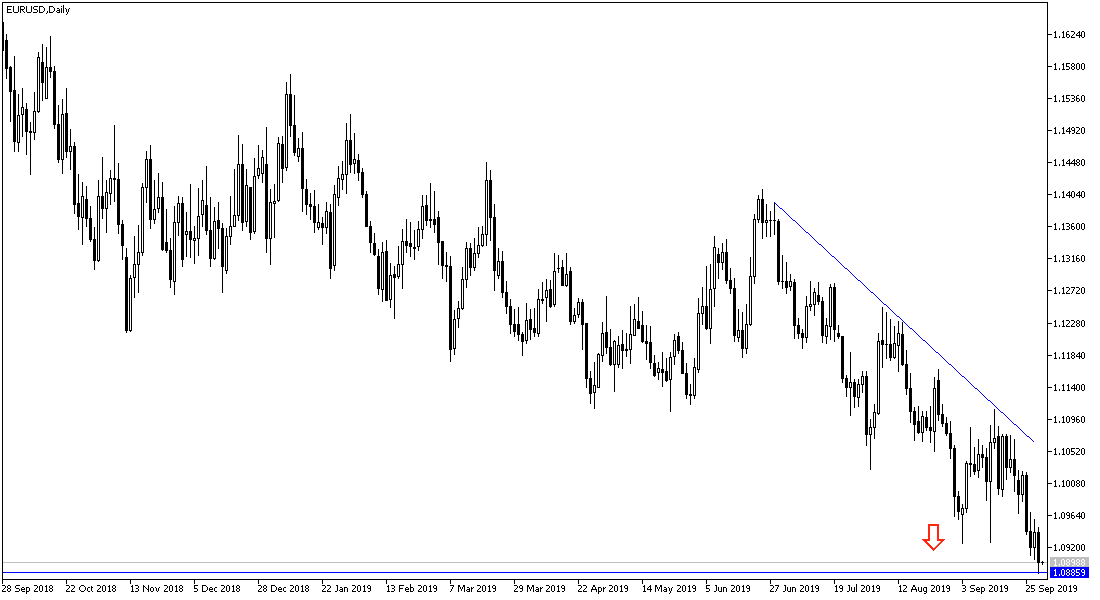

In the last trading session for the month of September, the price of the EUR / USD pair fell below the 1.0900 psychological support level, with losses reaching to the 1.0884 support level, the lowest in 28 months, with the continued gains of the US dollar against other major currencies and the pessimism that dominates the economic outlook for the Eurozone led by Germany, the largest economy in the bloc. There is no doubt that the continuation of the global trade war is worrying the region's economy, which depends on manufacturing and exports.

Germany posted a 0.5% gain in August retail sales, in line with expectations. Unemployment lists fell by 10,000 in August while economists had expected an increase of 5,000 and the July increase was halved (to 2k). Inflation in the Eurozone is expected to stabilize around 1.0% unchanged, with core inflation, which excludes more volatile energy and food, expected to rise to 1.0% from the previous 0.9%. The slight rise did not significantly change the ECB's policy as it prepares for more stimulus plans to revive the region's economy. Economists expect that the bank's announcement at its last meeting will not be enough to stimulate the slowdown, especially as the trade dispute between the world's two largest economies continues.

Italy announced a 1.5% rise in the CPI for September, and year on year inflation slowed to 0.3% from 0.5%. Separately, Italy reported that unemployment fell to 9.5% from a revised 9.8% (it was 9.9%). This was the lowest in eight years. Attention is now shifting to the new government budget for 2020. The budget strategy may be to expect a deficit of 2.1% and then negotiate for more. The draft budget is scheduled to be discussed in Brussels in mid-October.

In the Eurozone as a whole, preliminary data from the European statistics agency, Eurostat, showed that the unemployment rate unexpectedly fell in August to its lowest level in more than a decade.

According to the technical analysis of the pair: The general trend of the EUR / USD is still bearish and stability below the 1.0900 psychological support consolidates the strength of this trend and foreshadows stronger bearish moves that may push the price of the pair to the support levels of 1.0860, 1.0790 and 1.0700 respectively. Traders ignore the technical indicators reaching oversold levels in light of the continuing negative economic indicators for the Eurozone, especially from Germany. As we expected before, we now confirm that the correction will not be strong without the pair testing the 1.1100 resistance level, otherwise the bears will remain in control.

As for the economic data: On one hand, the Eurozone Manufacturing PMI and inflation figures will be released. From the US, ISM manufacturing PMI and construction spending index will be released.