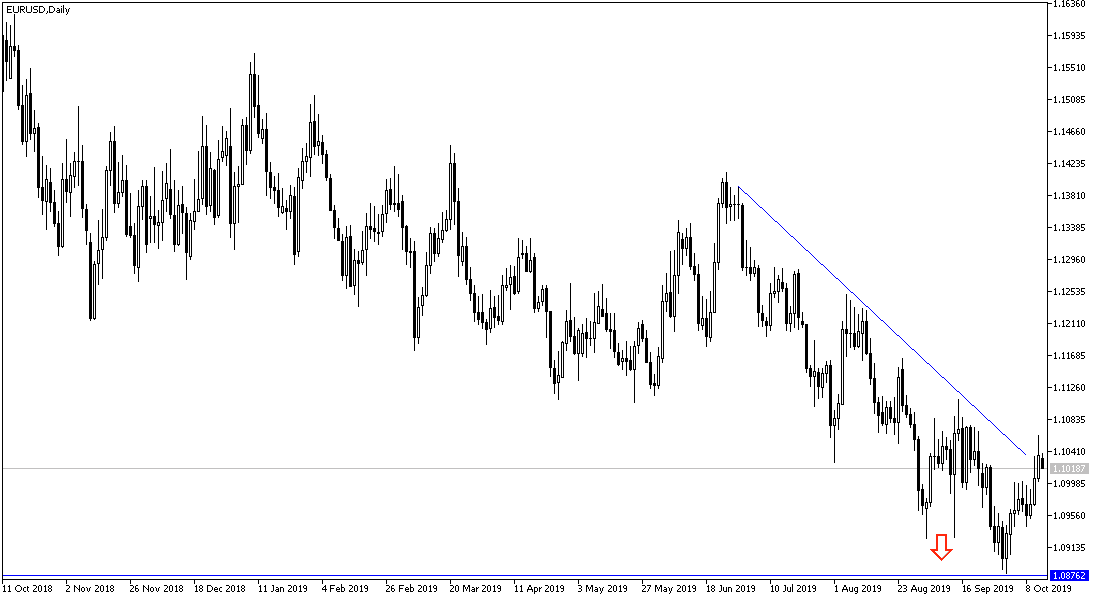

It was normal for the EUR/USD to move up to the 1.1062 resistance during the week's trading in light of the optimism that prevailed in the financial markets from the imminent conclusion of a trade agreement between the United States and China in the 13th round of trade talks between them, which took place in Washington, this is in addition to the pressure on the US dollar from expectations of a US rate cut for a third time this year when the US Federal Reserve meets later this month. The EUR/USD price may continue to be increasingly influenced by political factors in the coming weeks, especially from developments over Brexit and the US-China trade dispute. The pair rose by more than half a percent last week and emerged from the short-term downtrend channel.

The global trade war negatively affected the growth of the Eurozone and helped put Germany on the brink of recession, then the slowdown continued to encompass the entire global economy. Thus, significant progress in trade negotiations would improve the outlook for the Eurozone economy and thus support the euro.

Eurozone monetary policy. The pair will be supported by signs that the ECB will increase resources to provide liquidity to the Eurozone economy. While this may sound negative for the Euro, it is in fact positive, as the central bank's stimulus cuts interest rates and increases liquidity. The first detracts from foreign capital flows, and the second reduces the value of the local currency.

According to the technical analysis of the pair: Despite EUR/USD gains, it is expected that these gains will not last much, as the positive impact on the Eurozone economy will take more time and a lot of measures, and if a limited deal was reached between the US and China, we expect that the pair's gains will not increase above the resistance levels of 1.1120 and 1.1235, after which the correction will resume. Since the general trend over the long term is still bearish, support levels at 1.0975 and 1.0880 are key to the return of the bearish outlook for the pair again, which is not a far possibility.

As for the economic calendar data today: Today is a public holiday in the US markets. From the Eurozone, we will have the announcement of industrial production data, and therefore expect a quiet movement for the pair during Monday's trading session.