The single currency lacks momentum for gains against the other major currencies as the economic performance of the Eurozone continues to weaken, led by its largest economy, Germany. Since mid-September, EUR / JPY has been in a bearish correction that has pushed it towards its lowest level in a month at 117.13. Continuously weak European economic indicators contributed to Germany's leading economic institutes lowered expectations for economic growth this year and the next, citing mainly weak global demand for commodity exports. Economic growth forecasts for this year were cut to 0.5 percent from 0.8 percent and the forecast for next year shrank to 1.1 percent from 1.8 percent.

German employment is expected to grow by 380,000 this year. Only 120,000 and 160,000 new jobs are expected to be created in the next two years. The unemployment rate was expected to rise to 5.1 percent next year from 5 percent this year. Thereafter, it is expected to decline to 4.9 pe cent in 2021.

German inflation is expected to rise to 1.5 percent next year from 1.4 percent this year. In 2021, the figure is expected to rise to 1.6 percent. The country's budget surplus is also expected to be enormous this year, reaching around 50 billion Euros, but is expected to reach 4 billion Euros by 2021.

Japan's consumer confidence fell to its lowest level in more than eight years in September. The consumer confidence index fell to a seasonally adjusted 35.6 in September from 37.1 in August. The latest confidence index was the lowest since June 2011.

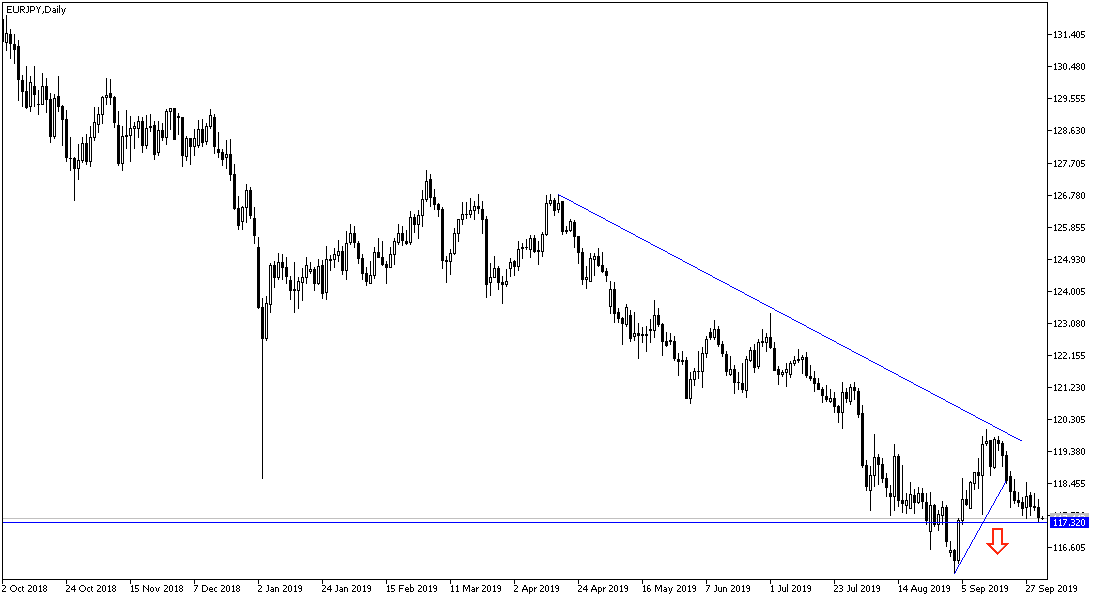

According to the technical analysis of the pair: In the long term, the overall trend of EUR / JPY will remain bearish, especially with its recent failure to cross the psychological 120.00 resistance, which will strengthen the downtrend of the pair to the support levels of 117.00, 116.35 and 115.00 respectively. There will be no chance for an upward correction without breaking the 120.00 resistance and this may happen as investors take renewed risk appetite and return to confidence in the Eurozone economy.

As for the economic data: There are no significant Japanese economic releases today. The pair will react to the release of the services PMI for Germany, France and the bloc in general. This is in addition to producer prices and retail sales in the Eurozone.