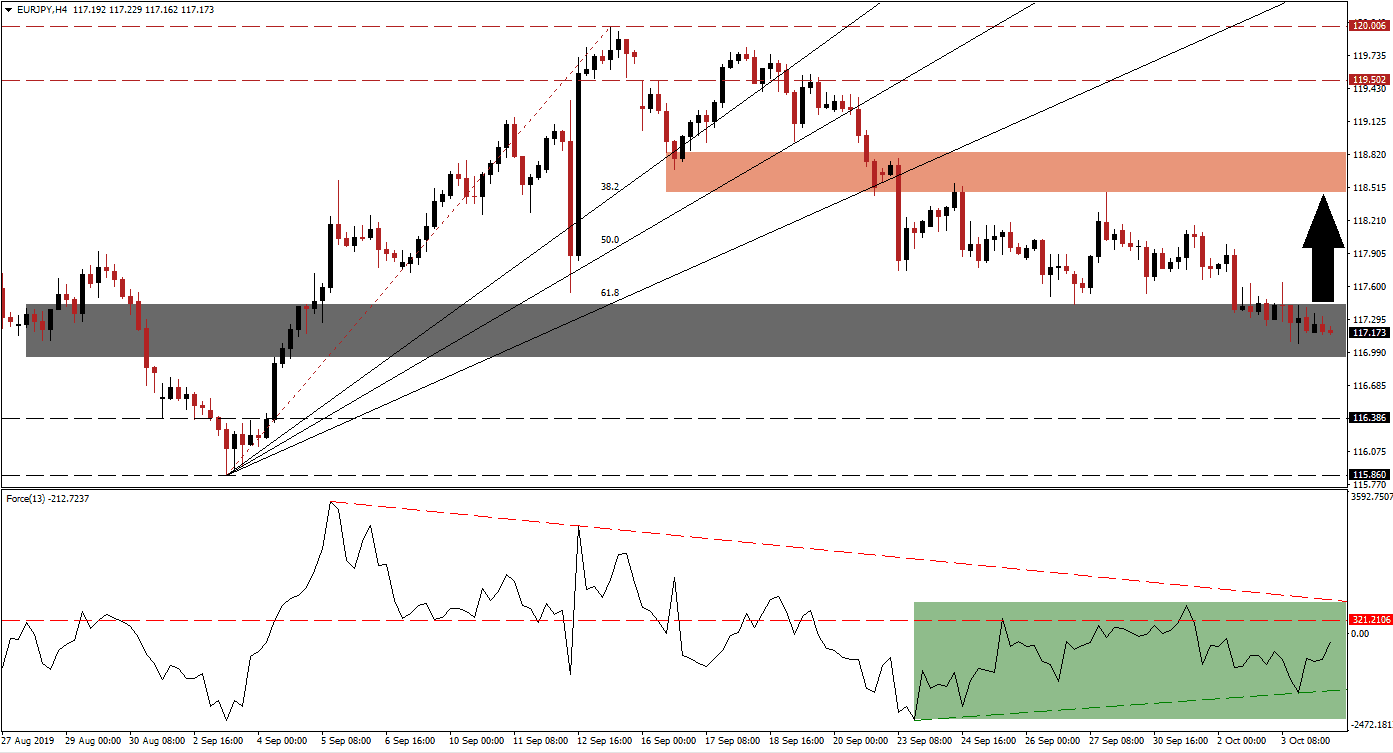

EUR/JPY: Can price action reverse from support?

Economic disappointment out of the Eurozone has driven the Euro lower, a move which was further aided by the announcement of new US tariffs on EU aircraft parts as well as agriculture due to the WTO ruling which was announced earlier in the week. The EUR/JPY contracted into its short-term support zone which is currently being tested. As a result of the sell-off, price action has created a wide gap to its ascending Fibonacci Retracement Fan sequence which will soon be invalidated and a new one will be formed in the opposite direction. Bullish pressures have been on the rise and if support holds, price action may engage into a short-term reversal

The Force Index, a next generation technical indicator, has formed a positive divergence which suggests that a price action reversal may be imminent. When the price of an assets descends while the technical indicators ascends, a positive divergence is formed; this is considered a bullish trading signal and often precedes an advance. The Force Index is now closing in on its horizontal resistance level and the rise in bullish momentum should suffice to result in a breakout above it, turning it into support; this is marked by the green rectangle. A move above this level will also take this technical indicator into positive territory and result in a breakout above its descending resistance level, placing bulls in full control of price action. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

As bullish momentum is suppressing bearish one, the short-term support zone which is located between 116.944 and 117.436 as marked by the grey rectangle, should be monitored together with the Force Index. Any move above the intra-day high of 117.642, which marks the last spike above support, is expected to result in new net long positions in the EUR/JPY if the Force Index can push above its horizontal resistance level. A short-covering rally may follow such an event which will further drive price action to the upside.

While the long-term trend in the EUR/JPY remains bearish, economic data out of Japan has pointed towards a much weaker-than-expected one; keeping downside pressure on the Japanese Yen. The following decrease in EUR/JPY bearish momentum has raised the potential for a short-term price action reversal, which would support the long-term downtrend. The next short-term resistance zone is located between 118.467 and 118.838 as marked by the red rectangle. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 117.150

Take Profit @ 118.500

Stop Loss @ 116.850

Upside Potential: 135 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 4.50

A breakdown in the EUR/JPY below its short-term support zone, confirmed by a reversal in the Force Index should take price action into its next long-term support zone which is located between 115.860 and 116.386. A further breakdown below this zone is not expected without a new fundamental catalyst, but forex traders should remain cautious if the EUR/JPY challenges long-term support.

EUR/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 116.700

Take Profit @ 116.150

Stop Loss @ 116.950

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20