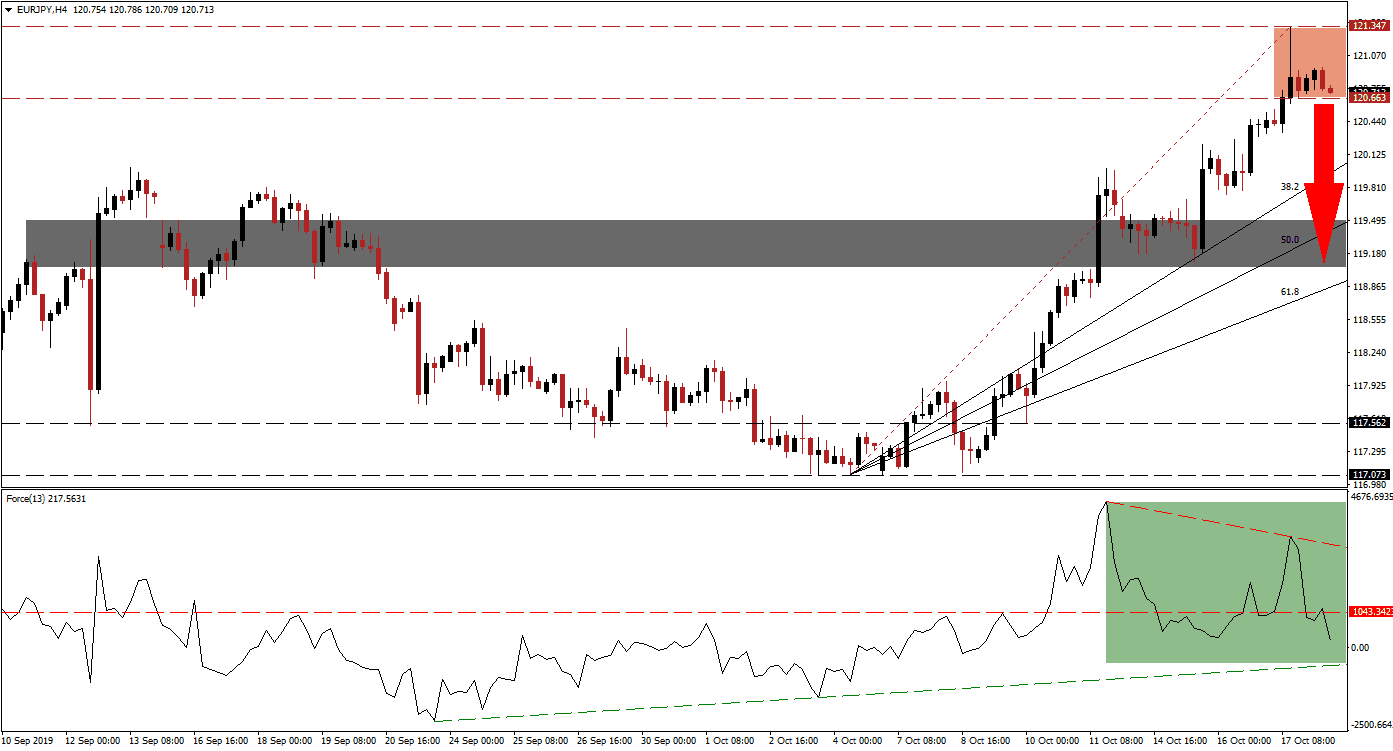

Today is the second and final day of the EU summit which yielded a new Brexit deal yesterday. The Euro rallied following the announcement, but uncertainty remains as British Prime Minister Johnson has to push it through Parliament tomorrow while his DUP allies already rejected the current proposal. Given this week’s risk on mood, the Japanese Yen came under selling pressure and the combination lifted the EUR/JPY into its resistance zone. The Fibonacci Retracement Fan sequence supported the advance which has now become vulnerable to a breakdown following the retreat from its highs.

The Force Index, a next generation technical indicator, is flashing a sell signal after a negative divergence formed; this happens when an asset advances while a technical indicator contracts and results in a bearish development. After the EUR/JPY recorded its most recent intra-day high of 121.347, the Force Index quickly reversed from a lower high and completed a breakdown below its horizontal support level which turned it into resistance. This technical indicator remains in positive territory, as marked by the green rectangle, but the magnitude of the directional change is likely to carry the Force Index below its ascending support level and into negative conditions. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Japanese inflation data pointed to the lack of inflationary pressures which is in line with the Bank of Japan’s latest evaluation that its 2.0% inflation target will not be reached. Going into the weekend, traders are likely to take risk off the table amid uncertain developments which will support the safe-haven Japanese Yen. A breakdown below its resistance zone, located between 120.663 and 121.347 as marked by the red rectangle, is expected to take the EUR/JPY into its 38.2 Fibonacci Retracement Fan Support Level from where more downside is possible. The Eurozone economy continues to faced structural weakness and a central bank which aims to loosen monetary policy further.

Forex traders should monitor the Force Index as a drop below the 0 center line is expected to result in the addition of fresh net sell orders in the EUR/JPY. A move below the intra-day low of 120.334 is further expected to fuel a corrective phase in this currency pair; this level marks the low before price action pushed into its resistance zone. The next short-term support zone is located between 119.047 and 119.494 which is marked by the grey rectangle; the ascending 50.0 Fibonacci Retracement Fan Support Level has approached the top range of this zone which also covers a minor price gap to the downside. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 120.700

Take Profit @ 119.100

Stop Loss @ 121.150

Downside Potential: 160 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.56

In the event of a reversal in the Force Index which will take it back above its horizontal resistance level, turning it back into support, the EUR/JPY may pressure its resistance zone to the upside. Upside potential is expected to be limited to its next resistance zone which is located between 122.119 and 122.312 which should be considered a solid long-term short selling opportunity.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 121.400

Take Profit @ 122.250

Stop Loss @ 121.100

Upside Potential: 85 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.83