During last month's trading, the most influential factor in the performance of the US dollar index DXY, which measures the performance of the US dollar against a basket of six rival currencies is the US interest rate. At the beginning of this month, investors' attention turned to the course of the US-China trade war. Traders, investors and central banks are watching the high-level trade negotiations in a few days. The direction of the market will be determined by the outcome of the US-China trade negotiations. Traders may want to hold their positions before learning the results of that round.

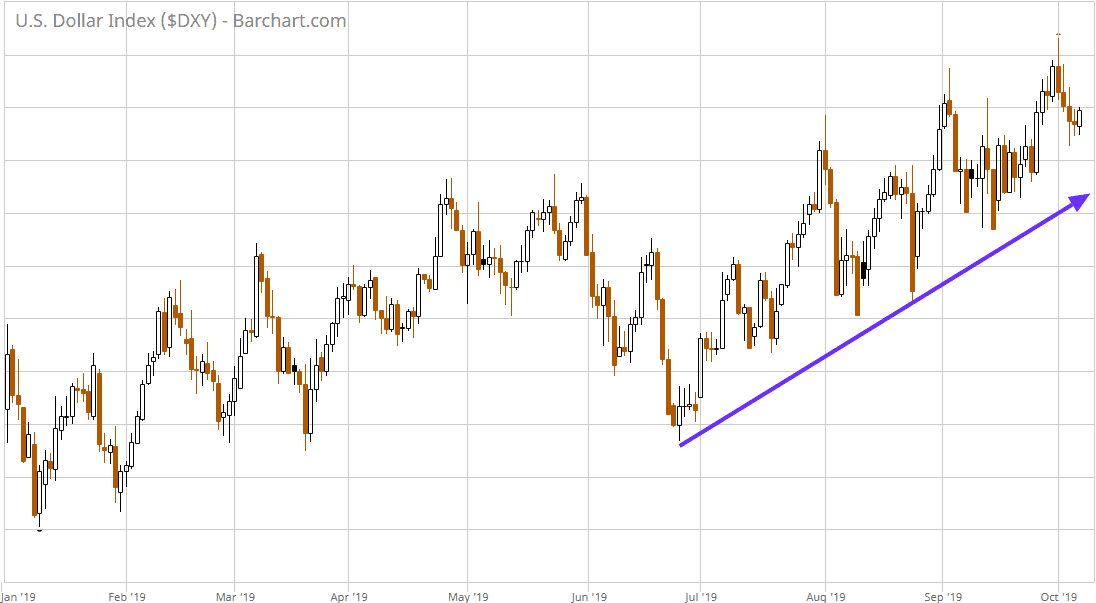

From a technical perspective: on the monthly chart, the price of the US dollar index is ready to rise further or start a correction from the top of the channel at 99.40, which is the key resistance to watch for now. If the index succeeds in breaching it, the 100.00 level will become the next major resistance which should be exceeded. We think the correction is due, but without any bearish close on the monthly chart, the index will still have a chance to go further up.

The US dollar index is moving within the bullish channel and there is no change in the situation so far. We had a bearish correction signal last week, but there is no confirmation of this pattern so far this week. The index may continue to rise and test 99.40 - 100.00 levels respectively without any chance of a downward correction.

The price of the US dollar index DXY tries to return to penetrate the resistance of 99.40 after the correction and the recent selling. Overall, it is still difficult to imagine the direction of the US dollar index. The main event is the future of the US-China trade war and we may soon get updated on its course. The two sides will hold high-level trade negotiations this month. The direction of the dollar index depends a lot on the outcome of this meeting.