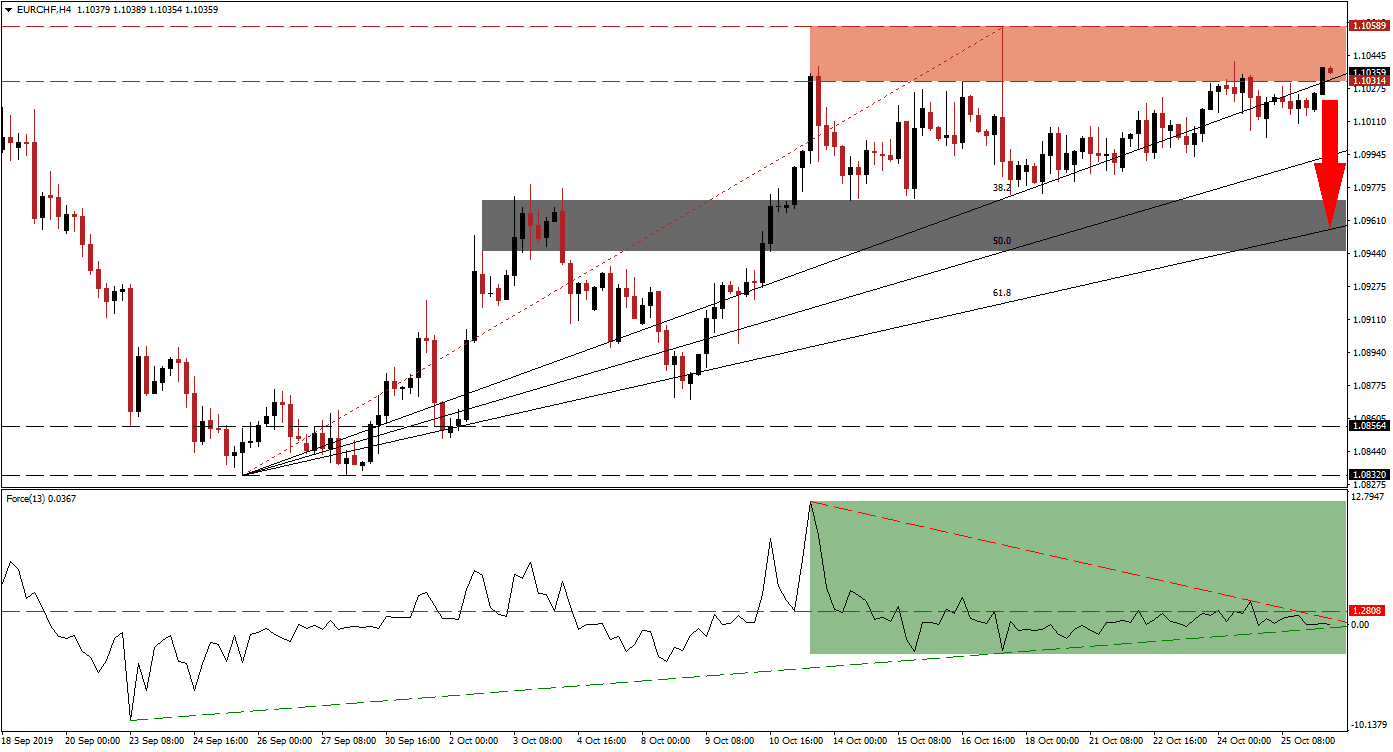

Similar to the Japanese Yen, the Swiss Franc is a safe haven asset which usually outperforms during risk-off sessions. As traders grew more optimistic about the global economy, inspired by a decent third-quarter earnings season so far, risk averse currencies underperformed. The EUR/CHF has now pushed back into its resistance zone, following a breakdown into its ascending 38.2 Fibonacci Retracement Fan Support Level, and is now once again exposed to a rise in bearish pressures. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next generation technical indicator, shows the loss in bullish momentum after the EUR/CHF first pushed into its resistance zone. A reversal in price action led to another advance which created a higher high, but the Force Index contracted and a negative divergence was formed. Another breakdown in this currency pair followed which has now been reversed, but this technical indicator never recovered; this suggests underlying weakness in the drift to the upside. The Force Index remains below its horizontal resistance level and is faced with additional downside pressure by its descending resistance level as marked by the green rectangle. A breakdown below its ascending support level is expected to push price action lower.

Pressures for either a breakdown or breakout are on the rise as the 38.2 Fibonacci Retracement Fan Support Level, which has guided price action higher, has now entered the resistance zone which rejected this currency pair on the previous two occasions. This zone is located between 1.10314 and 1.10589 as marked by the red rectangle. Brexit uncertainty is adding a layer of uncertainty for the Euro which is faced with a slowing economy, rise in deflationary pressures and a change of the guard at the European Central Bank while its next round of quantitative easing is set to begin this Friday. The fundamental picture, supported by technical factors, suggests a breakdown in the EUR/CHF is the most likely outcome. You can learn more about a breakdown here.

Forex traders should monitor the Force Index as push below its ascending support level is likely to lead to a double breakdown in price action, below its resistance zone as well as its 38.2 Fibonacci Retracement Fan Support Level. This would clear the path for a sell-off until the EUR/CHF can challenge its next short-term support zone which is located between 1.09451 and 1.09711 as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is nestled inside this zone. Depending on the magnitude of the sell-off, more downside is possible.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.10350

Take Profit @ 1.09600

Stop Loss @ 1.10600

Downside Potential: 75 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 3.00

In case the ascending support level can pressure the Force Index into a double breakout above its horizontal as well as descending resistance levels, the EUR/CHF could attempt a push above its resistance zone. Any move higher in this currency pair should be viewed as a good short selling opportunity; the next resistance zone awaits price action between 1.11098 and 1.11444 from where more upside would require a fundamental catalyst.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.10750

Take Profit @ 1.11350

Stop Loss @ 1.10450

Upside Potential: 60 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.00