EUR/GBP: How Long Can the Uptrend Continue?

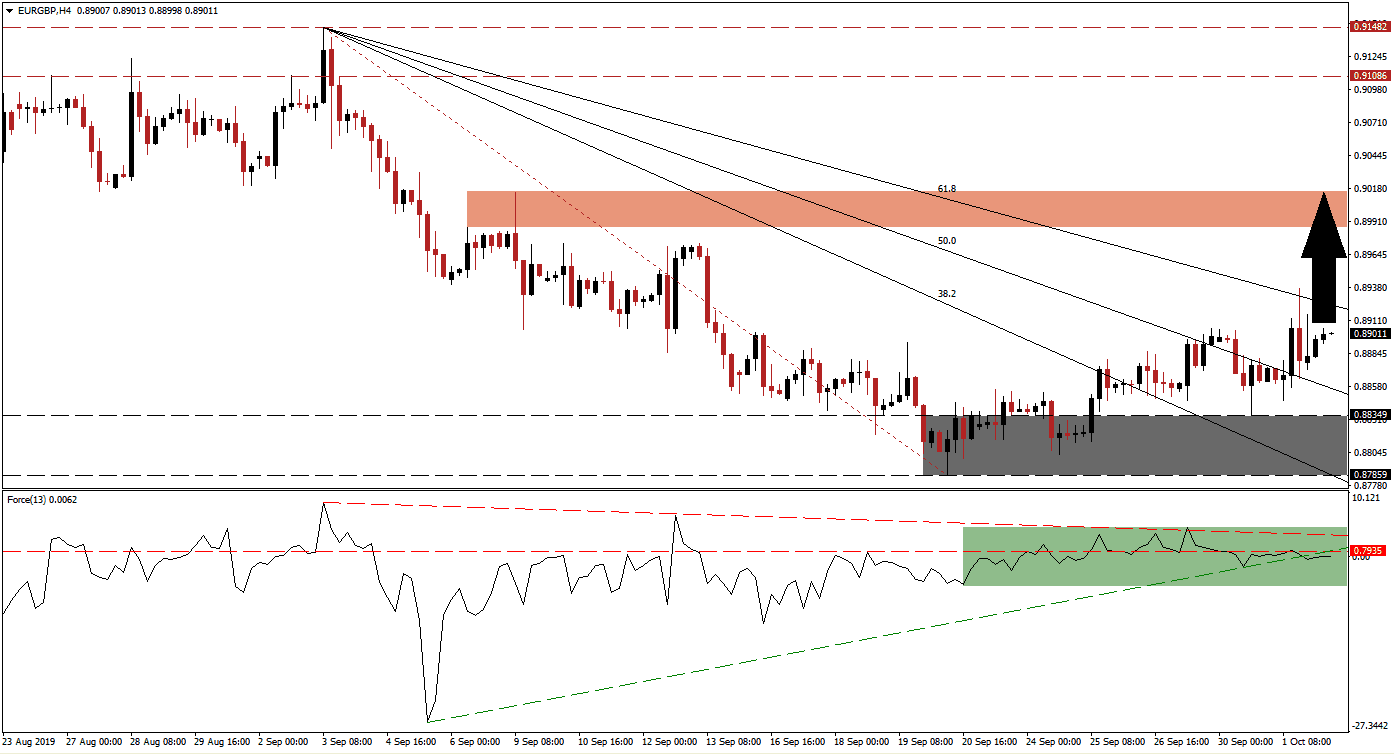

Brexit is less than 30 days away and British Prime Minister Johnson issued an ultimatum to the EU; either it will be his proposed deal or no deal at all and sources are suggesting that the EU is considering a major concession to the UK in regards to the Irish backstop. This didn’t stop the Euro from gaining ground on the British Pound as the EUR/GBP has advanced out of its support zone and completed a series of breakouts above its Fibonacci Retracement Fan sequence, turning it from resistance into support. Volatility is expected to increase as the October 31st 2019 Brexit deadline approaches.

The Force Index, a next generation technical indicator, started to flatten out in positive territory and just below its horizontal resistance level which caused it to move below its ascending support level; a shallow descending resistance level is slowly approaching. This is marked by the green rectangle in the chart. Given the approaching Brexit deadline as well as the worse-than-expected economic slowdown in the Eurozone, the EUR/GBP may be confided to a trading range over the next few weeks. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

After the EUR/GBP pushed above its support zone, located between 0.87859 and 0.88349 which is marked by the grey rectangle, bullish momentum increased and allowed price action to complete a breakout above its descending 38.2 and 50.0 Fibonacci Retracement Fan Resistance Levels, turning them into support. The advance has been gradual and support levels held, allowing the uptrend to extend. A move in the Force Index above its ascending support level, which will additionally take it above its horizontal resistance level, should lead to a final breakout above its 61.8 Fibonacci Retracement Fan Resistance Level.

Earlier this morning UK economic data pointed towards a weak consumer which allowed price action to advance. A breakout above its 61.8 Fibonacci Retracement Fan Resistance Level will cleat the path for the EUR/GBP to challenge its next short-term resistance zone which is located between 0.89863 and 0.90145 as marked by the red rectangle. A fundamental catalyst would be required to extend the current advance above this mark, but the current economic environment makes this unlikely. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/GBP Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.89000

Take Profit @ 0.90100

Stop Loss @ 0.88650

Upside Potential: 110 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 3.14

Failure of the Force Index to extend its advance and eclipse its horizontal resistance level could lead to a reversal in the EUR/GBP into its support zone. The uncertainty surrounding Brexit makes a breakdown below it unlikely. As long as the current fundamental scenario remains intact and supported by the technical picture, any move by this currency pair into its support zone should be considered an attractive buying opportunity.

EUR/GBP Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.88550

Take Profit @ 0.87900

Stop Loss @ 0.88850

Downside Potential: 65 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.17