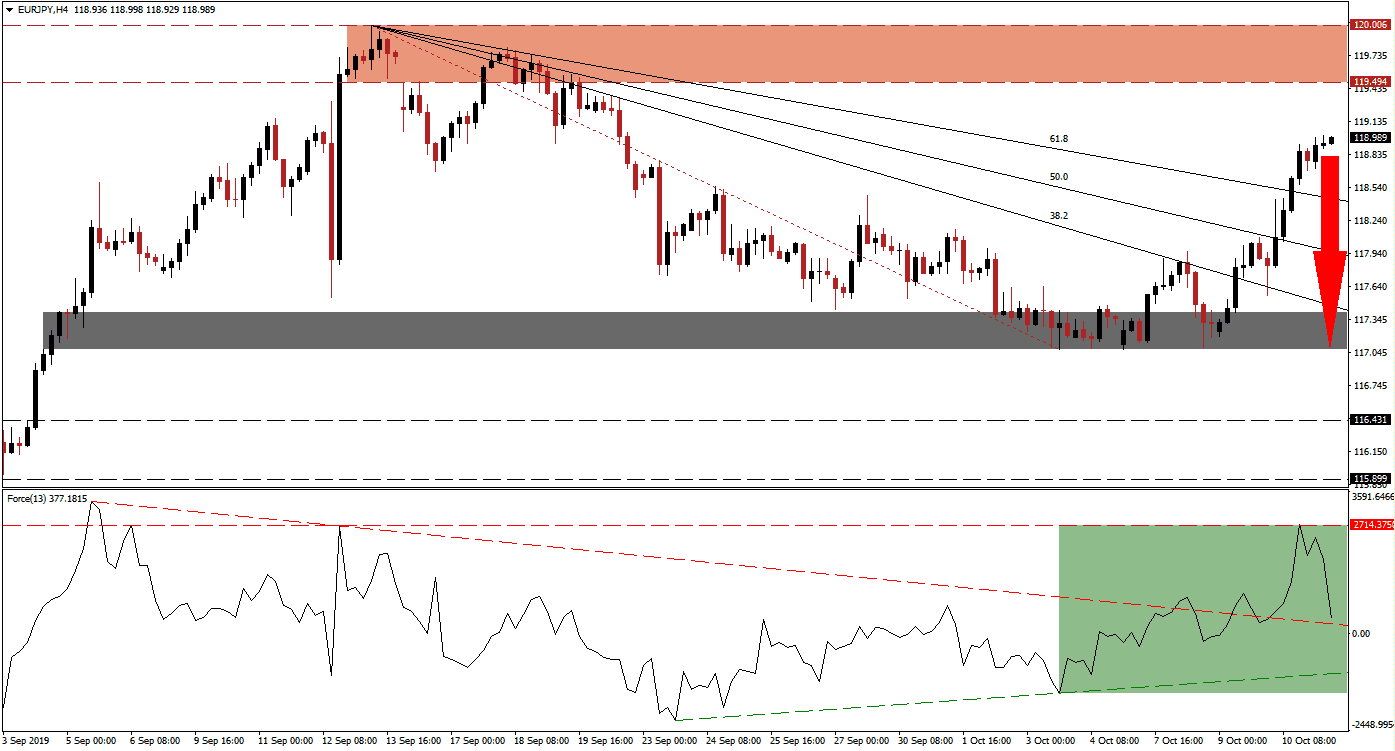

Risk-on sentiment was dominant during the Asian trading session as the majority of market participants expect a currency pact to be announced, additional tariffs delayed and for talks to resume at a later date. This was enough to result in profit taking in the Japanese Yen, a safe haven currency, which pushed the EUR/JPY through its entire Fibonacci Retracement Fan sequence. Following the breakout, bullish momentum started to fade quickly as fundamental factors don’t support the advance. A price action reversal is now expected to unfold which can take this currency pair back down into its next short-term support zone.

The Force Index, a next generation technical indicator, accelerated with the EUR/JPY as this currency pair embarked on its breakout sequence. Despite the short-term boost in bullish momentum, the Force Index was unable to eclipse its own horizontal resistance level which marked the peak on two previous occasions. This technical indicator quickly reversed and plunged into its longer-term descending resistance level which acts as temporary support due to a preceding breakout; this is marked by the green rectangle. The Force Index remains in positive conditions, but the magnitude of the momentum shift is expected to move this technical indicator in negative territory which would place bears in control. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Upside potential for the EUR/JPY is limited to its next resistance zone which is located between 119.494 and 120.006 as marked by the red rectangle. Given the collapse in bullish momentum, this currency pair is not expected to push ahead unless the final announcement after US-China trade talks conclude offer more than is currently priced in. Economic data out of the Eurozone continues to disappoint and with the global economy facing challenges, the fundamental picture supports a weaker EUR/JPY. Forex traders should now watch out for the Force Index, as a move below 0 is expected to lead this currency pair into a sell-off.

Another key level to monitor is the intra-day low of 118.690 which represents the low of the current pause in the rally following the breakout above its 61.8 Fibonacci Retracement Fan Resistance Level, turning it into support. A sustained moved below this level is likely to result in the addition of new net short positions in the EUR/JPY. The next short-term support zone is located between 117.075 and 117.408 which is marked by the grey rectangle. The descending 38.2 Fibonacci Retracement Fan Support Level is approaching the top range of this support zone. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/JPY Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 118.950

Take Profit @ 117.200

Stop Loss @ 119.350

Downside Potential: 175 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 4.38

As today’s session will be dominated by news flow surrounding the final day of US-China trade talks, a short term spike in the EUR/JPY cannot be ruled out. The resistance zone is unlikely to be breached given the Eurozone fundamentals which remain extremely weak. Yesterday’s German trade data confirmed the ongoing slowdown. Any potential spike into the resistance zone should be viewed as an excellent long-term short opportunity as a change in the fundamental picture is not expected in the immediate future. Any deal announced today between the US and China will not address any of the core issues and will simply act as a bridge for new talks.

EUR/JPY Technical Trading Set-Up - Limited Breakout Extension Scenario

Long Entry @ 119.450

Take Profit @ 119.950

Stop Loss @ 119.200

Upside Potential: 50 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.00