While the Eurozone continues to face fundamental economic struggles as well as yet another potential Brexit delay, the outcome of yesterday’s Canadian elections left PM Trudeau with a much weaker mandate. This fundamental scenario may result in downside pressure on the Canadian Dollar which will trump weakness out of the Eurozone and therefore push the EUR/CAD to the upside following its breakdown below the entire Fibonacci Retracement Fan sequence and into its short-term support zone.

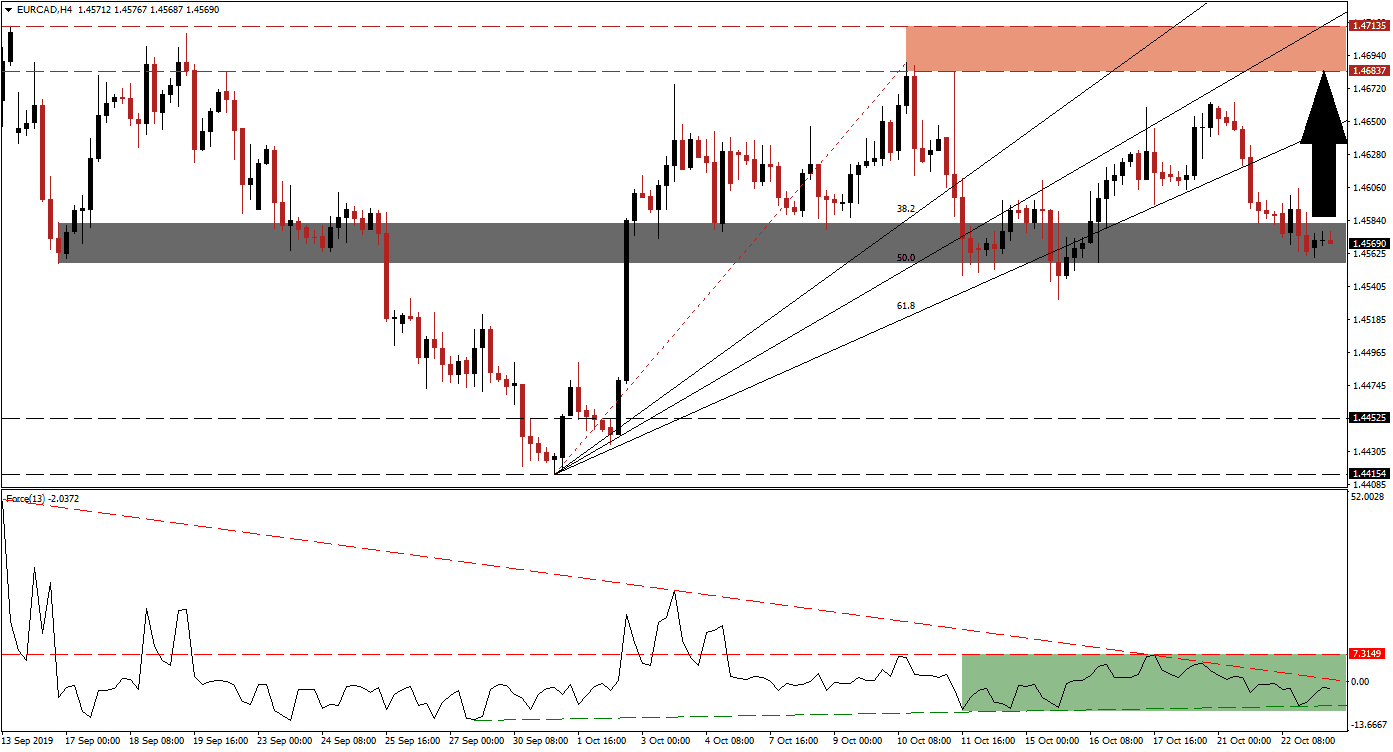

The Force Index, a next generation technical indicator, has been confined to a narrow range after completing a breakdown below its horizontal support level which turned it into resistance. As the EUR/CAD established its short-term support zone, a shallow ascending support level emerged and the Force Index is currently trading above it as marked by the green rectangle. Its descending resistance level has crossed below its horizontal resistance level and is now approaching this technical indicator; a breakout above it is likely to lead price action higher. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Bearish momentum in the EUR/CAD is depleting inside the short-term support zone which is located between 1.45554 and 1.45822 as marked by the grey rectangle; this zone has reverse three previous sell-offs and is expected to repeat this pattern for a fourth time. A breakout in the Force Index is expected to lead price action into a breakout from where a short-covering rally is likely to add to buying pressure. A move above the intra-day high of 1.46058, the peak of previous push above this short-term support zone, is expected to result in the addition of new net long positions.

A price action reversal will close the gap between the EUR/CAD and its Fibonacci Retracement Fan sequence and lead this currency pair back into its next resistance zone. This zone is located between 1.46837 and 1.47135 which is marked by the red rectangle; the 61.8 and the 50.0 Fibonacci Retracement Fan Resistance Levels embrace the resistance zone. The end point of the re-draw Fibonacci Retracement Fan sequence at an intra-day high of 1.46891 is also located inside this zone from where a breakout is unlikely without a fresh fundamental catalyst. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

EUR/CAD Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 1.45700

Take Profit @ 1.46850

Stop Loss @ 1.45350

Upside Potential: 115 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 3.29

A breakdown in the Force Index below its ascending support level could lead to a breakdown in the EUR/CAD below its short-term support zone and extend the sell-off. More Brexit disappointments may provide a fundamental catalyst for a breakdown and the next long-term support zone is located between 1.44154 and 1.44525; this would represent an excellent buying opportunity.

EUR/CAD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.45150

Take Profit @ 1.44300

Stop Loss @ 1.44450

Downside Potential: 85 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.83