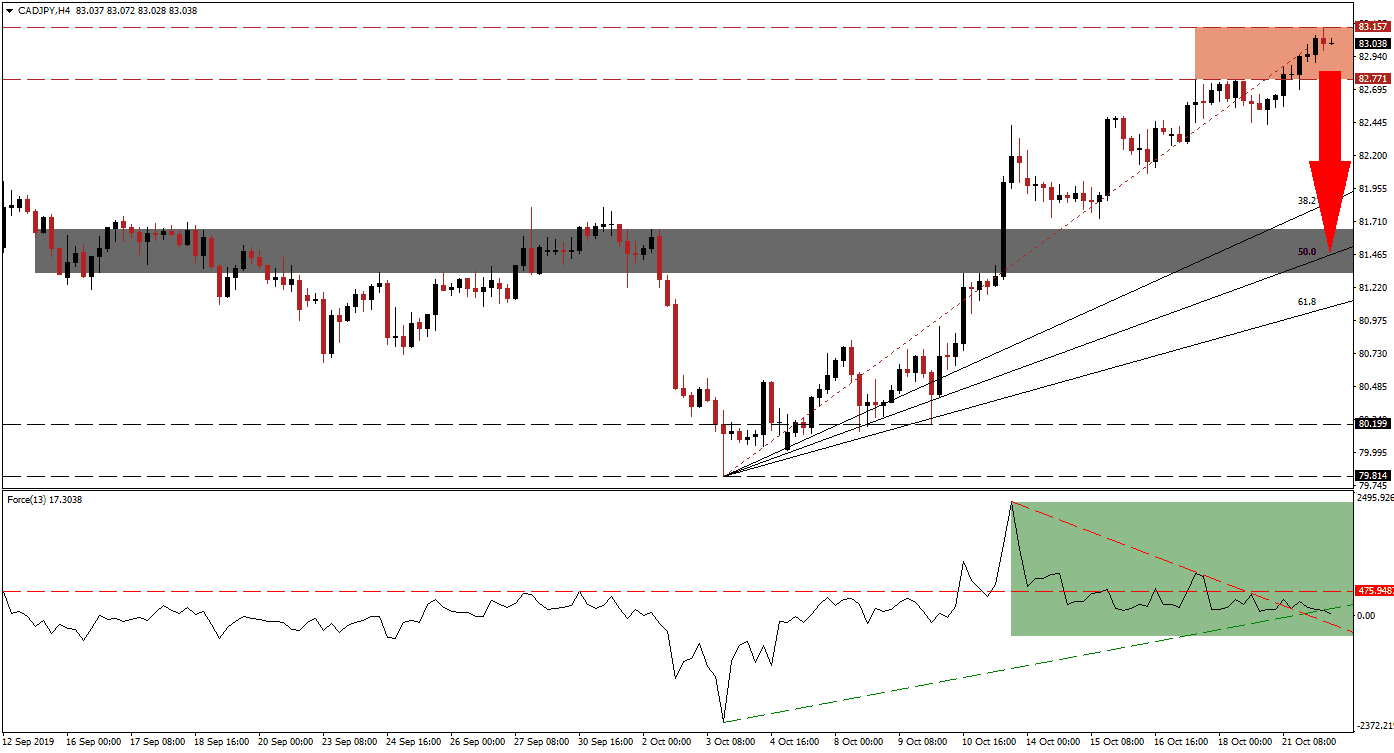

The Canadian Dollar is the best performing G-10 currency this year, but after elections showed that incumbent Prime Minister Trudeau may be forced into a minority government, it could halt the stellar performance of the Canadian currency. He could also try to form a coalition government which remains very unlikely; regardless of which path he may chose, he is a much weaker PM than before. The CAD/JPY extended its advance which was partially pushed higher as risk-on sentiment expanded, but price action is now testing the strength of its resistance zone from where a counter-trend correction may emerge.

The Force Index, a next generation technical indicator, suggests that a sell-off is imminent with the formation of a negative divergence which represents a bearish trading signal. A negative divergence forms when an asset advances while its underlying technical indicator contracts. Following the negative divergence, the Force Index completed a breakdown below its horizontal support level, turning it into resistance. While a sideways drift pushed this technical indicator above its descending resistance level, it also moved below its ascending support level as marked by the green rectangle; this represents another bearish development. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

With uncertainty of how the next Canadian Parliament will look like, the CAD/JPY is likely to come under short-term selling pressure which will result in a breakdown below its resistance zone; this zone is located between 82.771 and 83.157 as marked by the red rectangle. The strong push into this zone has also caused price action to disconnect from its Fibonacci Retracement Fan sequence and the gap is likely to be closed over the next few trading sessions. The intra-day lows of 82.695, the last time price action dipped below its resistance zone, and of 82.430, the low before the most recent push higher, should be monitored closely; a move lower is expected to result in a spike in selling pressure for this currency pair.

After the CAD/JPY initially stalled just below its resistance zone, price action moved below the Fibonacci Retracement Fan trendline in another bearish development. The next short-term support zone is located between 81.328 and 81.656 as marked by the grey rectangle and the ascending 50.0 Fibonacci Retracement Fan Support Level is passing through this zone. A move into this short-term support zone would keep the long-term uptrend intact, but geopolitical risks as well as a steeper global economic slowdown may provide the next fundamental catalyst to the downside. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 83.050

Take Profit @ 81.550

Stop Loss @ 83.400

Downside Potential: 150 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 4.29

A reversal in the Force Index above its ascending support level, which acts as temporary resistance, as well as a sustained breakout above its horizontal resistance level could lead the CAD/JPY into a breakout of its own. Given the outcome of the Canadian elections, together with the state of the global economy, such a breakout is unlikely to be sustained if it materializes at all. The next resistance zone is located between 84.065 and 84.349 which should be considered a great short-selling opportunity in this currency pair.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 83.500

Take Profit @ 84.200

Stop Loss @ 83.200

Upside Potential: 70 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.33