EUR/CHF: Will the short-term resistance zone hold?

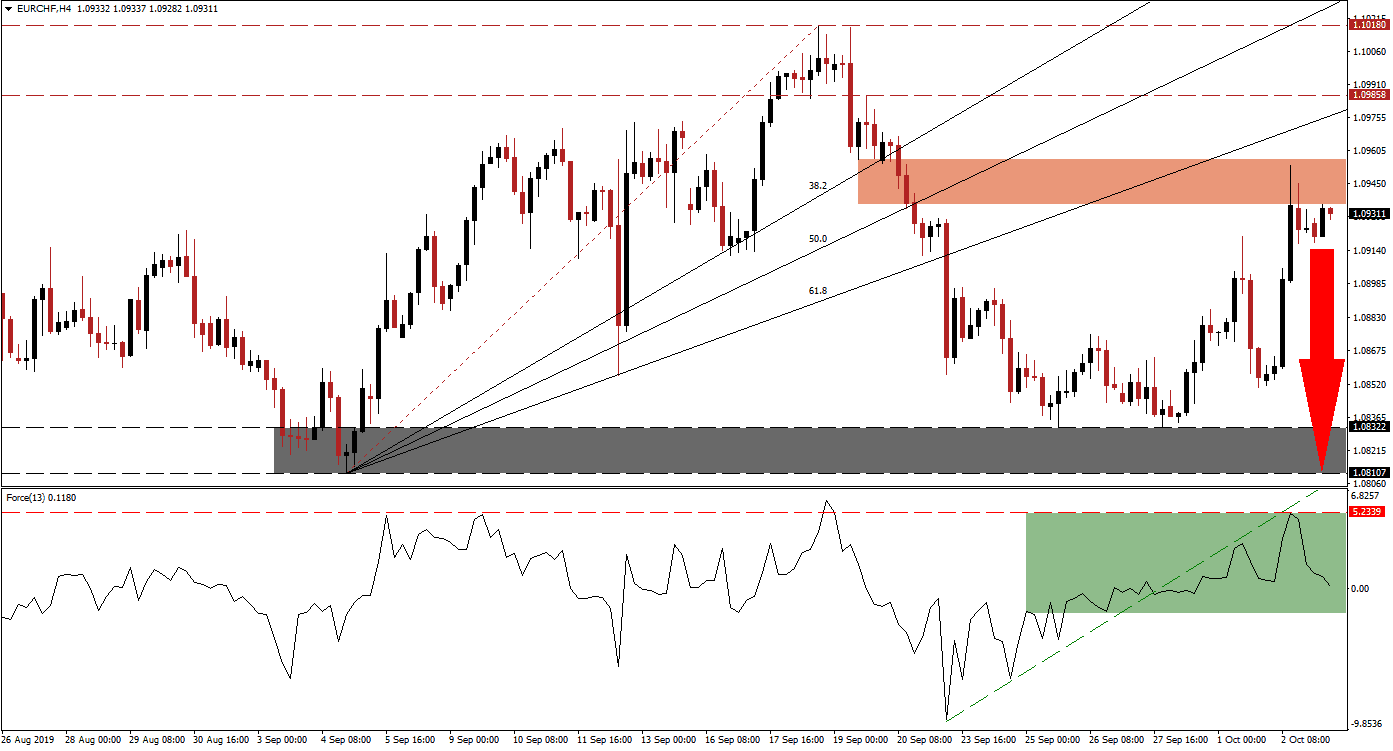

Bullish momentum is collapsing as the EUR/CHF reached its short-term resistance zone which is located beneath the ascending 61.8 Fibonacci Retracement Fan Resistance Level. The intra-day high of 1.09534 almost closed the gap between this currency pair and the 61.8 Fibonacci Retracement Fan Resistance Level before a loss in bullish momentum resulted in a breakdown. The EUR/CHF retraced its breakdown back to the bottom range of its short-term resistance zone and a series of PMI data out of the Eurozone and key member countries is expected to provide the next fundamental catalyst for this currency pair.

The Force Index, a next generation technical indicator, advanced into its horizontal resistance level from where a quick reversal followed. A previous sideways trend resulted in a move below its ascending support level which now acts as temporary resistance; the peak in the Force Index ran into its new ascending resistance level which is marked by the green rectangle. The magnitude of the reversal in the Force Index is now expected to take this indicator below the 0 center line which will put bears in charge and lead the EUR/CHF to the downside. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Forex traders are advised to monitor the intra-day low of 1.09179 which represents the low of the breakdown in this currency pair below its short-term resistance zone. This zone is located between 1.09354 and 1.09563 which is marked by the red rectangle in the chart. The Swiss Franc, which is consider a safe haven currency similar to the Japanese Yen, was unable to strengthen as financial markets came under pressure as the Swiss economy is showing signs of extreme weakness; Switzerland was a rare bright spot throughout the year. Today’s PMI data out of the Eurozone which will be released throughout the European morning trading session is expected to inject volatility and lower-than-expected numbers should be expected.

Should price action push below the 1.09179 and the Force Index cross into negative territory, a fresh wave of sell orders in the EUR/CHF is expected to follow. This can force price action back into its support zone which is located between 1.08107 and 1.08322 as marked by the grey rectangle. The Euro is also expected to come under additional selling pressure following the WTO ruling in favor of the US which allowed it to impose $7.5 billion worth of tariffs on the Eurozone; the US noted it will target aircraft parts as well as agriculture. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/CHF Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 1.09300

Take Profit @ 1.08100

Stop Loss @ 1.09700

Downside Potential: 120 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.00

In the event that Eurozone economic data this morning will surprise to the upside, the EUR/CHF may push through its short-term resistance zone with limited upside potential. The next resistance zone is located between 1.09858 and 1.10180 and any advance into it should be considered a solid long-term short selling opportunity. Given the current fundamental scenario, this currency pair is favored to extend its sell-off long-term.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.09750

Take Profit @ 1.10150

Stop Loss @ 1.09550

Upside Potential: 40 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.00