The Euro will have a very important economic day today with the release of a series of PMI reports and the last ECB meeting chaired by outgoing President Draghi who will leave the central bank more divided than ever. Turkey saw its sanctions lifted which the US imposed as a result of its cross-border operations into Syria after US President Trump declared the ceasefire is now permanent. The EUR/TRY is therefore expected to gather bearish momentum inside of its short-term resistance zone from where a breakdown below its 61.8 Fibonacci Retracement Fan Support Level is likely to follow.

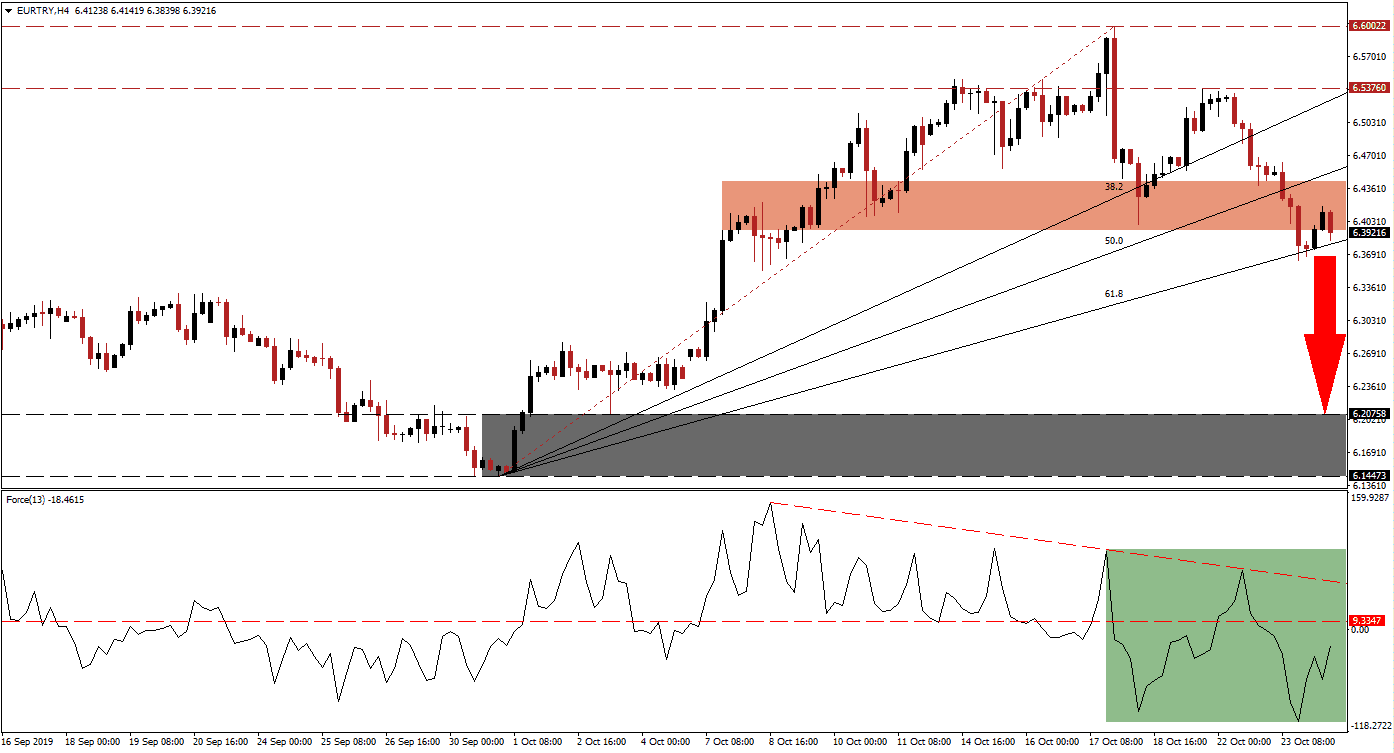

The Force Index, a next generation technical indicator, shows a series of lower highs which led to the formation of a negative divergence as the EUR/TRY reached its long-term resistance zone. A negative divergence forms when an asset advances while its technical indicator contracts. The breakdown in price action following the negative divergence was confirmed by the breakdown in the Force Index below its horizontal support level, turning it into resistance. This technical indicator remains below resistance in negative territory, as marked by the green rectangle, with its descending resistance level approaching. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

After price action completed a breakdown below its long-term resistance zone, located between 6.53760 and 6.60022, the 61.8 Fibonacci Retracement Fan Support Level paused the sell-off. The EUR/TRY then advanced back into its short-term resistance zone which is located between 6.39340 and 6.44383 as marked by the red rectangle from where a renewed breakdown is likely. This zone is nestled between its 61.8 and its 50.0 Fibonacci Retracement Fan Support Levels, while the 38.2 Fibonacci Retracement Fan Resistance Level has reached the bottom range of the long-term resistance zone.

Forex traders should monitor the intra-day low of 6.36320, following a breakdown below its short-term resistance zone, which represents the most recent low of the sell-off. A push lower is likely to result in the addition of new net short positions in the EUR/TRY while today’s Eurozone economic data may provide a fresh fundamental catalyst. The next support zone is located between 6.14473 and 6.20758 which is marked by the grey rectangle, and this currency pair will face little resistance in its sell-off following a confirmed breakdown its 61.8 Fibonacci Retracement Fan Support Level. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 6.39000

Take Profit @ 6.18000

Stop Loss @ 6.44750

Downside Potential: 2,100 pips

Upside Risk: 575 pips

Risk/Reward Ratio: 3.65

Should the Force Index be able to complete a double breakout, above its horizontal as well as descending resistance levels, the EUR/TRY could follow suit with a breakout above its short-term resistance zone. Given the fundamental picture, such a breakout is expected to remain limited to its long-term resistance zone and should be considered a solid short-selling opportunity in this currency pair.

EUR/TRY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 6.48000

Take Profit @ 6.55250

Stop Loss @ 6.44500

Upside Potential: 725 pips

Downside Risk: 350 pips

Risk/Reward Ratio: 2.07