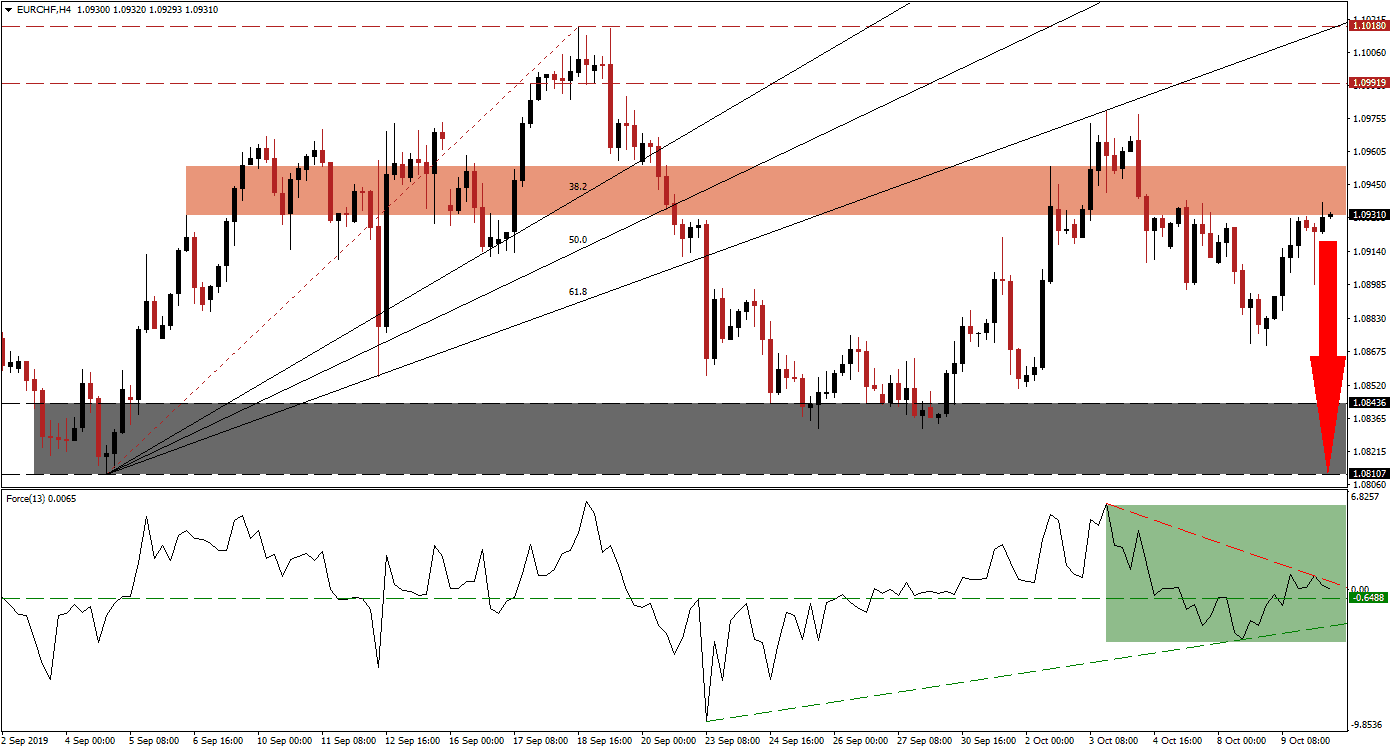

Volatility in the EUR/CHF increased as price action initially pushed above its short-term resistance zone and advanced into its ascending 61.8 Fibonacci Retracement Fan Resistance Level. This was followed by a breakdown, before this currency pair retraced back into its short-term resistance zone. Throughout this process, bullish momentum was depleted and the short-term resistance zone is expected to hold firm and force yet another reversal. The Swiss Franc may additionally benefit from safe haven demand as the US-China trade talks appear to have stalled.

The Force Index, a next generation technical indicator, rebounded from its ascending support level after the EUR/CHF completed its breakdown below the short-term resistance zone. The following advance pushed the Force Index back above its horizontal resistance level which turned it into support, but this technical indicator ran into its descending resistance level from where it started to drift lower. While the Force Index currently remains in positive territory, as marked by the green rectangle in the chart, downside pressure is expected to push it back into negative conditions which place bears in charge of price action. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

With news flow in regards to the US-China trade talks front and center today, safe haven assets such as the Swiss Franc are set to outperform if the overall flow is negative. Bearish momentum is on the rise as the short-term resistance zone, located between 1.09305 and 1.09534 as marked by the red rectangle, is expected to prevent an extension of the current advance. Forex traders should monitor the Force Index which is trading near the center line, a breakdown into negative territory could lead to the next wave of sell orders in the EUR/CHF; a move below its ascending support level is also possible which will boost bearish momentum further.

A price action reversal from its short-term resistance zone is likely to extend into its next support zone which is located between 1.08107 and 1.08436 as marked by the grey rectangle. The intra-day low of 1.09171 should be monitored, this level represents the low of the first reversal after the EUR/CHF advanced into its short-term resistance zone. A sustained move below this level is expected to lead to more selling pressure. The release of minutes from the September ECB policy meeting could provide another fundamental catalyst for the Euro, which may weaken if the report indicates the central bank sees more economic issues on the horizon. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/CHF Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 1.09300

Take Profit @ 1.08150

Stop Loss @ 1.09650

Downside Potential: 115 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 3.29

Unexpected positive developments out of the US-China trade talks, although chances are limited, could force a breakout in the EUR/CHF above its short-term resistance zone. The Force Index would need confirm such a move with a breakout above its descending resistance level. This can extend an advance in price action into its next long-term resistance zone which is located between 1.09919 and 1.10180, but any such advance is expected to remain a short-term development. Given the economic issues as well as tariffs in the Eurozone, an advance into its next resistance zone should be considered an excellent selling opportunity as the fundamental picture favors a weaker EUR/CHF moving forward.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.09750

Take Profit @ 1.10150

Stop Loss @ 1.09550

Upside Potential: 40 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.00