EUR / USD technical analysis. Gains are new selling levels

The US dollar weakened amid expectations of a US rate cut for the third time in the upcoming Federal Reserve meeting at the end of October. That, along with optimism of a Brexit deal, are factors contributed to stronger EUR / USD gains, pushing it to the 1.1170 resistance, the highest level in more than two months, where it closed the week’s trading around. However, investors are more willing to sell the Euro because factors for its gains are temporary due to the continued weak economic performance of the Eurozone led by Germany. As the global trade war is not over, the Euro is expected to come under pressure again.

The partial agreement between the world's two largest economies did not prevent the prospect of further global recession, and the Eurozone economy depends on manufacturing and exports, which are most affected by these trade disputes. The European region has a goal for the Trump administration to open a front of increasing tariffs, especially on the automotive sector. The US tariff came into effect on $ 7.5 billion of European imports imposed by the World Trade Organization (WTO) for damages caused by improper subsidies to Airbus. Europe has threatened retaliation, and if it does, the US is likely to respond in a similar way.

It may be better for Europe to wait until the WTO makes a formal conclusion about US support for Boeing. If deemed illegal, the EU has a cover for revenge, but has the courage to negotiate through it. European exports to the United States in 2018 amounted to $ 487 billion.

The Euro is due this week with a release of the preliminary PMI for October, and Draghi will hold another ECB board meeting. We still doubt the stability of the Eurozone economy, which means that the data should start to improve sequentially. In fact, there is a reasonable opportunity to improve the results of both purchasing managers in the manufacturing and service sectors. The focus is on the German Manufacturing PMI. It has risen only once last year, and in the past seven months, it has alternated between gains and weakness and generally remains below the 50 level that separates growth from deflation.

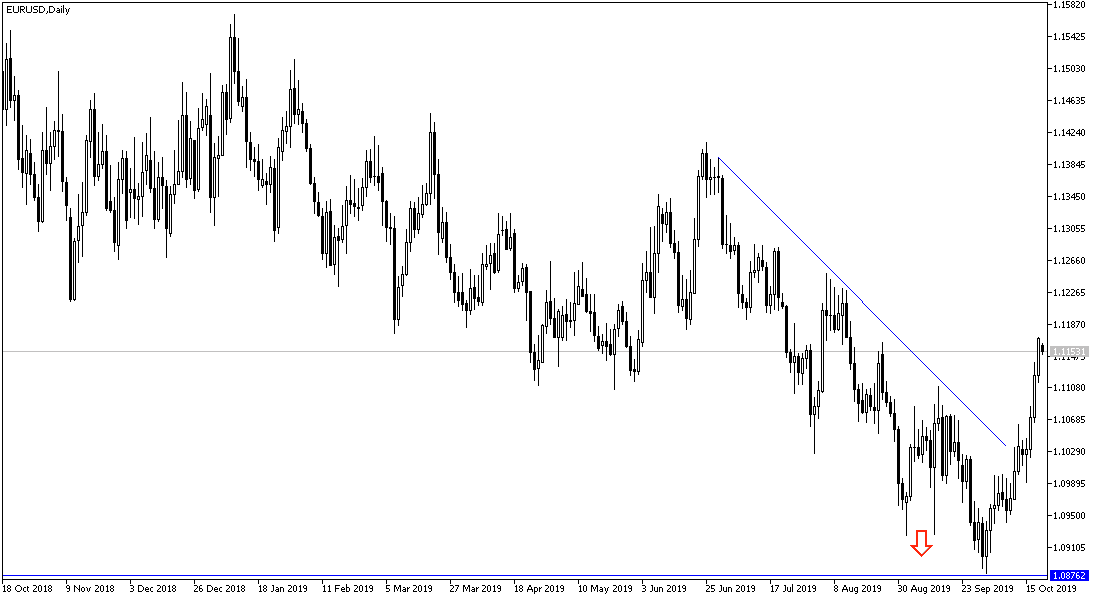

According to the technical analysis of the pair: On the daily chart of the EUR / USD there is a clear break of the downtrend supported by stability above 1.1120 resistance, and we still confirm good opportunities for the pair being to sell from the current level. The nearest bearish targets will be 1.1090, 1.1000 and 1.0935, respectively, which are once again consolidating downward strength. Always taking into account that without improvement in the economic performance of the Eurozone, especially Germany, the Euro will remain a target for sale.

According to the economic data today: We expect a quiet trading session, as we only expect the German PPI to be announced from the Eurozone. There are no significant US data releases expected today.