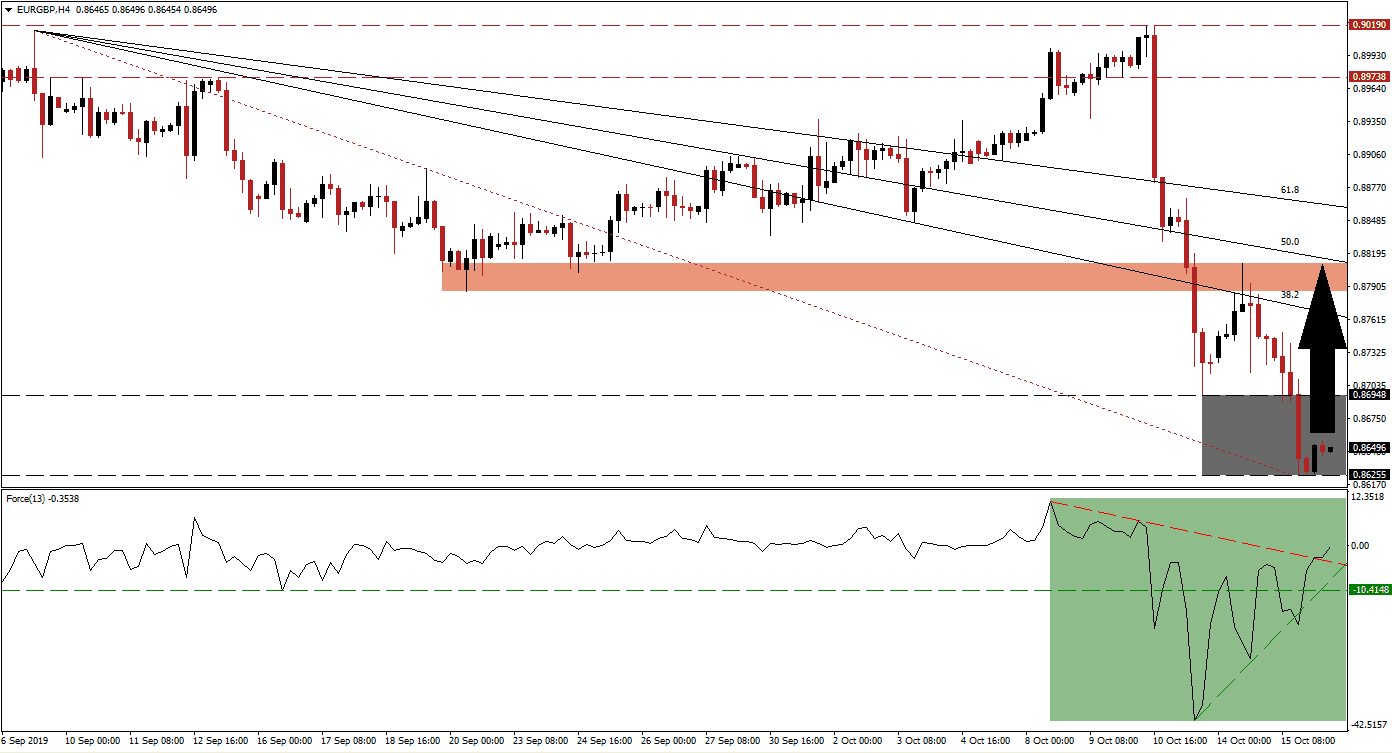

Optimism about a Brexit deal by the end of this week’s EU summit, which will start tomorrow and conclude on Friday, have pushed the British Pound to a multi-month high. The strong rally now appears to be exhausted and vulnerable to a short-term corrective phase. The EUR/GBP crashed below its resistance zone, through its entire Fibonacci Retracement Fan sequence and into it support zone in a move covering almost 400 pips in five trading sessions. Bearish momentum is now fading and price action is expected to partially retrace its sell-off, keeping the long-term downtrend intact.

The Force Index, a next generation technical indicator, has formed a positive divergence which occurs when price action contracts while the underlying indicator expands. As price action is testing the strength of its support zone, the Force Index accelerated to the upside and carries a great deal of positive momentum. This technical indicator moved above its horizontal resistance level turning it back into support and also eclipsed its descending resistance level in a very bullish move which is marked by the green rectangle. The Force Index is now on track to move back into positive territory which will place bulls in control of the EUR/GBP. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

A move by the Force Index above the 0 center line is expected to lead price action higher and into a breakout above its support zone, located between 0.86255 and 0.86948 as marked by the grey rectangle. This is likely to initiate a short-covering rally which will further drive the EUR/GBP higher. Today’s inflation data out of the UK could provide a short-term catalyst for this currency pair which is expected to challenge its descending 38.2 Fibonacci Retracement Fan Resistance Level; forex traders should also monitor the intra-day high of 0.88105 which marks the peak prior to the most recent leg lower.

While the Eurozone economy remains weak, the expected recovery in the EUR/GBP is expected to be driven by profit taking which won’t violate the long-term downtrend. Short-term counter-trend moves are required in order to keep the long-term trend active. The next short-term resistance zone is located between 0.87859 and 0.88105 as marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Resistance Level is located at the top range of this zone with the 38.2 Fibonacci Retracement Fan Resistance Level below it; more upside is unlikely unless Brexit will be delayed. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/GBP Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 0.86450

- Take Profit @ 0.88050

- Stop Loss @ 0.86000

- Upside Potential: 140 pips

- Downside Risk: 45 pips

- Risk/Reward Ratio: 3.11

In the event of a reversal in the Force Index, the EUR/GBP could be pressured below its support zone and extend its sell-off. A fundamental catalysts would be required such as the announcement of a deal which will allow the UK to exit on October 31st 2019. Volatility is expected to remain elevated throughout the process and the next support zone is located between 0.84884 and 0.85181. Longer term, the fundamental picture suggests more downside potential for this currency pair, but the technical scenario favors a short-term advance which would ensure the long-term downtrend remains healthy.

EUR/GBP Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 0.85850

- Take Profit @ 0.85200

- Stop Loss @ 0.86100

- Downside Potential: 65 pips

- Upside Risk: 25 pips

- Risk/Reward Ratio: 2.60