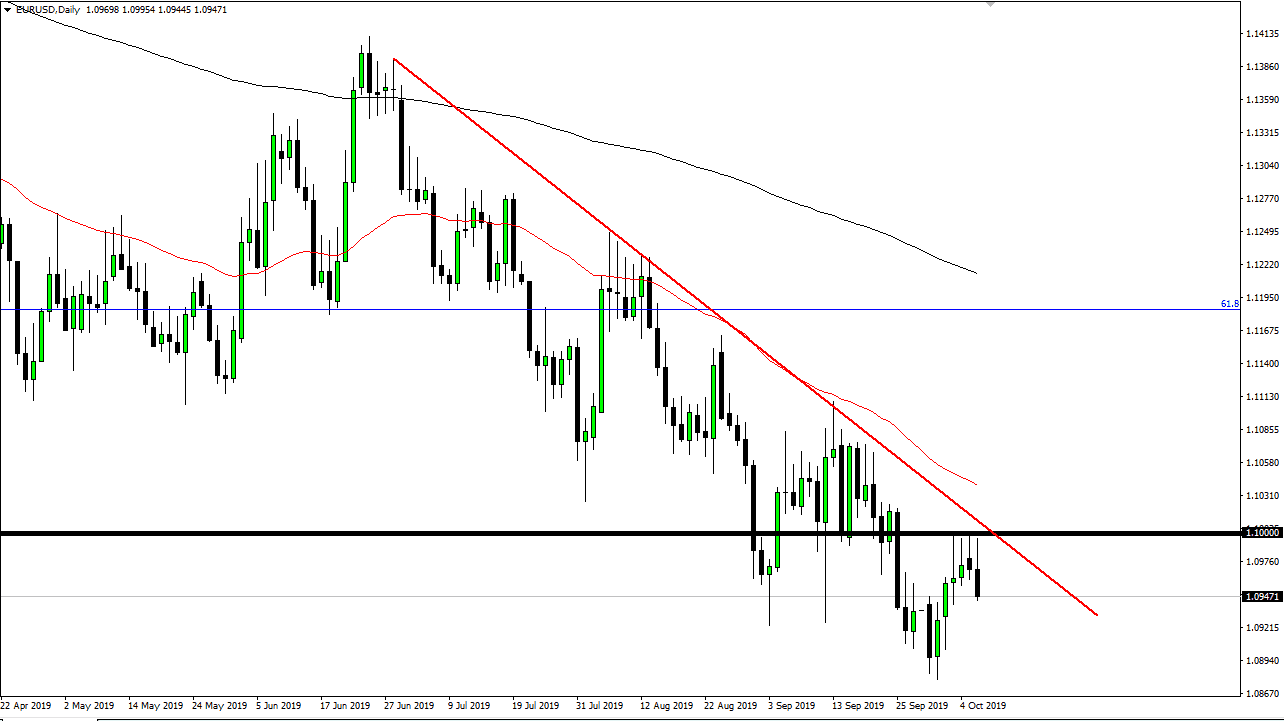

The Euro initially tried to rally during the trading session on Tuesday but found trouble again at the 1.10 level to roll over again for the fourth day in a row. As that is the case, it’s obvious that there are a lot of sellers out there willing to press this market lower. Beyond that, the downtrend line has acted as resistance as well, just as we had seen a major selloff just above that level from the breakdown candle couple of weeks ago. At this point, it’s very likely that the market participants will continue to sell rallies as they occur, but I don’t necessarily think that the Euro is going to melt straight down.

It’s possible that we will go looking towards the 1.09 level eventually, but keep in mind that this market continues to look slightly over extended and then drop as the longer-term trend certainly has been negative. For the last 18 months or so, we have seen a lot of choppy trading, but in the end, sellers continue to show strength in this marketplace. The trend is most certainly to the downside, which makes quite a bit of sense when you look at the political situation with the Brexit, and of course the looming recession in the European Union. On the other side of the Atlantic, you have the Americans, which are showing more strength than the Europeans, so it makes sense that money would go toward the Americans. That continues to strengthen the US dollar, and therefore the trend should continue.

Market participants continue to look at the bond markets for yield as well, as the US bond markets offer positive yields when European bonds offer negative. With that being the case it makes quite a bit of sense that we continue to see massive pressure. Ultimately, this is a market that will continue to see a lot of noise attached to it, so I would not be looking for a longer-term move, simply short-term “sell on the rally” type of scenarios. In fact, it’s not until we close on a daily chart above the 50 day EMA that I would be considering buying. That doesn’t mean that we can’t bounce, simply that it should offer another opportunity. When you look at the longer-term charts, you can see that the gap underneath is near the 1.0750 level, and that could be the longer-term target.