for the next several months. However, if we roll over again it will be obvious and then the pair should start to look back towards the 1.10 level at the very least. We are about to get some type of decision, but it’s going to take a day or two to settle all of this. The looming Brexit boat that of course is without a doubt the most important short-term thing coming down the road that will influence the Euro against not only the US dollar but several other currencies.