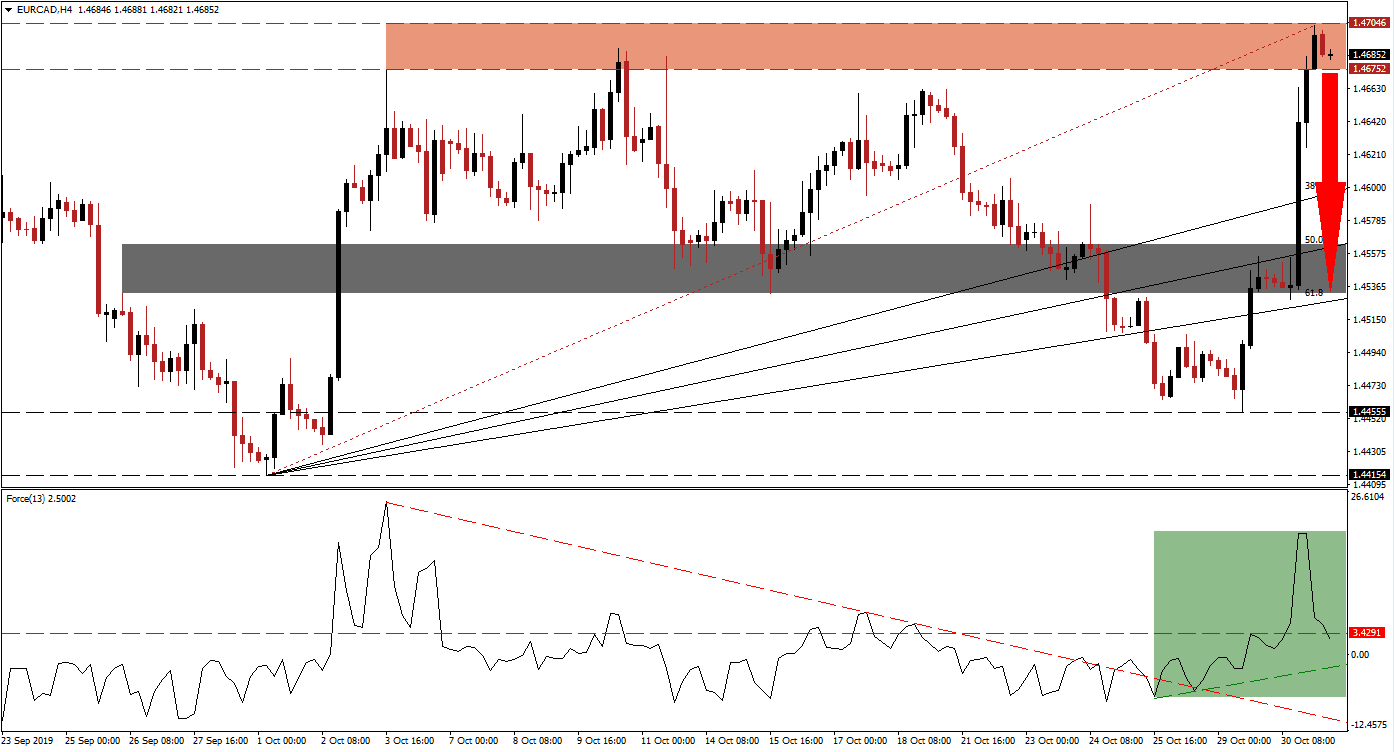

After the Bank of Canada kept interest rates unchanged at 1.75%, the Canadian Dollar plunged as the central bank suggested that an interest rate cut is coming. This has spiked the EUR/CAD from below its 50.0 Fibonacci Retracement Fan Resistance Level, which was converted into support, into its resistance zone and a higher high. While this represents a bullish development, momentum collapsed as the sharp advance was an overreaction to fundamental facts. The Eurozone economy printed a set of disappointing economic figures the ECB is in monetary easing mode with a fresh round of quantitative easing set to kick in on November 1st 2019. Price action is vulnerable to a retracement back into its 50.0 Fibonacci Retracement Fan Support Level.

The Force Index, a next generation technical indicator, indicated the spike in bullish momentum as well as its quick reversal as the EUR/CAD inched out a higher high. Another red flag appeared as the rise in the Force Index resulted in a lower high and therefore did not confirm the move in this currency pair. This technical indicator has now collapsed below its horizontal support level and turned it into resistance as marked by the green rectangle; a preceding sideways trend pushed the Force Index above its descending resistance level which now acts as a descending support level. Given the magnitude of the correction, this technical indicator is on course to complete a breakdown below its ascending support level which is likely to lead price action into a sell-off. You can learn more about the Force Index here.

Bullish momentum is fading inside the resistance zone which is located between 1.46752 and 1.47046 as marked by the red rectangle; this currency pair is vulnerable to a corrective phase, fueled by a combination of profit taking sell-off and adjustment to fundamental reality. Canadian GDP will be released today and may provide the spark for a sell-off in the EUR/CAD and forex traders should monitor the intra-day high of 1.46625, this level marks a previous high which failed to reach the resistance zone and led to a contraction down to the top range of its long-term support zone; a move below this level is expected to attract new net short positions in this currency pair.

Following a confirmed breakdown below its resistance zone, the EUR/CAD is clear to descend into its next short-term support zone which is located between 1.45322 and 1.45636 as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is about to cross above this zone while the 61.8 Fibonacci Retracement Fan Support Level is nearing the bottom range of it; a correction into this zone will keep the longer-term uptrend intact, but a breakdown cannot be ruled out. This may take price action down to its long-term support zone located between 1.44154 and 1.44555. You can learn more about a support zone here.

EUR/CAD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.46850

Take Profit @ 1.45350

Stop Loss @ 1.47300

Downside Potential: 150 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.33

In the event of a reversal in the Force Index which will lead to a sustained breakout above its horizontal resistance level, the EUR/CAD may attempt to follow through with a breakout attempt of its own. The next resistance zone is located between 1.48582 and 1.49138; given the current fundamental scenario and the technical picture supporting it, any further advance is expected to represent a short-term event and offer a good short-selling opportunity.

EUR/CAD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.47500

Take Profit @ 1.48600

Stop Loss @ 1.47000

Upside Potential: 110 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.20