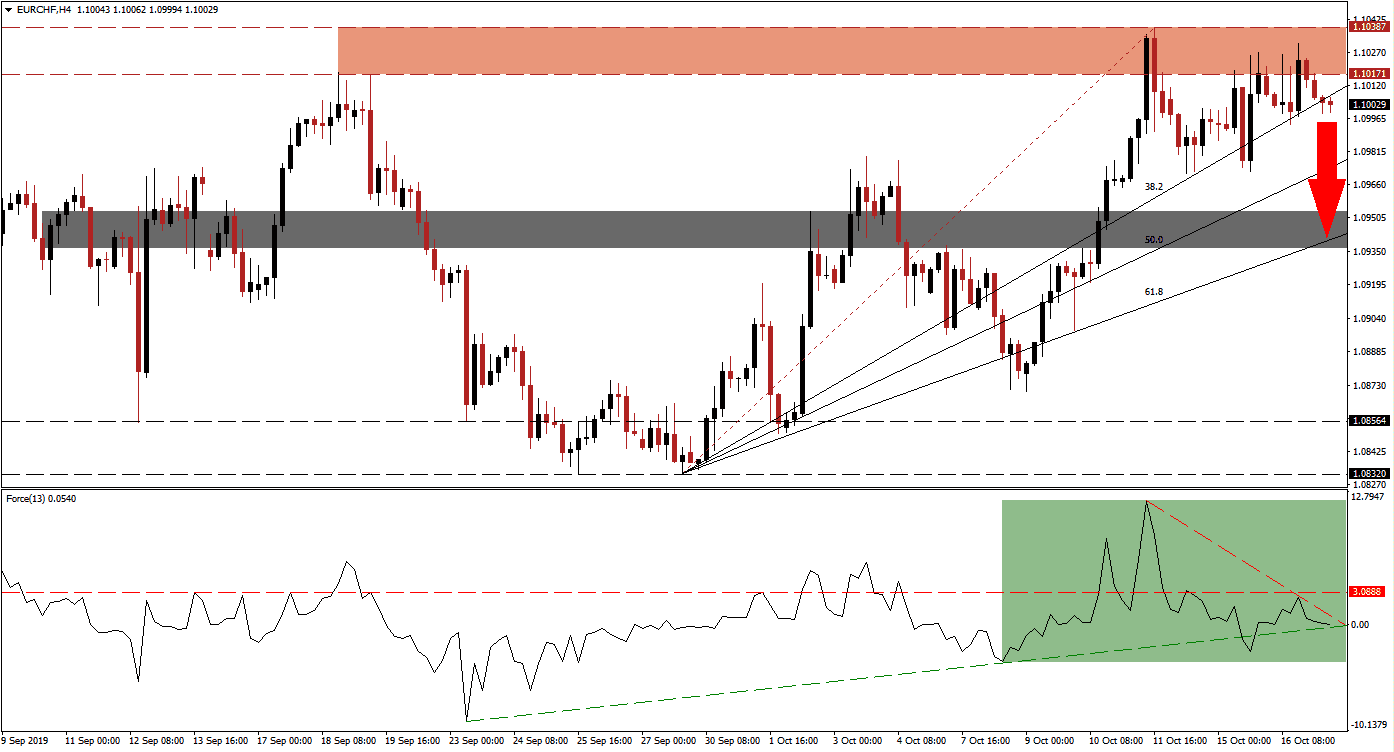

Today is the start of the much anticipated two-day EU Summit where Brexit will remain the dominant topic. The Euro is coming under selling pressure this morning against the Swiss Franc, a safe haven currency, which resulted in a breakdown by the EUR/CHF below its resistance zone as well as below its ascending 38.2 Fibonacci Retracement Fan Support Level which is located just below. Preceding the breakdown was a lower high, another bearish development, and more downside is now expected following the double breakdown while volatility is likely to remain elevated as news trickle out of the summit.

The Force Index, a next generation technical indicator, shows the loss in bullish momentum after the EUR/CHF recorded its intra-day high of 1.10387 which also marks the top range of its resistance zone as well as the end point of its Fibonacci Retracement Fan sequence. A breakdown followed and the subsequent reversal resulted in a lower intra-day high of 1.10314 which was also reversed. The Force Index collapsed below its horizontal support level, turned it into resistance and briefly dipped below its ascending support level before recovering slightly above it. This technical indicator remains in positive conditions as marked by the green rectangle, but its descending resistance level is pressuring for a breakdown. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

After the lower high was formed inside the resistance zone, located between 1.10171 and 1.10387 which is marked by the red rectangle, bearish pressures started to increase. Forex traders are now advised to monitor the Force Index for a breakdown below its ascending support level which will place it in negative territory and bears in control of the EUR/CHF. The intra-day low of 1.09940 should also be watched; this level represents the low of a previous breakdown which was reversed and resulted in the lower high. A sustained move below it is expected to initiate the next series of sell orders in this currency pair.

Economically, the Eurozone is faced with structural weakness with the latest confirmation provided yesterday by the slump in Italian industrial sales and new orders; Italy is the third largest economy in the Eurozone. With geopolitical risks elevated, the Swiss Franc is expected to outperform the Euro which will push the EUR/CHF into a price action reversal. The next short-term support zone is located between 1.09365 and 1.09534 as marked by the grey rectangle, the 61.8 Fibonacci Retracement Fan Support Level is nestled inside this zone. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.10050

Take Profit @ 1.09400

Stop Loss @ 1.10250

Downside Potential: 65 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 3.25

Should the Force Index reverse direction and complete a double breakout, above its descending resistance level and its horizontal resistance level, the EUR/CHF should follow with a push above its resistance zone. A fundamental catalyst would be required in order to sustain a breakout which is currently absent. The next resistance zone is located between 1.10887 and 1.11098 from where a previous sell-off emerged, any advance into this zone should be considered an excellent long-term selling opportunity.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.10500

Take Profit @ 1.10950

Stop Loss @ 1.10300

Upside Potential: 45 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.25