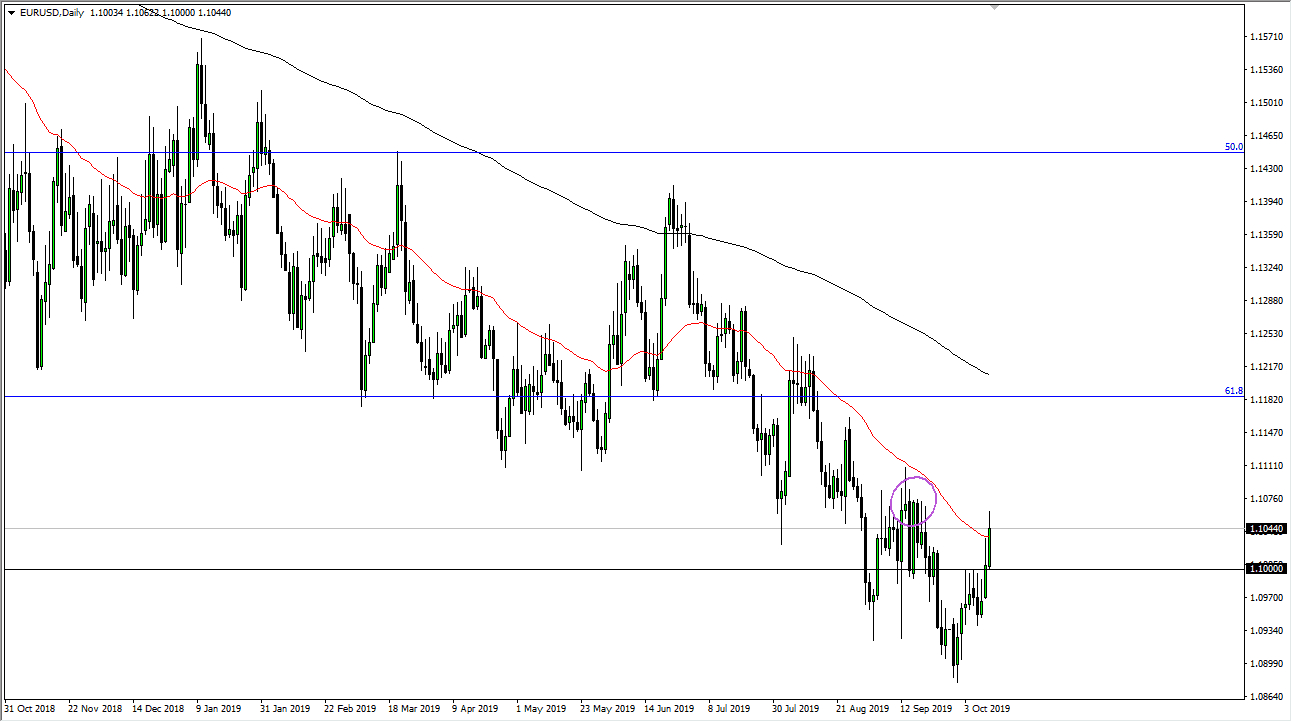

The Euro rallied again during the trading session on Friday, breaking above the 50 day EMA. By doing so, this is a very bullish sign and it could lead to bigger moves. However, there is an area just above that has a lot of noise attached to it, especially near the 1.1075 handle that extends to at least the 1.11 level. This is an area that has been tested several times and has held quite nicely. On the other hand, we have recently broke above the 1.10 level, an area that was very resistive in and of itself.

It is perhaps due to the idea that Brexit may be moving along with a bit of positive momentum that the Euro has gained, because quite frankly from an economic standpoint there’s no reason to think that the EU is going to outperform the United States anytime soon. Beyond that, the bond market is offering negative yields in many of the European economies, so that’s something to pay attention to as well. As long as that’s going to be the case it will greatly influence where the next move flows towards.

All things being equal I believe that the market is probably going to continue to be negative the longer-term, because I just don’t see the trend change quite yet. It isn’t to say that we can’t change the trend, but even with this nice rally that we’ve had over the last week or so, it still is simply normal back and forth variety trading that we have seen over the last 18 months. It seems as if every time we have rallied like this, the sellers eventually come back in. All things being equal it’s likely that this market will roll over, and most certainly a move below the 1.10 level would be very negative. In the meantime, I suspect it’s probably easier to see whether or not we get some type of exhaustive candle above to take advantage of.

The 200 day EMA is currently trading just above the 1.12 handle, and that of course is going to be a major indicator for the longer-term trend. Obviously, if the market were to break back above there it would be a complete trend change but right now we are far from there. Overall, it’s likely that the resistance will eventually come back into the market and send this market lower. I am going to fade rallies when I see existence, I just don’t have it set up yet.